Answered step by step

Verified Expert Solution

Question

1 Approved Answer

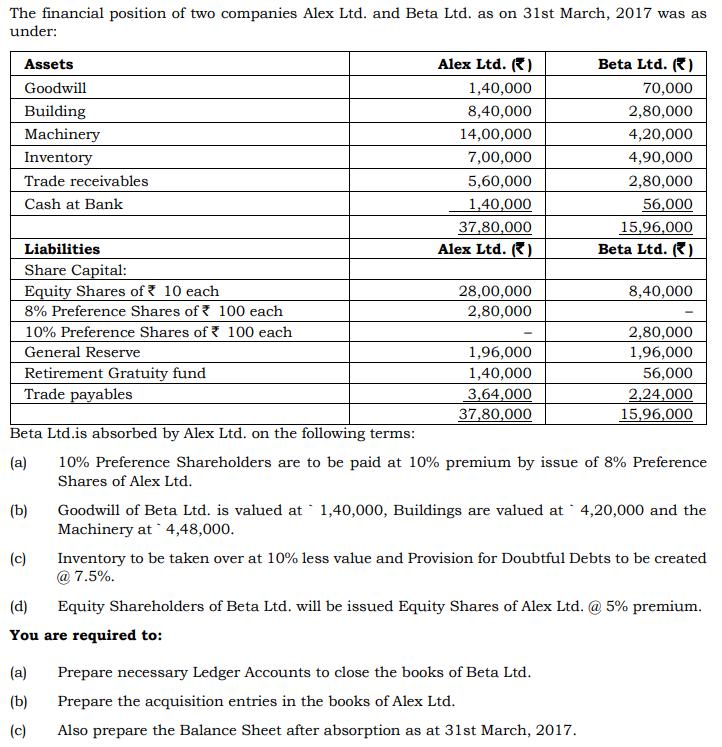

The financial position of two companies Alex Ltd. and Beta Ltd. as on 31st March, 2017 was as under: Assets Alex Ltd. (R) Beta

The financial position of two companies Alex Ltd. and Beta Ltd. as on 31st March, 2017 was as under: Assets Alex Ltd. (R) Beta Ltd. () Goodwill 1,40,000 70,000 Building 8,40,000 2,80,000 Machinery 14,00,000 4,20,000 Inventory 7,00,000 4,90,000 Trade receivables 5,60,000 2,80,000 Cash at Bank 1,40,000 56,000 37,80,000 15,96,000 Beta Ltd. (R) Liabilities Alex Ltd. () Share Capital: Equity Shares of 10 each 28,00,000 2,80,000 8,40,000 8% Preference Shares of ? 100 each 10% Preference Shares of 100 each 2,80,000 1,96,000 General Reserve 1,96,000 Retirement Gratuity fund Trade payables 56,000 1,40,000 3,64,000 37,80,000 2,24,000 15,96,000 Beta Ltd.is absorbed by Alex Ltd. on the following terms: 10% Preference Shareholders are to be paid at 10% premium by issue of 8% Preference Shares of Alex Ltd. (a) Goodwill of Beta Ltd. is valued at 1,40,000, Buildings are valued at 4,20,000 and the Machinery at 4,48,000. (b) (c) Inventory to be taken over at 10% less value and Provision for Doubtful Debts to be created @ 7.5%. (d) Equity Shareholders of Beta Ltd. will be issued Equity Shares of Alex Ltd. @ 5% premium. You are required to: (a) Prepare necessary Ledger Accounts to close the books of Beta Ltd. (b) Prepare the acquisition entries in the books of Alex Ltd. (c) Also prepare the Balance Sheet after absorption as at 31st March, 2017.

Step by Step Solution

★★★★★

3.34 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Answer Solution Realisation AC Date Particulars Debit Credit Debit 1596000 1624000 56000 1568000 224...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started