Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The financial projections for the Brittle Corp. are presented below. You are asked to calculate the company value under three different long-run scenarios: a.

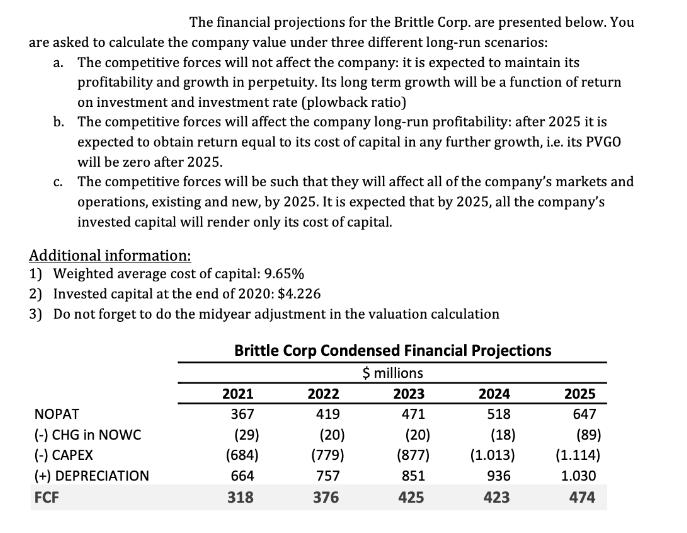

The financial projections for the Brittle Corp. are presented below. You are asked to calculate the company value under three different long-run scenarios: a. The competitive forces will not affect the company: it is expected to maintain its profitability and growth in perpetuity. Its long term growth will be a function of return on investment and investment rate (plowback ratio) b. The competitive forces will affect the company long-run profitability: after 2025 it is expected to obtain return equal to its cost of capital in any further growth, i.e. its PVGO will be zero after 2025. c. The competitive forces will be such that they will affect all of the company's markets and operations, existing and new, by 2025. It is expected that by 2025, all the company's invested capital will render only its cost of capital. Additional information: 1) Weighted average cost of capital: 9.65% 2) Invested capital at the end of 2020: $4.226 3) Do not forget to do the midyear adjustment in the valuation calculation NOPAT (-) CHG in NOWC (-) CAPEX (+) DEPRECIATION FCF Brittle Corp Condensed Financial Projections $ millions 2023 471 2021 367 (29) (684) 664 318 2022 419 (20) (779) 757 376 (20) (877) 851 425 2024 518 (18) (1.013) 936 423 2025 647 (89) (1.114) 1.030 474

Step by Step Solution

★★★★★

3.24 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started