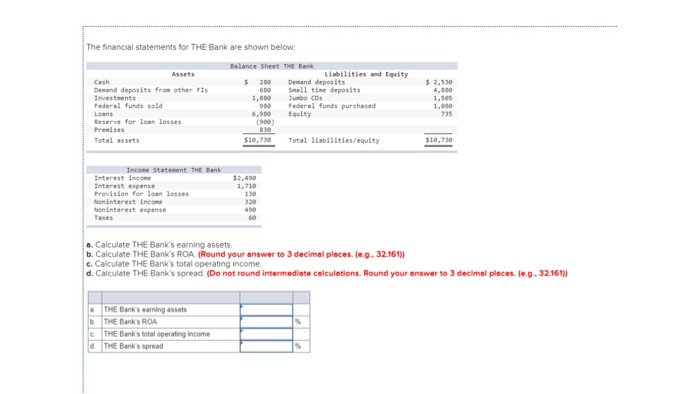

The financial statements for THE Bank are shown below. Balance Sheet THE Bank Liabilities and Equity Demand deposits Small time deposits Demand deposits from other FIS Federal funds sold Federal funds purchased Equity Reserve for loan losses Premises Total assets $10,730 Total liabilities/equity Income Statement THE Bank Interest Income Interest expens Provision for loan losses Non interest Income Noninterest expense a. Calculate THE Bank's earning assets b. Calculate THE Bank's ROA (Round your answer to 3 decimal places. (e.g.. 32.161)) c. Calculate THE Bank's total operating income d. Calculate THE Bank's spread. (Do not round intermediate calculations. Round your answer to 3 decimal places. e... 32.161) THE Bank's caming assets THE Bank's ROA THE Bank's total operating Income THE Banks spread The financial statements for THE Bank are shown below Balance Sheet The Sank abilities and Equity Demand deposits Small time deposits Demand deposits from other is Federal funds purchased Equity Reserve for loan losses Total abilities/equity Income Statement THE Bank a. Calculate THE Bank's earning assets b. Calculate THE Bank's ROA. (Round your answer to 3 decimal places. leg. 32.161) Ec. Calculate THE Bank's total operating income d. Calculate THE Bank's spread. (Do not round Intermediate calculations. Round your answer to 3 decim a THE Bank's eaming sets THE Bank's ROA THE Bank's total operating income THE Bank's spread d The financial statements for THE Bank are shown below. Balance Sheet THE Bank Liabilities and Equity Demand deposits Small time deposits Demand deposits from other FIS Federal funds sold Federal funds purchased Equity Reserve for loan losses Premises Total assets $10,730 Total liabilities/equity Income Statement THE Bank Interest Income Interest expens Provision for loan losses Non interest Income Noninterest expense a. Calculate THE Bank's earning assets b. Calculate THE Bank's ROA (Round your answer to 3 decimal places. (e.g.. 32.161)) c. Calculate THE Bank's total operating income d. Calculate THE Bank's spread. (Do not round intermediate calculations. Round your answer to 3 decimal places. e... 32.161) THE Bank's caming assets THE Bank's ROA THE Bank's total operating Income THE Banks spread The financial statements for THE Bank are shown below Balance Sheet The Sank abilities and Equity Demand deposits Small time deposits Demand deposits from other is Federal funds purchased Equity Reserve for loan losses Total abilities/equity Income Statement THE Bank a. Calculate THE Bank's earning assets b. Calculate THE Bank's ROA. (Round your answer to 3 decimal places. leg. 32.161) Ec. Calculate THE Bank's total operating income d. Calculate THE Bank's spread. (Do not round Intermediate calculations. Round your answer to 3 decim a THE Bank's eaming sets THE Bank's ROA THE Bank's total operating income THE Bank's spread d