Answered step by step

Verified Expert Solution

Question

1 Approved Answer

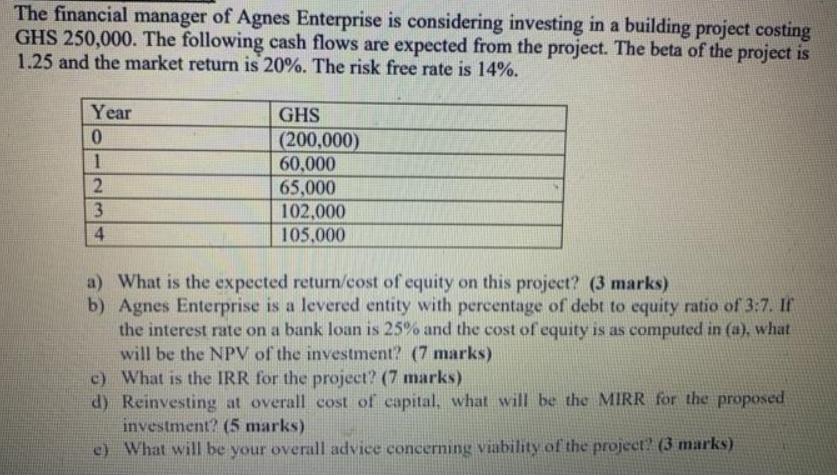

The financial manager of Agnes Enterprise is considering investing in a building project costing GHS 250,000. The following cash flows are expected from the

The financial manager of Agnes Enterprise is considering investing in a building project costing GHS 250,000. The following cash flows are expected from the project. The beta of the project is 1.25 and the market return is 20%. The risk free rate is 14%. Year GHS (200,000) 0 1 60,000 2 65,000 3 102,000 4 105,000 a) What is the expected return/cost of equity on this project? (3 marks) b) Agnes Enterprise is a levered entity with percentage of debt to equity ratio of 3:7. If the interest rate on a bank loan is 25% and the cost of equity is as computed in (a), what will be the NPV of the investment? (7 marks) c) What is the IRR for the project? (7 marks) d) Reinvesting at overall cost of capital, what will be the MIRR for the proposed investment? (5 marks) e) What will be your overall advice concerning viability of the project? (3 marks)

Step by Step Solution

★★★★★

3.47 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Solution a 18901 Expected return cast of equidy Calculation we know as per CAPM Mod...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started