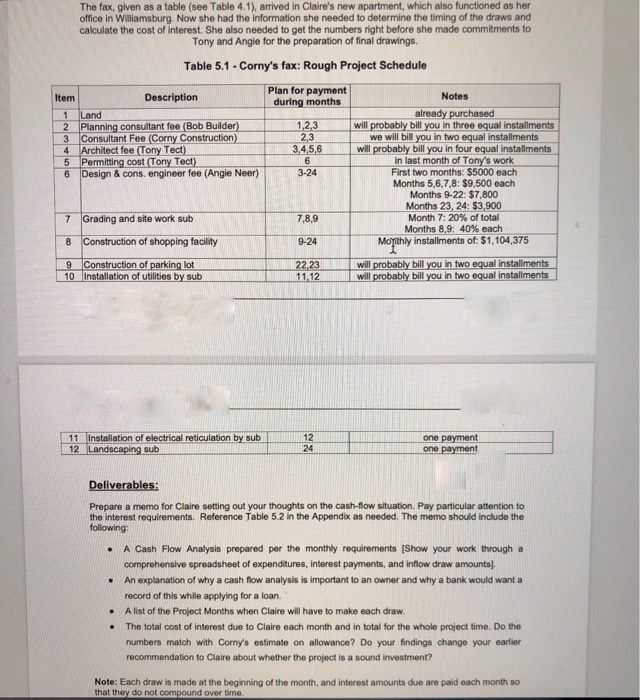

The fax, given as a table (see Table 4.1), arrived in Claire's new apartment, which also functioned as her office in Wiliamsburg. Now she had the information she needed to determine the timing of the draws and calculate the cost of interest. She also needed to get the numbers right before she made commitments to Tony and Angie for the preparation of final drawings. Table 5.1 - Corny's fax: Rough Project Schedule Item 1 2 Description dation Land Planning consultant fee (Bob Builder) Consultant Fee (Corny Construction) Architect fee Tony Tect) Permitting cost Tony Tect) Design & cons. engineer fee (Angie Neer) 4 Plan for payment Notes during months already purchased 1,2,3 will probably bill you in three equal installments 2.3 we will bill you in two equal installments 3,4,5,6 will probably bill you in four equal installments in last month of Tony's work 3-24 First two months: $5000 each Months 5,6,7,8: $9,500 each Months 9-22: $7,800 Months 23, 24: $3,900 7,8,9 Month 7: 20% of total Months 8,9: 40% each 9-24 Moyithly installments of: $1,104,375 7 Grading and site work sub 8 Construction of shopping facility 9 10 Construction of parking lot Installation of utilities by sub 22,23 11.12 will probably bill you in two equal installments will probably bill you in two equal installments 11 Installation of electrical reticulation by sub 12 Landscaping sub one payment one payment Deliverables: Prepare a memo for Claire setting out your thoughts on the cash-flow situation. Pay particular attention to the interest requirements. Reference Table 52 in the Appendix as needed. The memo should include the following: A Cash Flow Analysis prepared per the monthly requirements (Show your work through a comprehensive spreadsheet of expenditures, interest payments, and inflow draw amounts) An explanation of why a cash flow analysis is important to an owner and why a bank would want a record of this while applying for a loan. A list of the Project Months when Claire will have to make each draw. The total cost of interest due to Claire each month and in total for the whole project time. Do the numbers match with Corny's estimate on allowance? Do your findings change your earlier recommendation to Claire about whether the project is a sound investment? Note: Each draw is made at the beginning of the month, and interest amounts due are paid each month so that they do not compound over time. The fax, given as a table (see Table 4.1), arrived in Claire's new apartment, which also functioned as her office in Wiliamsburg. Now she had the information she needed to determine the timing of the draws and calculate the cost of interest. She also needed to get the numbers right before she made commitments to Tony and Angie for the preparation of final drawings. Table 5.1 - Corny's fax: Rough Project Schedule Item 1 2 Description dation Land Planning consultant fee (Bob Builder) Consultant Fee (Corny Construction) Architect fee Tony Tect) Permitting cost Tony Tect) Design & cons. engineer fee (Angie Neer) 4 Plan for payment Notes during months already purchased 1,2,3 will probably bill you in three equal installments 2.3 we will bill you in two equal installments 3,4,5,6 will probably bill you in four equal installments in last month of Tony's work 3-24 First two months: $5000 each Months 5,6,7,8: $9,500 each Months 9-22: $7,800 Months 23, 24: $3,900 7,8,9 Month 7: 20% of total Months 8,9: 40% each 9-24 Moyithly installments of: $1,104,375 7 Grading and site work sub 8 Construction of shopping facility 9 10 Construction of parking lot Installation of utilities by sub 22,23 11.12 will probably bill you in two equal installments will probably bill you in two equal installments 11 Installation of electrical reticulation by sub 12 Landscaping sub one payment one payment Deliverables: Prepare a memo for Claire setting out your thoughts on the cash-flow situation. Pay particular attention to the interest requirements. Reference Table 52 in the Appendix as needed. The memo should include the following: A Cash Flow Analysis prepared per the monthly requirements (Show your work through a comprehensive spreadsheet of expenditures, interest payments, and inflow draw amounts) An explanation of why a cash flow analysis is important to an owner and why a bank would want a record of this while applying for a loan. A list of the Project Months when Claire will have to make each draw. The total cost of interest due to Claire each month and in total for the whole project time. Do the numbers match with Corny's estimate on allowance? Do your findings change your earlier recommendation to Claire about whether the project is a sound investment? Note: Each draw is made at the beginning of the month, and interest amounts due are paid each month so that they do not compound over time