Answered step by step

Verified Expert Solution

Question

1 Approved Answer

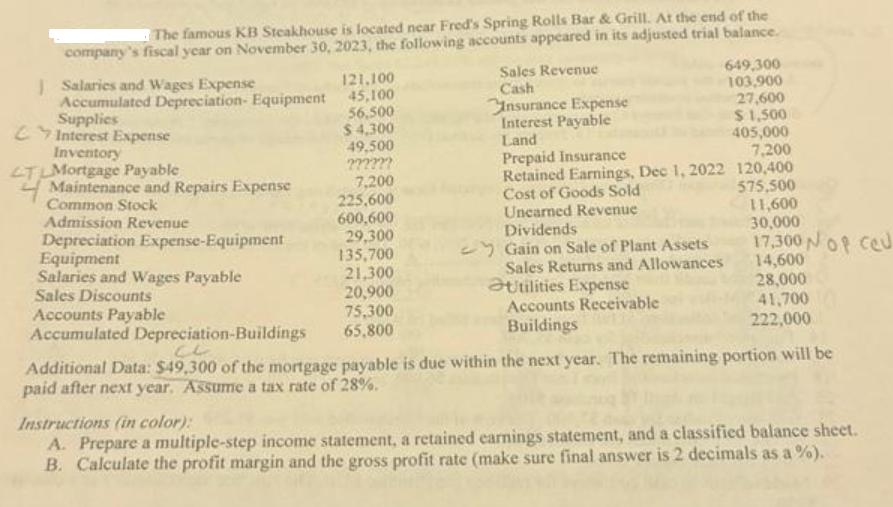

The famous KB Steakhouse is located near Fred's Spring Rolls Bar & Grill. At the end of the company's fiscal year on November 30,

The famous KB Steakhouse is located near Fred's Spring Rolls Bar & Grill. At the end of the company's fiscal year on November 30, 2023, the following accounts appeared in its adjusted trial balance. Salaries and Wages Expense Accumulated Depreciation- Equipment Supplies Interest Expense Inventory LTLMortgage Payable 4TH Maintenance and Repairs Expense Common Stock Admission Revenue Depreciation Expense-Equipment Equipment Salaries and Wages Payable Sales Discounts 121,100 45,100 56,500 $4,300 49,500 ?????? 7,200 225,600 600,600 29,300 135,700 21,300 20,900 75,300 65,800 Sales Revenue Cash Insurance Expense Interest Payable Land 649,300 103,900 Unearned Revenue Dividends Gain on Sale of Plant Assets Sales Returns and Allowances Utilities Expense Accounts Receivable Buildings 27,600 $1,500 405,000 Prepaid Insurance 7,200 Retained Earnings, Dec 1, 2022 120,400 Cost of Goods Sold 575,500 11,600 30,000 17,300 N of Ceu 14,600 28,000 41,700 222,000 Accounts Payable Accumulated Depreciation-Buildings CL Additional Data: $49,300 of the mortgage payable is due within the next year. The remaining portion will be paid after next year. Assume a tax rate of 28%. Instructions (in color): A. Prepare a multiple-step income statement, a retained earnings statement, and a classified balance sheet. B. Calculate the profit margin and the gross profit rate (make sure final answer is 2 decimals as a %).

Step by Step Solution

★★★★★

3.46 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

A KB Steakhouse MultipleStep Income Statement For the Year Ended November 30 2023 Sales Revenue 6493...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started