Answered step by step

Verified Expert Solution

Question

1 Approved Answer

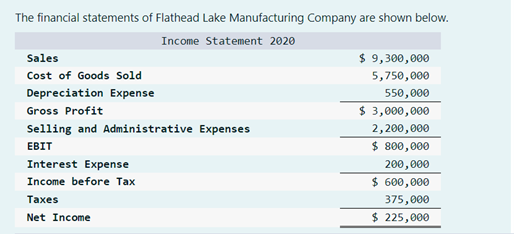

The financial statements of Flathead Lake Manufacturing Company are shown below. Income Statement 2020 Sales Cost of Goods Sold Depreciation Expense Gross Profit Selling

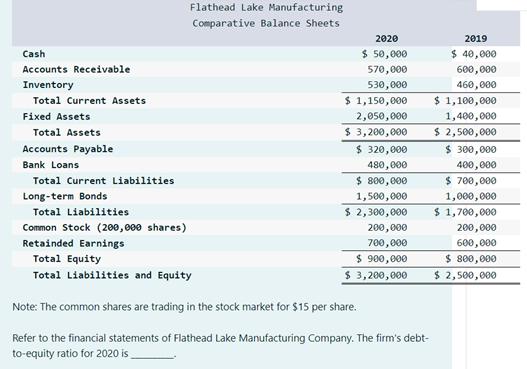

The financial statements of Flathead Lake Manufacturing Company are shown below. Income Statement 2020 Sales Cost of Goods Sold Depreciation Expense Gross Profit Selling and Administrative Expenses EBIT Interest Expense Income before Tax Taxes Net Income $ 9,300,000 5,750,000 550,000 $ 3,000,000 2,200,000 $ 800,000 200,000 $ 600,000 375,000 $ 225,000 Cash Accounts Receivable Inventory Total Current Assets Fixed Assets Total Assets Accounts Payable Bank Loans Total Current Liabilities Long-term Bonds Flathead Lake Manufacturing Comparative Balance Sheets 2020 $ 50,000 570,000 530,000 $ 1,150,000 2,050,000 $ 3,200,000 $ 320,000 480,000 $ 800,000 1,500,000 $ 2,300,000 Total Liabilities Common Stock (200,000 shares) Retainded Earnings Total Equity Total Liabilities and Equity Note: The common shares are trading in the stock market for $15 per share. Refer to the financial statements of Flathead Lake Manufacturing Company. The firm's debt- to-equity ratio for 2020 is 200,000 700,000 $ 900,000 $ 3,200,000 2019 $ 40,000 600,000 460,000 $ 1,100,000 1,400,000 $ 2,500,000 $ 300,000 400,000 $ 700,000 1,000,000 $ 1,700,000 200,000 600,000 $ 800,000 $ 2,500,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Step 1 Ratio Analysis Ratio analysis is the mathem...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started