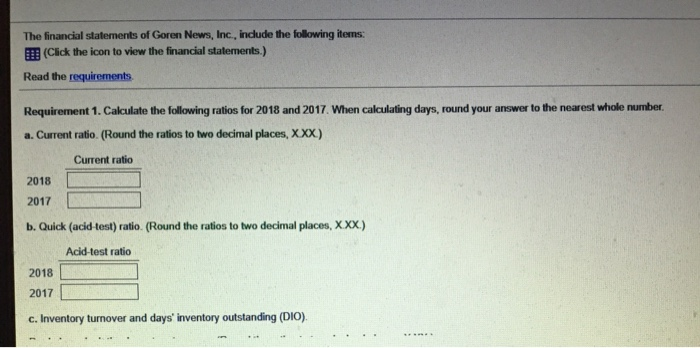

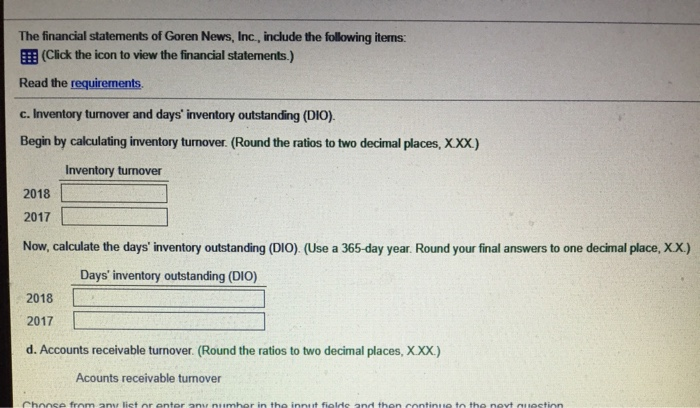

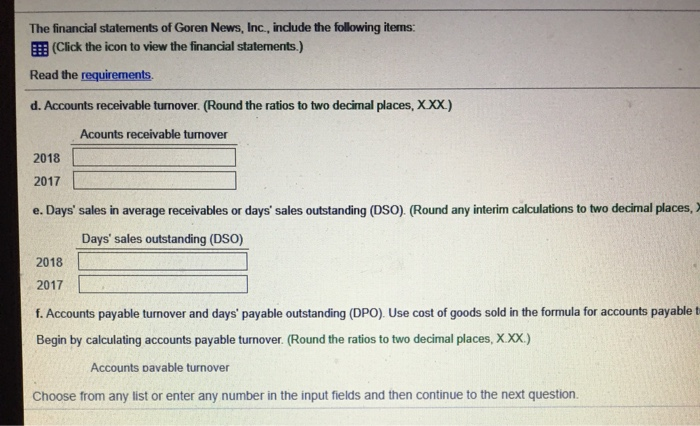

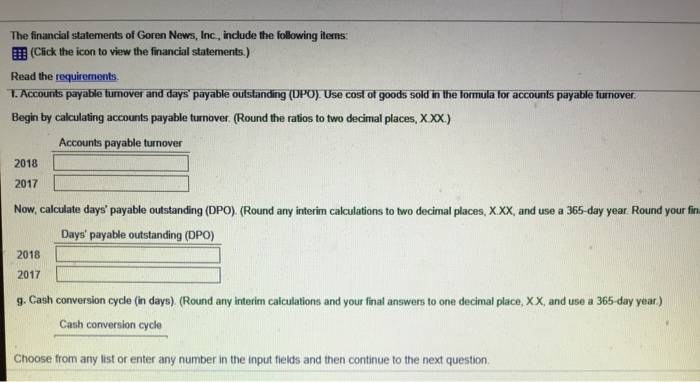

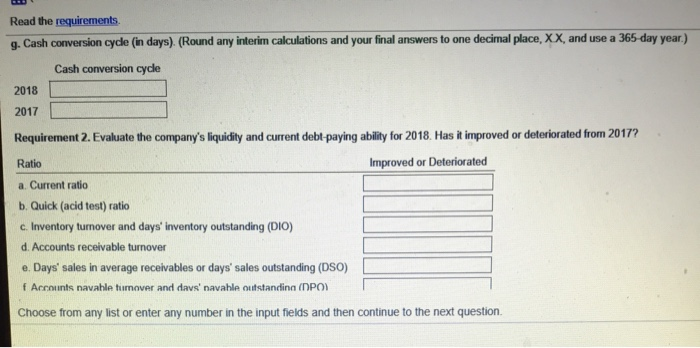

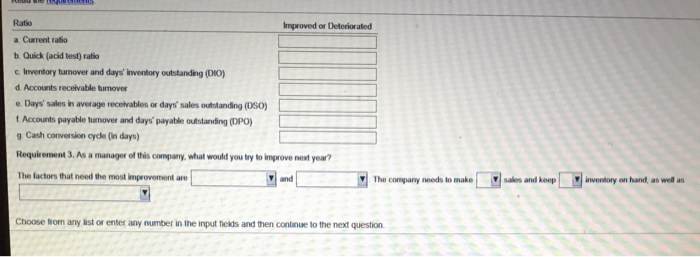

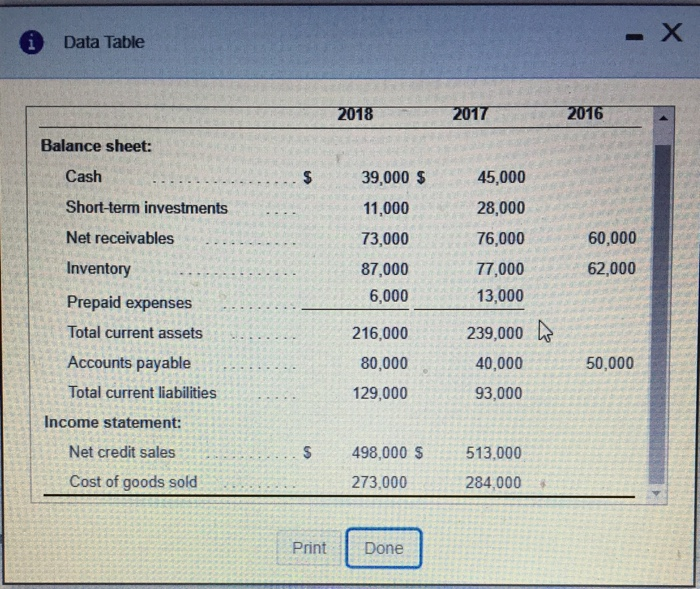

The financial statements of Goren News, Inc., include the following items. (Click the icon to view the financial statements.) Read the requirements Requirement 1. Calculate the following ratios for 2018 and 2017 When calculating days, round your answer to the nearest whole number a. Current ratio. (Round the ratios to two decimal places, XXX) Current ratio 2018 2017 b. Quick (acid-test) ratio. (Round the ratios to two decimal places, XXX) Acid-test ratio 2018 2017 c. Inventory turnover and days' inventory outstanding (DIO). The financial statements of Goren News, Inc., include the following items: (Click the icon to view the financial statements.) Read the requirements c. Inventory turnover and days' inventory outstanding (DIO). Begin by calculating inventory turnover. (Round the ratios to two decimal places, X.XX.) Inventory turnover 2018 2017 Now, calculate the days' inventory outstanding (DIO). (Use a 365-day year. Round your final answers to one decimal place, XX.) Days' inventory outstanding (DIO) 2018 2017 d. Accounts receivable turnover (Round the ratios to two decimal places, XXX.) Acounts receivable turnover Choose from a list or entorn imhor in the innat foute that the navnet The financial statements of Goren News, Inc., include the following items! (Click the icon to view the financial statements.) Read the requirements 1. Accounts payable turnover and days payable outstanding (DPO). Use cost of goods sold in the formula for accounts payable turnover. Begin by calculating accounts payable turnover (Round the ratios to two decimal places, XXX.) Accounts payable turnover 2018 2017 Now, calculate days' payable outstanding (DPO). (Round any interim calculations to two decimal places, X.XX, and use a 365-day year. Round your fin. Days' payable outstanding (DPO) 2018 2017 g. Cash conversion cycle (in days). (Round any interim calculations and your final answers to one decimal place, XX, and use a 365-day year.) Cash conversion cycle Choose from any list or enter any number in the input fields and then continue to the next question Read the requirements g. Cash conversion cycle (in days). (Round any interim calculations and your final answers to one decimal place, XX, and use a 365 day year.) Cash conversion cycle 2018 2017 Requirement 2. Evaluate the company's liquidity and current debt paying ability for 2018. Has it improved or deteriorated from 2017? Ratio Improved or Deteriorated a. Current ratio b. Quick (acid test) ratio c. Inventory turnover and days'inventory outstanding (D10) d. Accounts receivable turnover e Days' sales in average receivables or days' sales outstanding (DSO) f Accounts navale tumover and days' navable outstanding (DPO) Choose from any list or enter any number in the input fields and then continue to the next question Improved or Duterte a Current ratio b. Quick (acid test) ratio crventory tumover and days inventory outstanding (D ) d Accounts receivable turnover Days' sales in average receivables or days' sales outstanding (OSO) Accounts payable tumover and days payable outstanding (DPO) 9 Cash conversion cyde (in days) Requirements. As a manager of this company, what would you by to improvement year? The factors that need the most improvement are The company needs to make sales and keep inventory on hand as well as Choose from any stor enter any number in the input fiets and then continue to the next question i Data Table X 2018 2017 2016 39,000 $ 11,000 73,000 87,000 6,000 JUUU TOVU 60.000 62,000 Balance sheet: Cash Short-term investments Net receivables Inventory Prepaid expenses Total current assets Accounts payable Total current liabilities Income statement: Net credit sales Cost of goods sold 45,000 28,000 76,000 77,000 13,000 239,000 W 40,000 93,000 216,000 80,000 129,000 50,000 498,000 $ 273,000 513,000 284,000 Print Done