Answered step by step

Verified Expert Solution

Question

1 Approved Answer

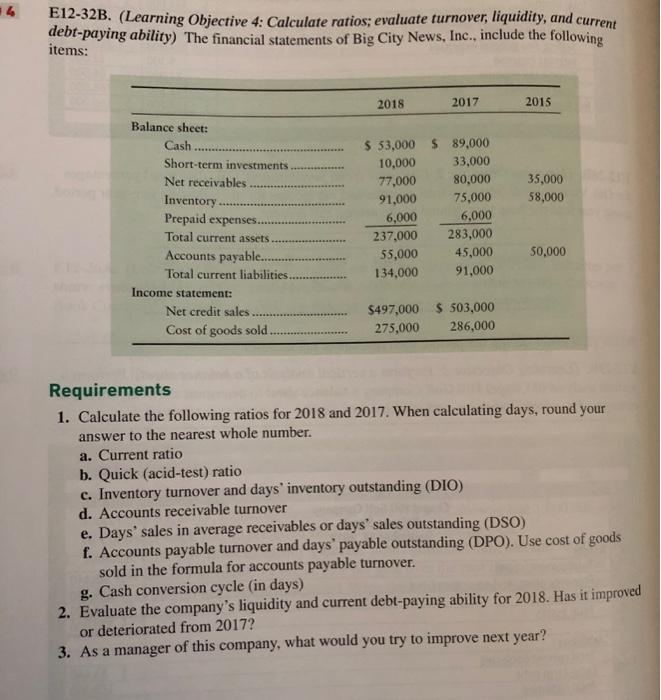

14 E12-32B. (Learning Objective 4: Calculate ratios; evaluate turnover, liquidity, and current debt-paying ability) The financial statements of Big City News, Inc., include the

14 E12-32B. (Learning Objective 4: Calculate ratios; evaluate turnover, liquidity, and current debt-paying ability) The financial statements of Big City News, Inc., include the following items: 2018 2017 2015 Balance sheet: Cash $ 53,000 89,000 Short-term investments 10,000 33,000 Net receivables 77,000 80,000 35,000 91,000 75,000 58,000 Inventory Prepaid expenses... 6,000 6,000 Total current assets. 237,000 283,000 45,000 50,000 Accounts payable... Total current liabilities. 55,000 134,000 91,000 Income statement: $497,000 $ 503,000 286,000 Net credit sales Cost of goods sold 275,000 Requirements 1. Calculate the following ratios for 2018 and 2017. When calculating days, round your answer to the nearest whole number. a. Current ratio b. Quick (acid-test) ratio c. Inventory turnover and days' inventory outstanding (DIO) d. Accounts receivable turnover e. Days' sales in average receivables or days' sales outstanding (DSO) f. Accounts payable turnover and days' payable outstanding (DPO). Use cost of goods sold in the formula for accounts payable turnover. g. Cash conversion cycle (in days) 2. Evaluate the company's liquidity and current debt-paying ability for 2018. Has it improved or deteriorated from 2017? 3. As a manager of this company, what would you try to improve next year?

Step by Step Solution

★★★★★

3.51 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Q4 Solution 1 a b Quick Ratio Quick Alsets Current liabilities c CS Current Rati...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started