Answered step by step

Verified Expert Solution

Question

1 Approved Answer

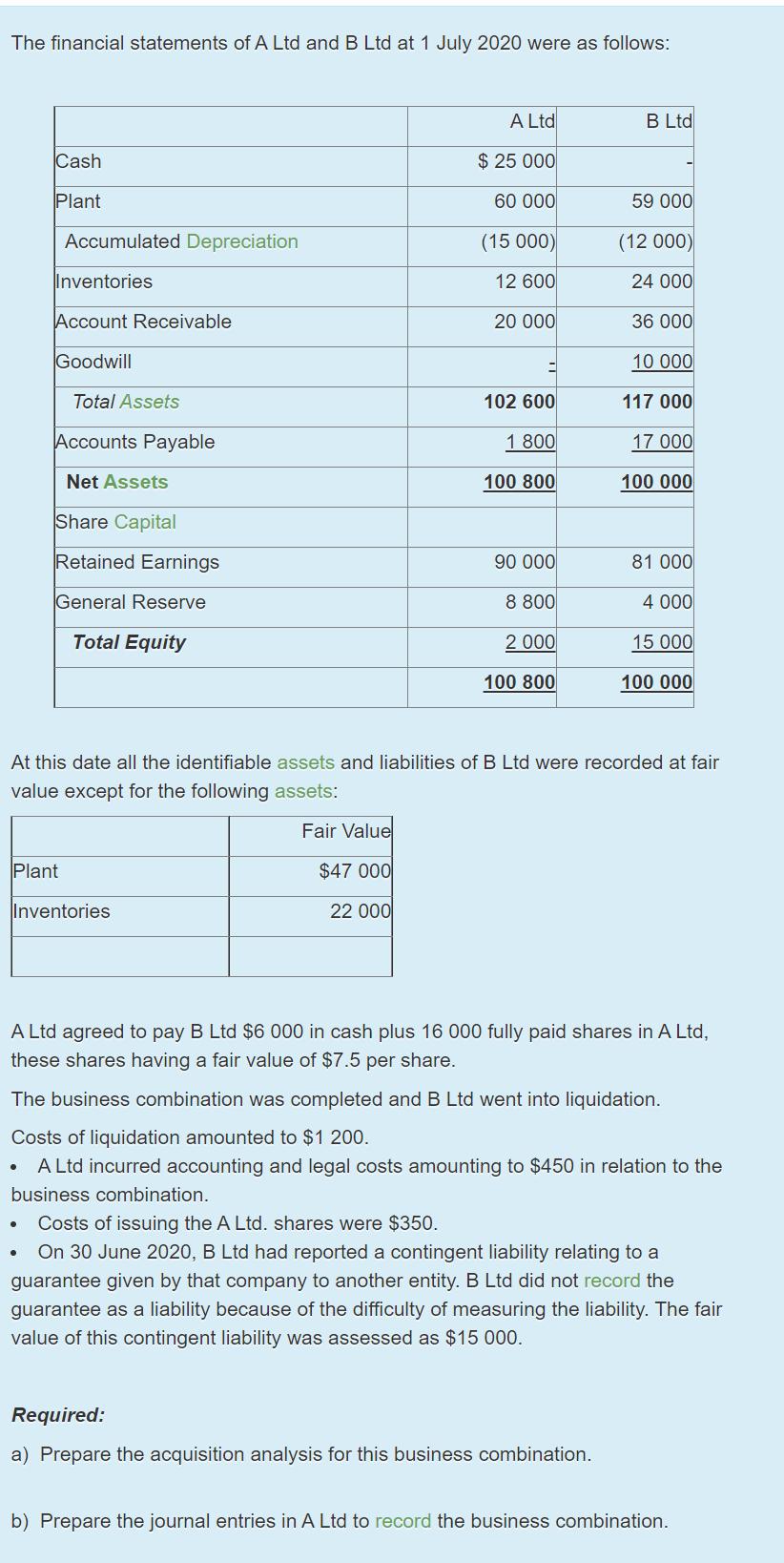

The financial statements of A Ltd and B Ltd at 1 July 2020 were as follows: A Ltd B Ltd Cash $ 25 000

The financial statements of A Ltd and B Ltd at 1 July 2020 were as follows: A Ltd B Ltd Cash $ 25 000 Plant 60 000 59 000 Accumulated Depreciation (15 000) (12 000) Inventories 12 600 24 000 Account Receivable 20 000 36 000 Goodwill 10 000 Total Assets 102 600 117 000 Accounts Payable 1 800 17000 Net Assets 100 800 100 000 Share Capital Retained Earnings 90 000 81 000 General Reserve 8 800 4 000 Total Equity 2 000 15 000 100 800 100 000 At this date all the identifiable assets and liabilities of B Ltd were recorded at fair value except for the following assets: Fair Value Plant $47 000 Inventories 22 000 A Ltd agreed to pay B Ltd $6 000 in cash plus 16 000 fully paid shares in A Ltd, these shares having a fair value of $7.5 per share. The business combination was completed and B Ltd went into liquidation. Costs of liquidation amounted to $1 200. A Ltd incurred accounting and legal costs amounting to $450 in relation to the business combination. Costs of issuing the A Ltd. shares were $350. On 30 June 2020, B Ltd had reported a contingent liability relating to a guarantee given by that company to another entity. B Ltd did not record the guarantee as a liability because of the difficulty of measuring the liability. The fair value of this contingent liability was assessed as $15 000. Required: a) Prepare the acquisition analysis for this business combination. b) Prepare the journal entries in A Ltd to record the business combination.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started