Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The federal government allows an income tax deduction for the decrease in value of certain capital assets such as automobiles, equipment and buildings. There

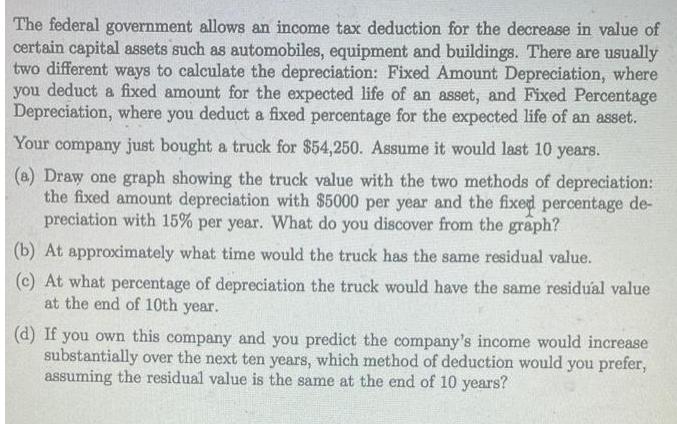

The federal government allows an income tax deduction for the decrease in value of certain capital assets such as automobiles, equipment and buildings. There are usually two different ways to calculate the depreciation: Fixed Amount Depreciation, where you deduct a fixed amount for the expected life of an asset, and Fixed Percentage Depreciation, where you deduct a fixed percentage for the expected life of an asset. Your company just bought a truck for $54,250. Assume it would last 10 years. (a) Draw one graph showing the truck value with the two methods of depreciation: the fixed amount depreciation with $5000 per year and the fixed percentage de- preciation with 15% per year. What do you discover from the graph? (b) At approximately what time would the truck has the same residual value. (c) At what percentage of depreciation the truck would have the same residual value at the end of 10th year. (d) If you own this company and you predict the company's income would increase substantially over the next ten years, which method of deduction would you prefer, assuming the residual value is the same at the end of 10 years?

Step by Step Solution

★★★★★

3.38 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Solutions As we can see in the residual value graphs the value becomes equal somewhere clo...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started