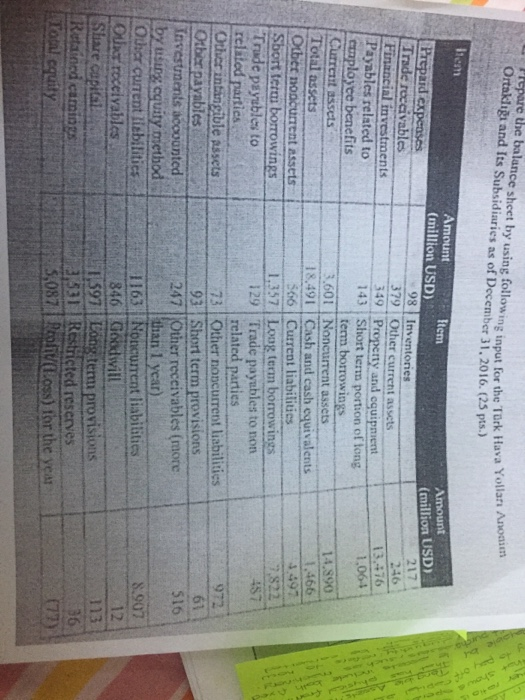

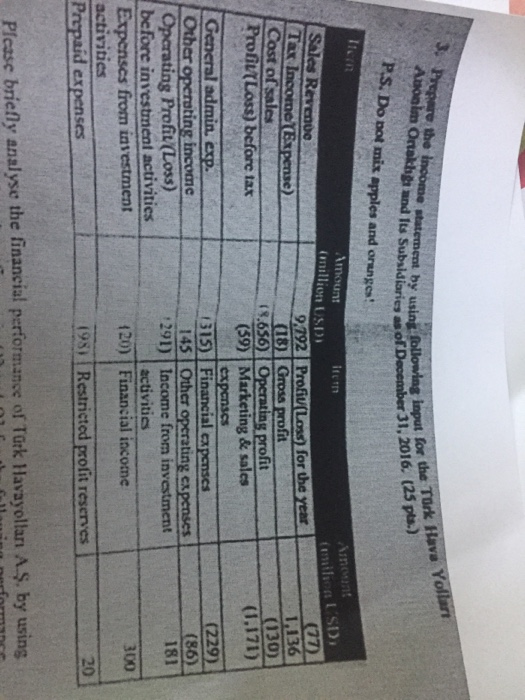

the financial performance of Trk Havayollan AS. by usi the given figures in 02 and Q3 for the following performance 4. Please briely analyse financial igures sn and (20 pts.) i. Liquidity i. Profitability ii. Deb: structure i. Earnings quality epare the balance sheet by using following input for the Trk Hava Ortakli and Its Subsidiaries as of December 31. 2016. (25 pts) Amount (million USD) ftem million USD 217 Prepaid ex Trade reecivables 98Inventories 379 Other current assets 349 Property and cquipment 143 Short term portion of tong term borrowings 3.601 INoncurrent assets Financial investments 1,064 Payables related to employee benefits 14.890 1-466 4 497 t assets Total assets Otber noncurent asses 18.491 Cash and cash equivalents 1357 Loog term borrowings 29 Trade payables to non related parties 73 Other noncurrent liabilities 93 Short term provisions Sbort term borrowings Trude paysbles to related partics 457 972 Otber payables Investments acoounted ising cquity method 516 247 Other receivables (maore than 1 year) 1163 Noncurent liabilities 846 Goodwill 8 907 tliebilitics 12 Ouksr roceivables Share capial tem provisions 3531 Restricted reseies canDin (77) the Anonim Ortakhgh and Its imput for the Trk F s Subsidiaries as of December 31, 2016. (25 pts.) o P.S. Do not mix apples and oranges Amount 17 for the (18) Gross profit 8.656 (59) Marketing&sale Cost of sales Profiu Loss) before tax (1,171) cx General admin (229) 315) Financial expenses229 (86 181 Other 145 Other operating expenses Operating Profit (Loss) before investment activities from investment 291) | Income from investment activitiss 300 120) Financial income 201 (%) 1 Restricted profit reserves | expenses ancial performance of Trk Havayollan AS, by using Please briely analyse the fi the financial performance of Trk Havayollan AS. by usi the given figures in 02 and Q3 for the following performance 4. Please briely analyse financial igures sn and (20 pts.) i. Liquidity i. Profitability ii. Deb: structure i. Earnings quality epare the balance sheet by using following input for the Trk Hava Ortakli and Its Subsidiaries as of December 31. 2016. (25 pts) Amount (million USD) ftem million USD 217 Prepaid ex Trade reecivables 98Inventories 379 Other current assets 349 Property and cquipment 143 Short term portion of tong term borrowings 3.601 INoncurrent assets Financial investments 1,064 Payables related to employee benefits 14.890 1-466 4 497 t assets Total assets Otber noncurent asses 18.491 Cash and cash equivalents 1357 Loog term borrowings 29 Trade payables to non related parties 73 Other noncurrent liabilities 93 Short term provisions Sbort term borrowings Trude paysbles to related partics 457 972 Otber payables Investments acoounted ising cquity method 516 247 Other receivables (maore than 1 year) 1163 Noncurent liabilities 846 Goodwill 8 907 tliebilitics 12 Ouksr roceivables Share capial tem provisions 3531 Restricted reseies canDin (77) the Anonim Ortakhgh and Its imput for the Trk F s Subsidiaries as of December 31, 2016. (25 pts.) o P.S. Do not mix apples and oranges Amount 17 for the (18) Gross profit 8.656 (59) Marketing&sale Cost of sales Profiu Loss) before tax (1,171) cx General admin (229) 315) Financial expenses229 (86 181 Other 145 Other operating expenses Operating Profit (Loss) before investment activities from investment 291) | Income from investment activitiss 300 120) Financial income 201 (%) 1 Restricted profit reserves | expenses ancial performance of Trk Havayollan AS, by using Please briely analyse the fi