Answered step by step

Verified Expert Solution

Question

1 Approved Answer

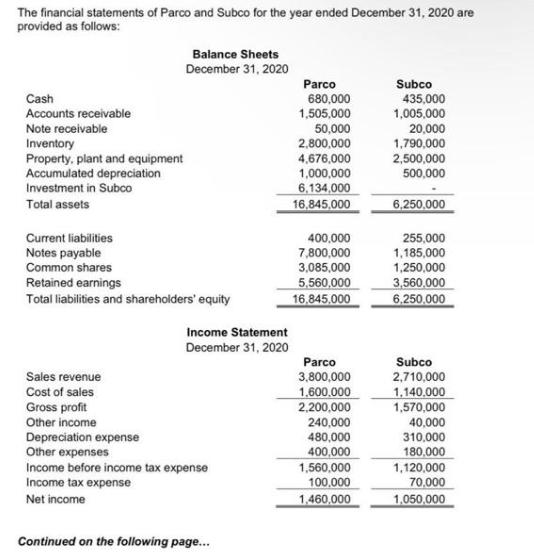

The financial statements of Parco and Subco for the year ended December 31, 2020 are provided as follows: Cash Accounts receivable Note receivable Inventory

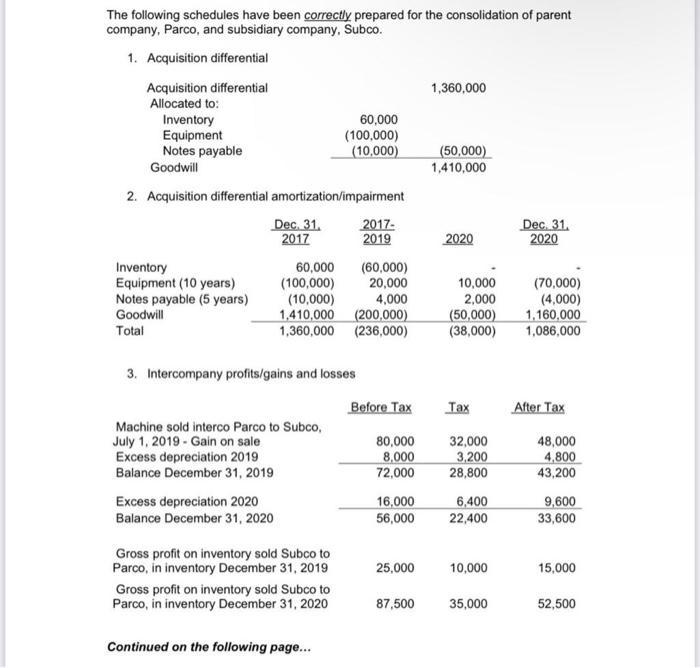

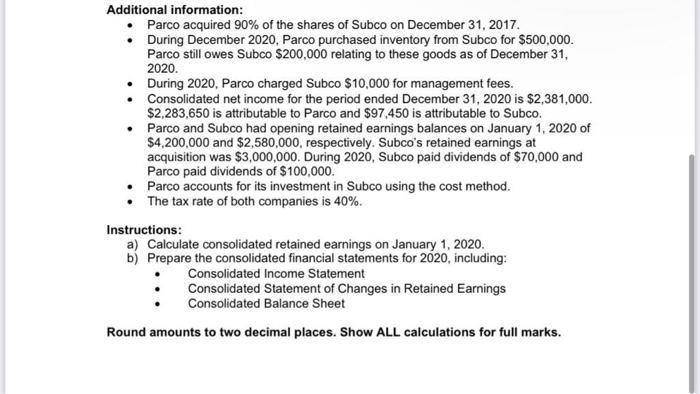

The financial statements of Parco and Subco for the year ended December 31, 2020 are provided as follows: Cash Accounts receivable Note receivable Inventory Property, plant and equipment Accumulated depreciation Investment in Subco Total assets Current liabilities Notes payable Balance Sheets December 31, 2020 Common shares Retained earnings Total liabilities and shareholders' equity Sales revenue Cost of sales Income Statement December 31, 2020 Gross profit Other income Depreciation expense Other expenses Income before income tax expense Income tax expense Net income Continued on the following page... Parco 680,000 1,505,000 50,000 2,800,000 4,676,000 1,000,000 6,134,000 16,845,000 400,000 7,800,000 3,085,000 5,560,000 16,845,000 Parco 3,800,000 1,600,000 2,200,000 240,000 480,000 400,000 1,560,000 100,000 1,460,000 Subco 435,000 1,005,000 20,000 1,790,000 2,500,000 500,000 6,250,000 255,000 1,185,000 1,250,000 3,560,000 6,250,000 Subco 2,710,000 1.140.000 1,570,000 40,000 310,000 180,000 1,120,000 70,000 1,050,000 The following schedules have been correctly prepared for the consolidation of parent company, Parco, and subsidiary company, Subco. 1. Acquisition differential Acquisition differential Allocated to: Inventory Equipment Notes payable Goodwill 2. Acquisition differential amortization/impairment Inventory Equipment (10 years) Notes payable (5 years) Goodwill Total Dec. 31. 2017 60,000 (100,000) (10,000) 1,410,000 Excess depreciation 2020 Balance December 31, 2020 3. Intercompany profits/gains and losses Machine sold interco Parco to Subco, July 1, 2019 - Gain on sale Excess depreciation 2019 Balance December 31, 2019 60,000 (100,000) (10,000) (200,000) 1,360,000 (236,000) Gross profit on inventory sold Subco to Parco, in inventory December 31, 2019 Gross profit on inventory sold Subco to Parco, in inventory December 31, 2020 Continued on the following page... 2017- 2019 (60,000) 20,000 4,000 Before Tax 80,000 8,000 72,000 16,000 56,000 25,000 87,500 1,360,000 (50,000) 1,410,000 2020 10,000 2,000 (50,000) (38,000) Tax 32,000 3,200 28,800 6,400 22,400 10,000 35,000 Dec. 31. 2020 (70,000) (4,000) 1,160,000 1,086,000 After Tax 48,000 4,800 43,200 9,600 33,600 15,000 52,500 Additional information: Parco acquired 90% of the shares of Subco on December 31, 2017. During December 2020, Parco purchased inventory from Subco for $500,000. Parco still owes Subco $200,000 relating to these goods as of December 31, 2020. . During 2020, Parco charged Subco $10,000 for management fees. Consolidated net income for the period ended December 31, 2020 is $2,381,000. $2,283,650 is attributable to Parco and $97,450 is attributable to Subco. Parco and Subco had opening retained earnings balances on January 1, 2020 of $4,200,000 and $2,580,000, respectively. Subco's retained earnings at acquisition was $3,000,000. During 2020, Subco paid dividends of $70,000 and Parco paid dividends of $100,000. Parco accounts for its investment in Subco using the cost method. The tax rate of both companies is 40%. Instructions: a) Calculate consolidated retained earnings on January 1, 2020. b) Prepare the consolidated financial statements for 2020, including: Consolidated Income Statement Consolidated Statement of Changes in Retained Earnings Consolidated Balance Sheet Round amounts to two decimal places. Show ALL calculations for full marks.

Step by Step Solution

★★★★★

3.52 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

a Calculation of consolidated retained earnings on January 1 2020 Retained earnings Parco January 1 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started