Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The financial manager of the WCW Co. expects a project to generate $350,000 in cash sales and $215,000 in cash operating expenses in the coming

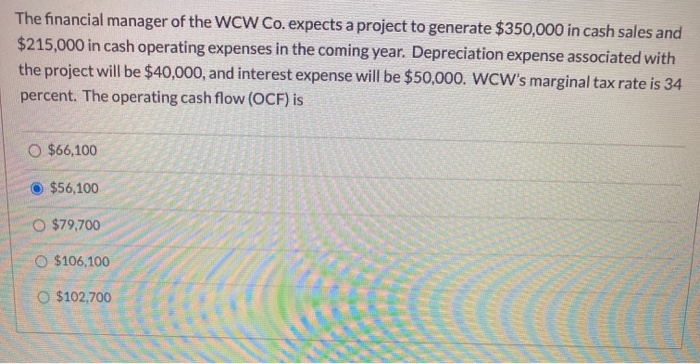

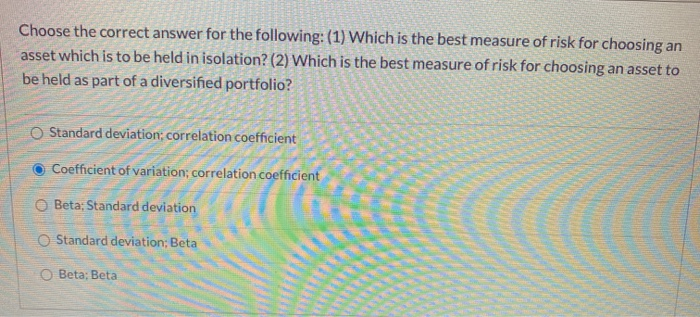

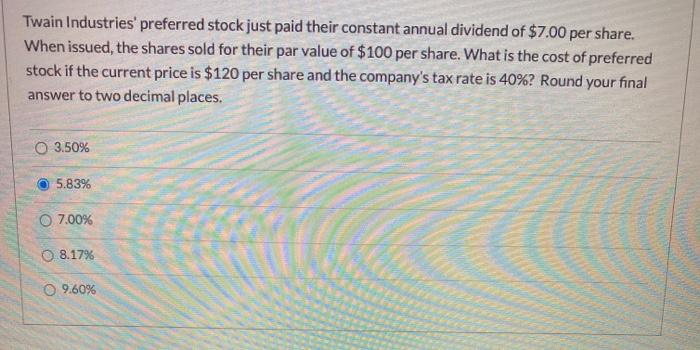

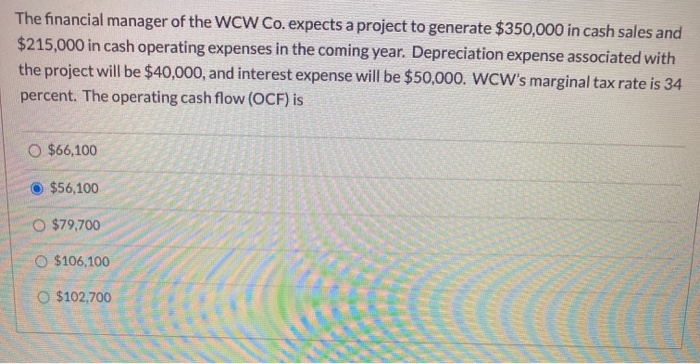

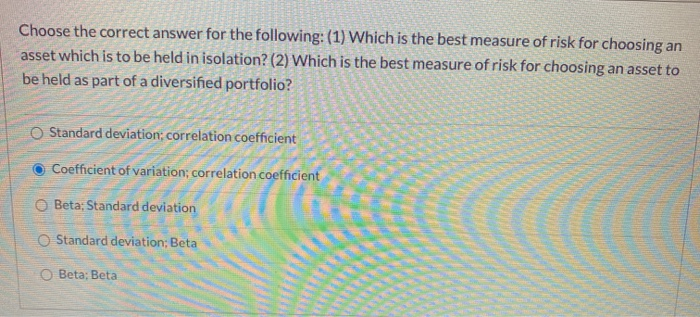

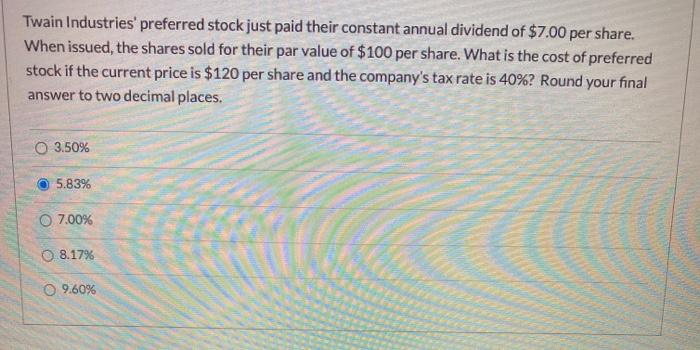

The financial manager of the WCW Co. expects a project to generate $350,000 in cash sales and $215,000 in cash operating expenses in the coming year. Depreciation expense associated with the project will be $40,000, and interest expense will be $50,000. WCW's marginal tax rate is 34 percent. The operating cash flow (OCF) is O $66,100 $56,100 O $79,700 O $106,100 O $102,700 Choose the correct answer for the following: (1) Which is the best measure of risk for choosing an asset which is to be held in isolation? (2) Which is the best measure of risk for choosing an asset to be held as part of a diversified portfolio? Standard deviation; correlation coefficient Coefficient of variation; correlation coefficient Beta: Standard deviation Standard deviation; Beta Beta: Beta Twain Industries' preferred stock just paid their constant annual dividend of $7.00 per share. When issued, the shares sold for their par value of $100 per share. What is the cost of preferred stock if the current price is $120 per share and the company's tax rate is 40%? Round your final answer to two decimal places. O 3.50% 5.83% O 7.00% 8.17% O 9.60%

The financial manager of the WCW Co. expects a project to generate $350,000 in cash sales and $215,000 in cash operating expenses in the coming year. Depreciation expense associated with the project will be $40,000, and interest expense will be $50,000. WCW's marginal tax rate is 34 percent. The operating cash flow (OCF) is O $66,100 $56,100 O $79,700 O $106,100 O $102,700 Choose the correct answer for the following: (1) Which is the best measure of risk for choosing an asset which is to be held in isolation? (2) Which is the best measure of risk for choosing an asset to be held as part of a diversified portfolio? Standard deviation; correlation coefficient Coefficient of variation; correlation coefficient Beta: Standard deviation Standard deviation; Beta Beta: Beta Twain Industries' preferred stock just paid their constant annual dividend of $7.00 per share. When issued, the shares sold for their par value of $100 per share. What is the cost of preferred stock if the current price is $120 per share and the company's tax rate is 40%? Round your final answer to two decimal places. O 3.50% 5.83% O 7.00% 8.17% O 9.60%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started