Question

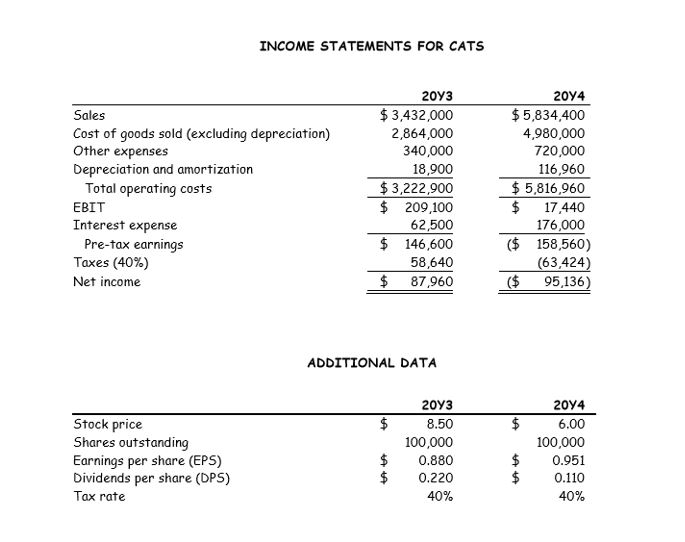

The finance group at CATS is working on forecasting its financial statements for 20Y5. They are working with the following assumptions: CATS will invest $180,000

The finance group at CATS is working on forecasting its financial statements for 20Y5. They are working with the following assumptions:

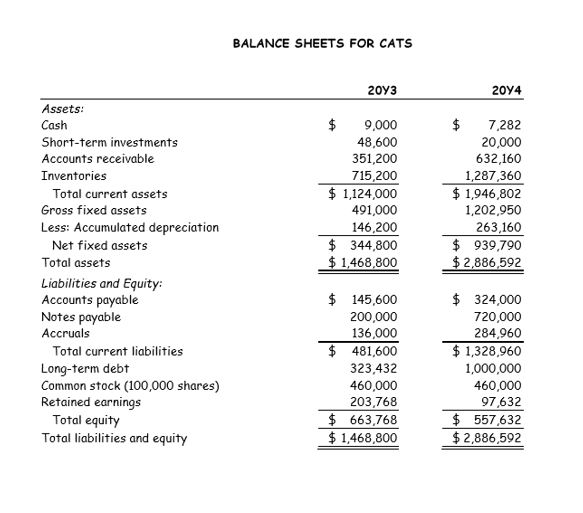

CATS will invest $180,000 in fixed assets in 20Y5; depreciation expense will increase by $17,469 in 20Y5 over the 20Y4 amount.

CATS will fund the investment in fixed assets with a long-term loan of $180,000. Interest expense will increase by $16,300 in 20Y5 over the 20Y4 amount. There will no change in the number of shares of common stock.

CATS will increase its common dividend by 5%.

The marketing group estimates that sales will increase 12.5% in 20Y5.

All NOWC accounts, except cash, will increase by 10% over the 20Y4 amounts. The ending cash balance for 20Y5 is expected to increase 22% over the 20Y4 amount. ST investments will remain constant.

The ratio of operating expenses (excluding other expenses and depreciation) to sales will decline from ~85.4% to 83%. The other expenses item on the income statement will increase 3%. The tax rate will remain at 40%.

The WACC for CATS is expected to remain at 10% for 20Y5.

Any additional funds needed (AFN) will come from a short-term borrowing, i.e., an increase in notes payable. Similarly, any funds released would be used to reduce notes payable. In other words, notes payable is a plug variable which will be used to balance the balance sheet.

d. Estimate EVA and MVA for CATS for 20Y5. Assume CATS stock price will increase 20% from year-end 20Y4 to year-end 20Y5.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started