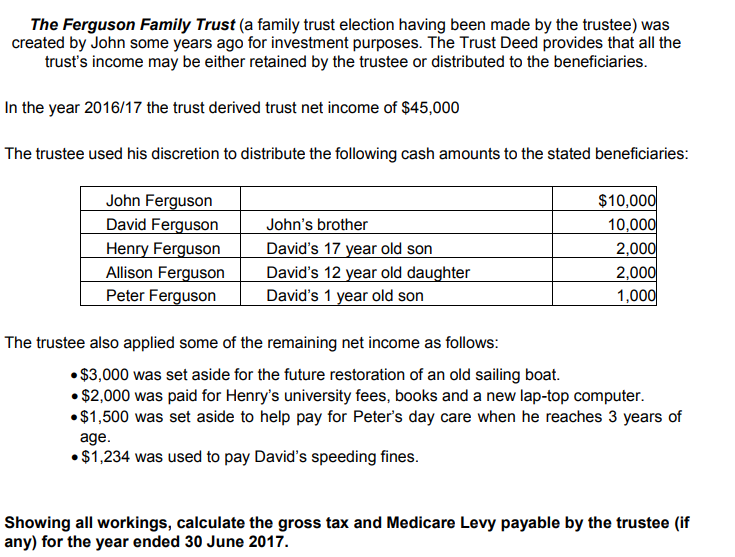

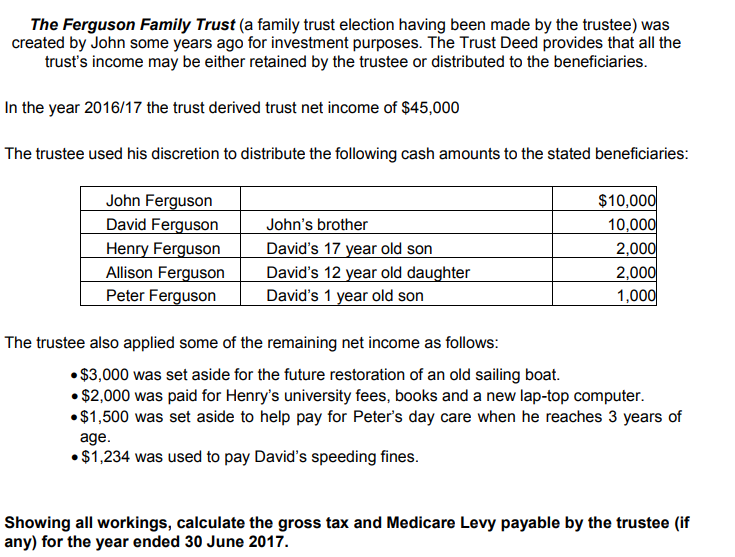

The Ferguson Family Trust (a family trust election having been made by the trustee) was created by John some years ago for investment purposes. The Trust Deed provides that all the trust's income may be either retained by the trustee or distributed to the beneficiaries In the year 2016/17 the trust derived trust net income of $45,000 The trustee used his discretion to distribute the following cash amounts to the stated beneficiaries John Ferquson David Ferguson Henry Ferquson Allison Ferquson Peter Ferguson John's brother David's 17 year old son David's 12 vear old daughter David's 1 year old son $10,00 10,00 2,00 2,00 1,00 The trustee also applied some of the remaining net income as follows $3,000 was set aside for the future restoration of an old sailing boat. . $2,000 was paid for Henry's university fees, books and a new lap-top computer $1,500 was set aside to help pay for Peter's day care when he reaches 3 years of age . $1,234 was used to pay David's speeding fines Showing all workings, calculate the gross tax and Medicare Levy payable by the trustee (if any) for the year ended 30 June 2017. The Ferguson Family Trust (a family trust election having been made by the trustee) was created by John some years ago for investment purposes. The Trust Deed provides that all the trust's income may be either retained by the trustee or distributed to the beneficiaries In the year 2016/17 the trust derived trust net income of $45,000 The trustee used his discretion to distribute the following cash amounts to the stated beneficiaries John Ferquson David Ferguson Henry Ferquson Allison Ferquson Peter Ferguson John's brother David's 17 year old son David's 12 vear old daughter David's 1 year old son $10,00 10,00 2,00 2,00 1,00 The trustee also applied some of the remaining net income as follows $3,000 was set aside for the future restoration of an old sailing boat. . $2,000 was paid for Henry's university fees, books and a new lap-top computer $1,500 was set aside to help pay for Peter's day care when he reaches 3 years of age . $1,234 was used to pay David's speeding fines Showing all workings, calculate the gross tax and Medicare Levy payable by the trustee (if any) for the year ended 30 June 2017