Answered step by step

Verified Expert Solution

Question

1 Approved Answer

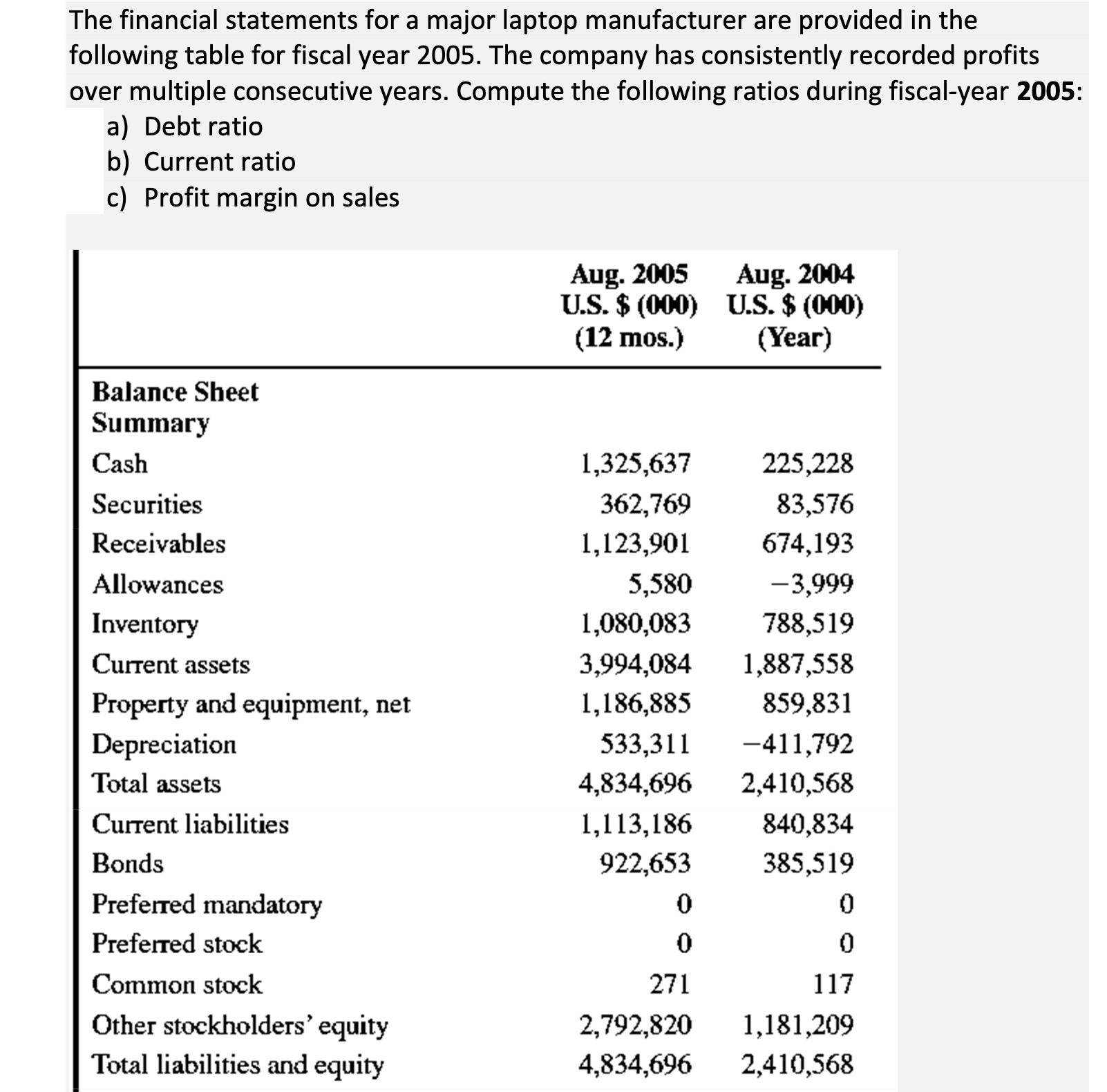

The financial statements for a major laptop manufacturer are provided in the following table for fiscal year 2005. The company has consistently recorded profits

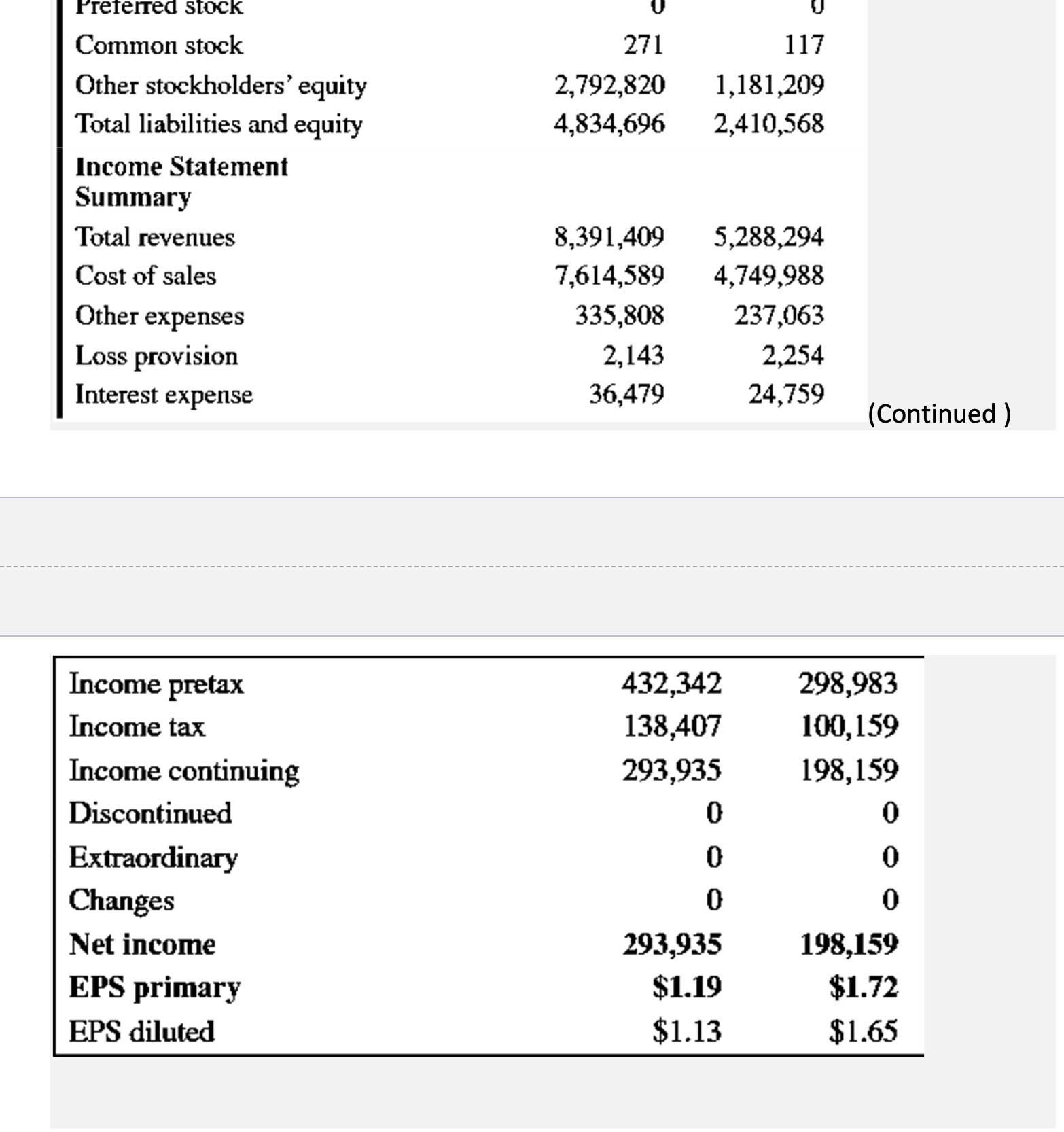

The financial statements for a major laptop manufacturer are provided in the following table for fiscal year 2005. The company has consistently recorded profits over multiple consecutive years. Compute the following ratios during fiscal-year 2005: a) Debt ratio b) Current ratio c) Profit margin on sales Balance Sheet Summary Aug. 2005 U.S. $ (000) (12 mos.) Aug. 2004 U.S. $ (000) (Year) Cash 1,325,637 225,228 Securities Receivables 362,769 83,576 1,123,901 674,193 Allowances 5,580 -3,999 Inventory 1,080,083 788,519 Current assets 3,994,084 1,887,558 Property and equipment, net 1,186,885 859,831 Depreciation 533,311 -411,792 Total assets 4,834,696 2,410,568 Current liabilities 1,113,186 840,834 Bonds 922,653 385,519 Preferred mandatory 0 0 Preferred stock 0 0 Common stock 271 117 Other stockholders' equity 2,792,820 1,181,209 Total liabilities and equity 4,834,696 2,410,568 Preferred stock Common stock Other stockholders' equity Total liabilities and equity 271 2,792,820 117 1,181,209 4,834,696 2,410,568 Income Statement Summary Total revenues 8,391,409 5,288,294 Cost of sales 7,614,589 4,749,988 Other expenses 335,808 237,063 Loss provision 2,143 2,254 Interest expense 36,479 24,759 (Continued) Income pretax 432,342 298,983 Income tax 138,407 100,159 Income continuing 293,935 198,159 Discontinued 0 0 Extraordinary 0 0 Changes 0 0 Net income 293,935 198,159 EPS primary $1.19 $1.72 EPS diluted $1.13 $1.65

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started