Answered step by step

Verified Expert Solution

Question

1 Approved Answer

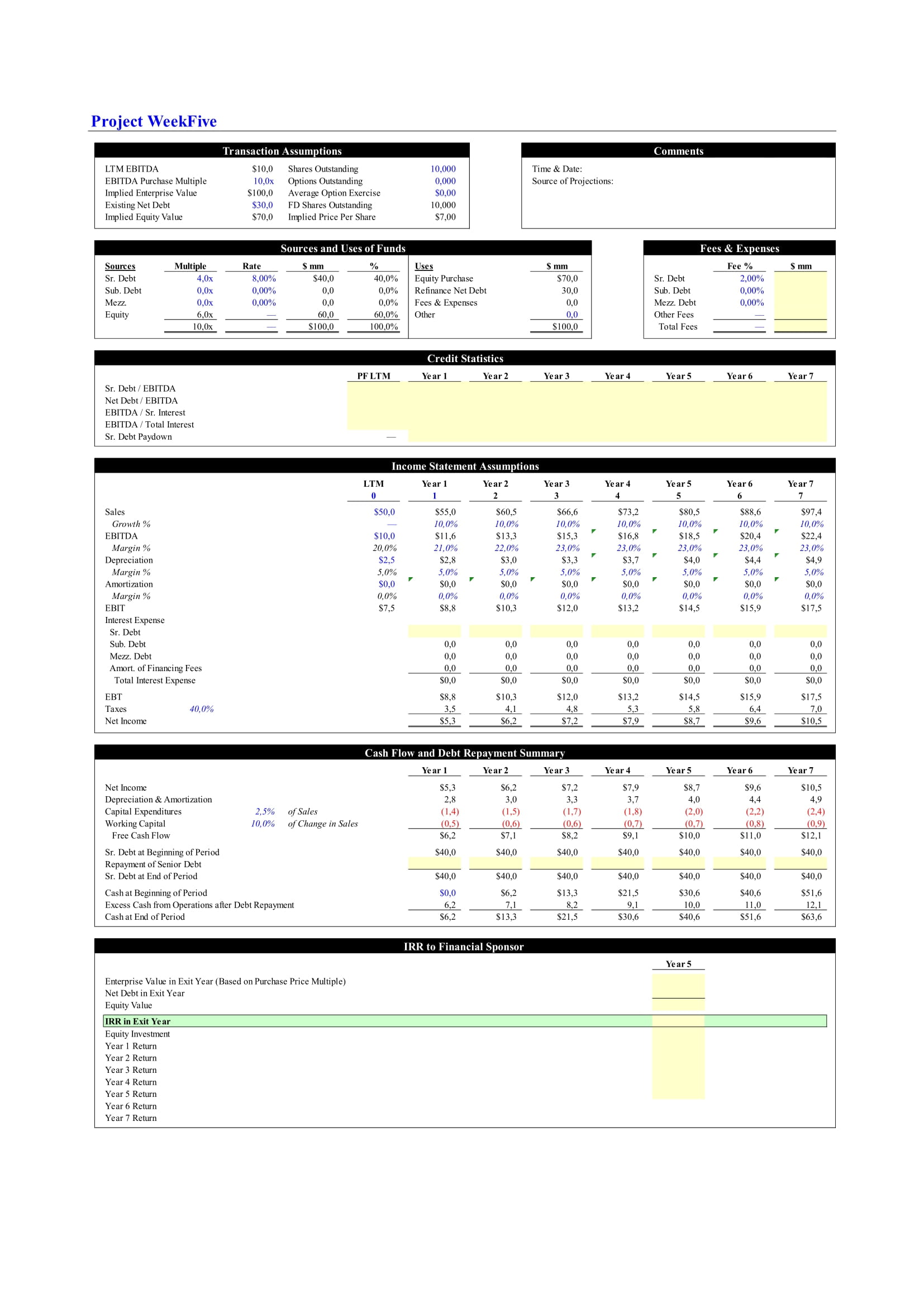

The firm is acquiring 1 0 0 % ?ownership in the target company. The firm plans to exit the investment at the end of Year

The firm is acquiring ?ownership in the target company.

The firm plans to exit the investment at the end of Year

There are no interim cash inflows to the firm, in the form of special dividends or otherwise, during the hold period.

All Free Cash Flow in a given period should be used to pay down the Senior Debt balance.

What is the Total Equity Value at exit?

EBITDA Purchase Multiple Project WeekFive LTM EBITDA Transaction Assumptions $10,0 Shares Outstanding 10,0x Options Outstanding 10,000 0,000 Implied Enterprise Value $100,0 Average Option Exercise $0,00 Existing Net Debt Implied Equity Value $30,0 FD Shares Outstanding 10,000 $70,0 Implied Price Per Share $7,00 Sources and Uses of Funds Sources Multiple Rate $ mm % Uses Sr. Debt 4,0x 8,00% $40,0 40,0% Equity Purchase Sub. Debt 0,0x 0,00% 0,0 0,0% Refinance Net Debt Mezz. 0,0x 0,00% 0,0 0.0% Fees & Expenses Equity 6,0x 60.0 60,0% Other 10,0x $100,0 100,0% Sr. Debt/EBITDA Net Debt/EBITDA EBITDA Sr. Interest EBITDA / Total Interest Sr. Debt Paydown Time & Date: Source of Projections: Comments Fees & Expenses $ mm Fee % $ mm $70,0 30,0 Sr. Debt 2,00% Sub. Debt 0,00% 0.0 Mezz. Debt 0,00% 0.0 Other Fees $100,0 Total Fees Credit Statistics PF LTM Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 Income Statement Assumptions LTM 0 Year 1 1 Year 2 2 Year 3 3 Year 4 4 Year 5 5 Year 6 6 Year 7 7 Sales $50,0 $55,0 $60,5 $66,6 $73,2 $80,5 $88,6 $97,4 Growth % 10,0% 10,0% 10,0% 10,0% 10,0% 10,0% 10,0% EBITDA . $10,0 $11,6 $13,3 $15,3 $16,8 $18,5 $20,4 $22,4 Margin % 20.0% 21,0% 22,0% 23,0% 23,0% 23,0% 23,0% 23,0% Depreciation $2.5 $2,8 $3,0 $3,3 $3,7 $4,0 $4,4 $4,9 Margin % 5,0% 5,0% 5,0% 5,0% 5,0% 5,0% 5,0% 5,0% L Amortization $0,0 $0,0 $0,0 $0.0 $0.0 $0.0 $0,0 $0,0 Margin % 0,0% 0,0% 0,0% 0,0% 0,0% 0,0% 0,0% 0,0% EBIT $7,5 $8,8 $10,3 $12,0 $13,2 $14,5 $15,9 $17,5 Interest Expense Sr. Debt Sub. Debt Mezz. Debt Amort. of Financing Fees Total Interest Expense EBT Taxes 40,0% Net Income 0,0 0,0 0,0 0,0 0,0 0,0 0,0 0,0 0,0 0,0 0,0 0,0 0,0 0.0 0,0 0.0 0,0 0,0 0,0 $0,0 $0,0 $0.0 $0.0 $0,0 $0,0 $0,0 $8,8 $10,3 $12,0 $13,2 $14,5 $15,9 $17,5 4.1 4,8 5.3 5,8 6,4 7,0 $5,3 $6,2 $7,2 $7,9 $8,7 $9,6 $10,5 Cash Flow and Debt Repayment Summary Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 Net Income $5,3 $6,2 $7,2 $7,9 $8,7 $9,6 $10,5 Depreciation & Amortization 2,8 3,0 3,3 3,7 4,0 4,4 4,9 Capital Expenditures 2,5% of Sales (1,4) (1,5) (1,7) (1,8) (2,0) (2,2) (2,4) Working Capital 10,0% of Change in Sales (0,5) (0,6) (0,6) (0,7) (0,7) (0,8) (0,9) Free Cash Flow $6,2 $7,1 $8,2 $9,1 $10.0 $11,0 $12,1 Sr. Debt at Beginning of Period $40,0 $40,0 $40,0 $40,0 $40,0 $40,0 $40,0 Repayment of Senior Debt Sr. Debt at End of Period $40,0 $40,0 $40,0 $40,0 $40,0 $40,0 $40,0 Cash at Beginning of Period Excess Cash from Operations after Debt Repayment Cash at End of Period $0,0 $6,2 $13,3 $21,5 $30,6 $40,6 $51,6 6,2 7.1 8,2 9.1 10,0 11,0 12,1 $6,2 $13,3 $21,5 $30,6 $40,6 $51,6 $63,6 Enterprise Value in Exit Year (Based on Purchase Price Multiple) Net Debt in Exit Year Equity Value IRR in Exit Year Equity Investment Year 1 Return Year 2 Return Year 3 Return Year 4 Return Year 5 Return Year 6 Return Year 7 Return IRR to Financial Sponsor Year 5

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started