Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The final pay period of the year will not be paid to employees until January 3, 2020. The company will accrue the wages for

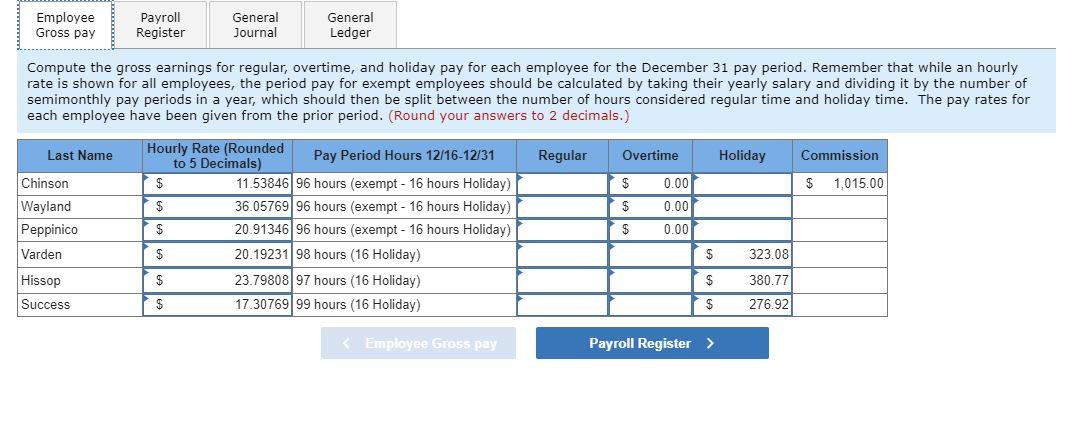

The final pay period of the year will not be paid to employees until January 3, 2020. The company will accrue the wages for the final pay period only. Because the pay period is complete, there will not be a reversing entry for the accrual. As a result, paychecks will not be issued for this pay period since they will be paid in the following year and reflected on the Employee Earning Record forms for each employee when paid. The remainder of the employer liability will be paid with the final filing for the year. The company pays for Christmas Eve and the day of Christmas for 2019. Employees will be paid for both Tuesday and Wednesday as holiday pay. Standard time for the pay period was 96 hours, but employees worked extra hours on Saturday during the week of 12/23- 12/27. Reminder, holidays and vacations are not included as hours worked for calculation of overtime. Complete the Employee Gross Pay tab. Complete the Payroll Register for December 31. Complete the General Journal entries for the December 31 payroll. Update the General Ledger with the ending ledger balances from the December 15 pay period ledger accounts first, and then post the journal entries from the current period to the General Ledger. Employee Gross pay Last Name Chinson Wayland Peppinico Varden Payroll Register Compute the gross earnings for regular, overtime, and holiday pay for each employee for the December 31 pay period. Remember that while an hourly rate is shown for all employees, the period pay for exempt employees should be calculated by taking their yearly salary and dividing it by the number of semimonthly pay periods in a year, which should then be split between the number of hours considered regular time and holiday time. The pay rates for each employee have been given from the prior period. (Round your answers to 2 decimals.) Hissop Success General Journal $ $ $ $ General Ledger Pay Period Hours 12/16-12/31 96 hours (exempt - 16 hours Holiday) Hourly Rate (Rounded to 5 Decimals) 11.53846 36.05769 96 hours (exempt - 16 hours Holiday) 20.91346 96 hours (exempt - 16 hours Holiday) 20.19231 98 hours (16 Holiday) 23.79808 97 hours (16 Holiday) 17.30769 99 hours (16 Holiday) $ $ < Employee Gross pay Regular Overtime $ $ $ 0.00 0.00 0.00 $ $ $ Payroll Register > Holiday 323.08 380.77 276.92 Commission $ 1,015.00

Step by Step Solution

★★★★★

3.42 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Employee Gross Pay Last NameHourly Rate Rounded to 5 DecimalsPay Period Hours 12161231RegularOvertimeHolidayCommission Chinson115384696 hours exempt 1...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started