Question

Letitia is a 42-year-old South African resident. During the 2023 year of assessment, her employer awarded a bona fide bursary to the value of

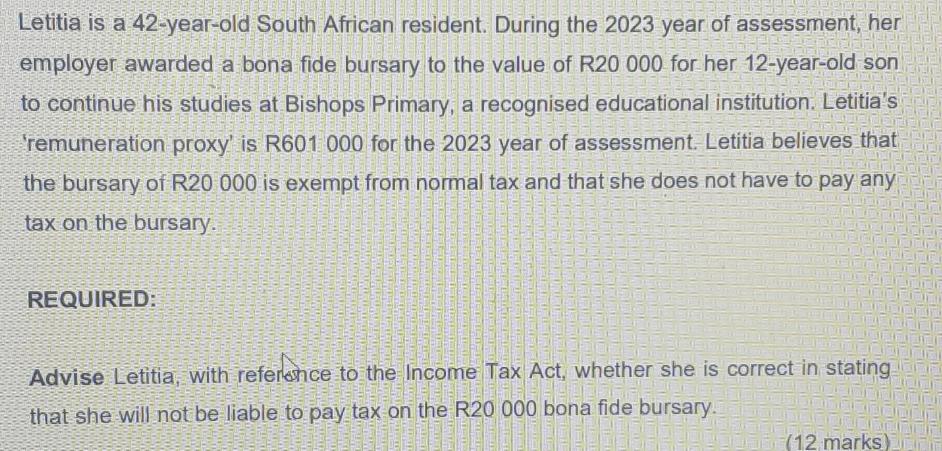

Letitia is a 42-year-old South African resident. During the 2023 year of assessment, her employer awarded a bona fide bursary to the value of R20 000 for her 12-year-old son to continue his studies at Bishops Primary, a recognised educational institution. Letitia's remuneration proxy' is R601 000 for the 2023 year of assessment. Letitia believes that the bursary of R20 000 is exempt from normal tax and that she does not have to pay any tax on the bursary. REQUIRED: Advise Letitia, with reference to the Income Tax Act, whether she is correct in stating that she will not be liable to pay tax on the R20 000 bona fide bursary. amon LANG LEKKE TATA (12 marks)

Step by Step Solution

3.34 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

According to the Income Tax Act a bona fide bursary or scholarship granted to enable or assist any p...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Income Tax Fundamentals 2013

Authors: Gerald E. Whittenburg, Martha Altus Buller, Steven L Gill

31st Edition

1111972516, 978-1285586618, 1285586611, 978-1285613109, 978-1111972516

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App