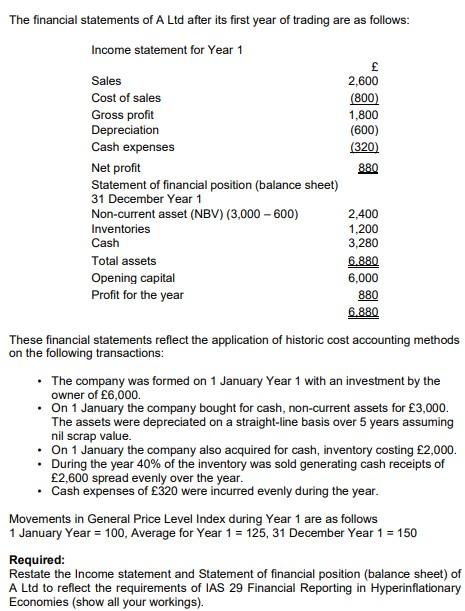

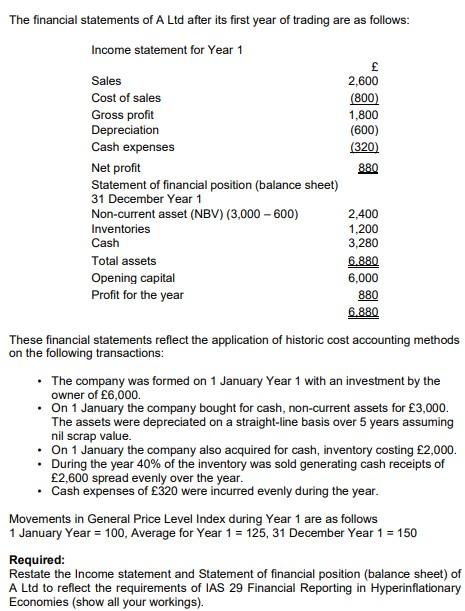

The financial statements of A Ltd after its first year of trading are as follows: Income statement for Year 1 Sales 2,600 Cost of sales (800) Gross profit 1,800 Depreciation (600) Cash expenses (320) Net profit 880 Statement of financial position (balance sheet) 31 December Year 1 Non-current asset (NBV) (3,000 - 600) 2,400 Inventories 1,200 Cash 3,280 Total assets 6.880 Opening capital 6,000 Profit for the year 880 6.880 These financial statements reflect the application of historic cost accounting methods on the following transactions: The company was formed on 1 January Year 1 with an investment by the owner of 6,000. . On 1 January the company bought for cash, non-current assets for 3,000. The assets were depreciated on a straight-line basis over 5 years assuming nil scrap value. On 1 January the company also acquired for cash, inventory costing 2,000. . During the year 40% of the inventory was sold generating cash receipts of 2,600 spread evenly over the year. Cash expenses of 320 were incurred evenly during the year. Movements in General Price Level Index during Year 1 are as follows 1 January Year = 100, Average for Year 1 = 125, 31 December Year 1 = 150 Required: Restate the Income statement and Statement of financial position (balance sheet) of A Ltd to reflect the requirements of IAS 29 Financial Reporting in Hyperinflationary Economies (show all your workings). The financial statements of A Ltd after its first year of trading are as follows: Income statement for Year 1 Sales 2,600 Cost of sales (800) Gross profit 1,800 Depreciation (600) Cash expenses (320) Net profit 880 Statement of financial position (balance sheet) 31 December Year 1 Non-current asset (NBV) (3,000 - 600) 2,400 Inventories 1,200 Cash 3,280 Total assets 6.880 Opening capital 6,000 Profit for the year 880 6.880 These financial statements reflect the application of historic cost accounting methods on the following transactions: The company was formed on 1 January Year 1 with an investment by the owner of 6,000. . On 1 January the company bought for cash, non-current assets for 3,000. The assets were depreciated on a straight-line basis over 5 years assuming nil scrap value. On 1 January the company also acquired for cash, inventory costing 2,000. . During the year 40% of the inventory was sold generating cash receipts of 2,600 spread evenly over the year. Cash expenses of 320 were incurred evenly during the year. Movements in General Price Level Index during Year 1 are as follows 1 January Year = 100, Average for Year 1 = 125, 31 December Year 1 = 150 Required: Restate the Income statement and Statement of financial position (balance sheet) of A Ltd to reflect the requirements of IAS 29 Financial Reporting in Hyperinflationary Economies (show all your workings)