Answered step by step

Verified Expert Solution

Question

1 Approved Answer

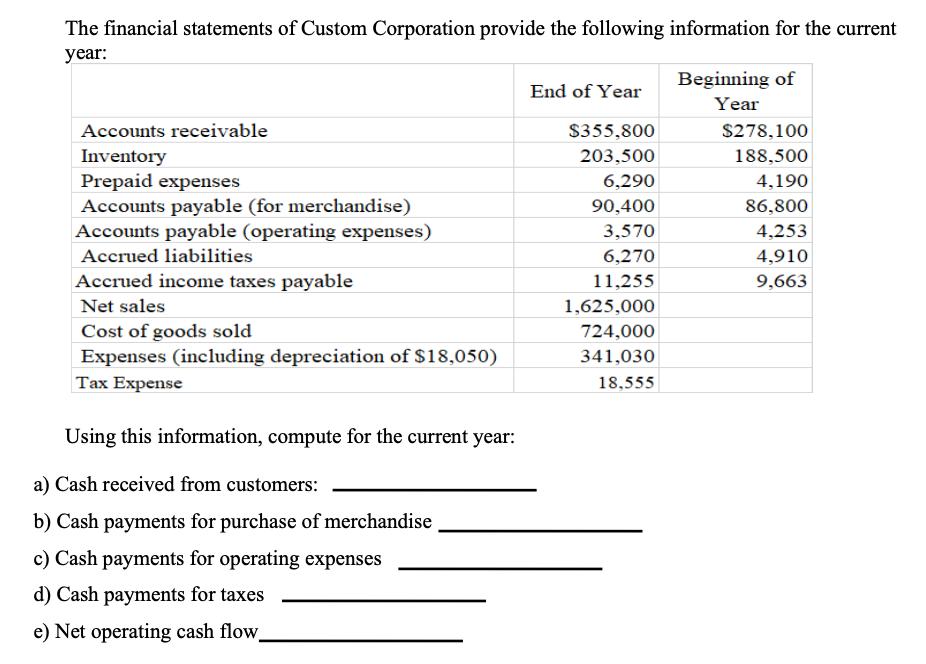

The financial statements of Custom Corporation provide the following information for the current year: Accounts receivable Inventory Prepaid expenses Accounts payable (for merchandise) Accounts

The financial statements of Custom Corporation provide the following information for the current year: Accounts receivable Inventory Prepaid expenses Accounts payable (for merchandise) Accounts payable (operating expenses) Accrued liabilities Accrued income taxes payable Net sales Cost of goods sold Expenses (including depreciation of $18,050) Tax Expense Using this information, compute for the current year: a) Cash received from customers: b) Cash payments for purchase of merchandise c) Cash payments for operating expenses d) Cash payments for taxes e) Net operating cash flow End of Year $355,800 203,500 6,290 90,400 3,570 6,270 11,255 1,625,000 724,000 341,030 18,555 Beginning of Year $278,100 188,500 4,190 86,800 4,253 4,910 9,663

Step by Step Solution

★★★★★

3.53 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

a Cash received from customers To calculate cash received from customers we need to adjust net sales ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started