Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The families goals are to eliminate their debt, save at least $25000 for each childs education, protect their family, and retire with 70% of their

The families goals are to eliminate their debt, save at least $25000 for each childs education, protect their family, and retire with 70% of their current spending power reasoning that no debt and no kids at retirement wont require their full cash flow.

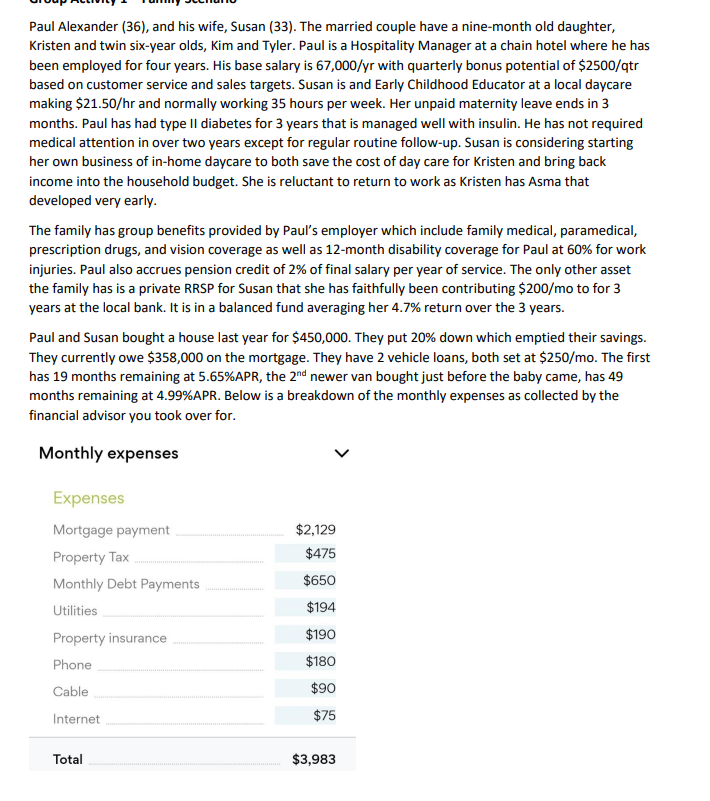

Paul Alexander (36), and his wife, Susan (33). The married couple have a nine-month old daughter, Kristen and twin six-year olds, Kim and Tyler. Paul is a Hospitality Manager at a chain hotel where he has been employed for four years. His base salary is 67,000/y r with quarterly bonus potential of $2500/q tr based on customer service and sales targets. Susan is and Early Childhood Educator at a local daycare making $21.50/hr and normally working 35 hours per week. Her unpaid maternity leave ends in 3 months. Paul has had type II diabetes for 3 years that is managed well with insulin. He has not required medical attention in over two years except for regular routine follow-up. Susan is considering starting her own business of in-home daycare to both save the cost of day care for Kristen and bring back income into the household budget. She is reluctant to return to work as Kristen has Asma that developed very early. The family has group benefits provided by Paul's employer which include family medical, paramedical, prescription drugs, and vision coverage as well as 12 -month disability coverage for Paul at 60% for work injuries. Paul also accrues pension credit of 2% of final salary per year of service. The only other asset the family has is a private RRSP for Susan that she has faithfully been contributing $200/mo to for 3 years at the local bank. It is in a balanced fund averaging her 4.7% return over the 3 years. Paul and Susan bought a house last year for $450,000. They put 20% down which emptied their savings. They currently owe $358,000 on the mortgage. They have 2 vehicle loans, both set at $250/mo. The first has 19 months remaining at 5.65%APR, the 2nd newer van bought just before the baby came, has 49 months remaining at 4.99% APR. Below is a breakdown of the monthly expenses as collected by the financial advisor you took over forStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started