Snowbot Snow Removal Company of Halifax purchased some snowplow equipment on March 10, 2020, that had a cost of $140,000 (ignore GST/PST). Prepare the

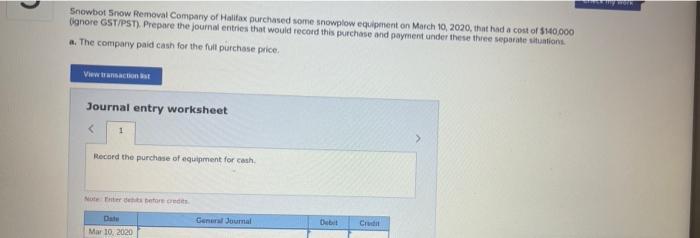

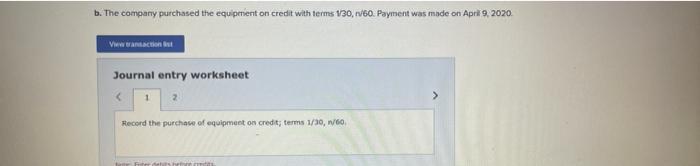

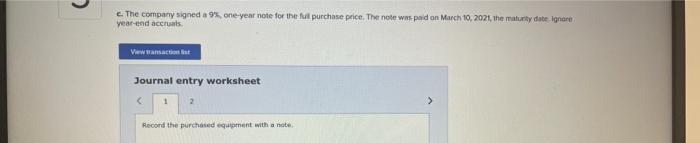

Snowbot Snow Removal Company of Halifax purchased some snowplow equipment on March 10, 2020, that had a cost of $140,000 (ignore GST/PST). Prepare the journal entries that would record this purchase and payment under these three separate situations. a. The company paid cash for the full purchase price. View transaction ist Journal entry worksheet 1 Record the purchase of equipment for cash. Note Enter debts before credits Date Mar 10, 2020 General Journal Debit Credit b. The company purchased the equipment on credit with terms 1/30, n/60. Payment was made on April 9, 2020 View transaction t Journal entry worksheet 1 Record the purchase of equipment on credit; terms 1/30, n/60. dets beton citas e. The company signed a 9%, one-year note for the full purchase price. The note was paid on March 10, 2021, the maturity date ignore year-end accruals. View transactions Journal entry worksheet < 1 Record the purchased equipment with a note.

Step by Step Solution

3.41 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

Question a The company paid cash for the full purchase price Date Par...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started