Question

The Federal Reserve is performing a preliminary study to determine the relationship between certain economic indicators and annual percentage change in gross national product GNP

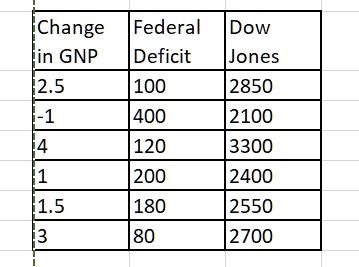

The Federal Reserve is performing a preliminary study to determine the relationship between certain economic indicators and annual percentage change in gross national product GNP Two such indicators being examined are the amount of federal governments deficit in billion dollars and the Dow Jones industrial average the mean value over the year Data for six years are given below.

a Calculate the regression equation that best describes the data

b What percentage change in GNP would be expected in a year in which the federal deficit was $ billion and mean Dow Jones value was

c Comment on R and R square

d Interpret the pvalue in terms of strength of the variables used in the model

Change in GNP 2.5 -1 14 1 1.5 13 Federal Deficit 100 400 120 200 180 80 Dow Jones 2850 2100 3300 2400 2550 2700

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started