Answered step by step

Verified Expert Solution

Question

1 Approved Answer

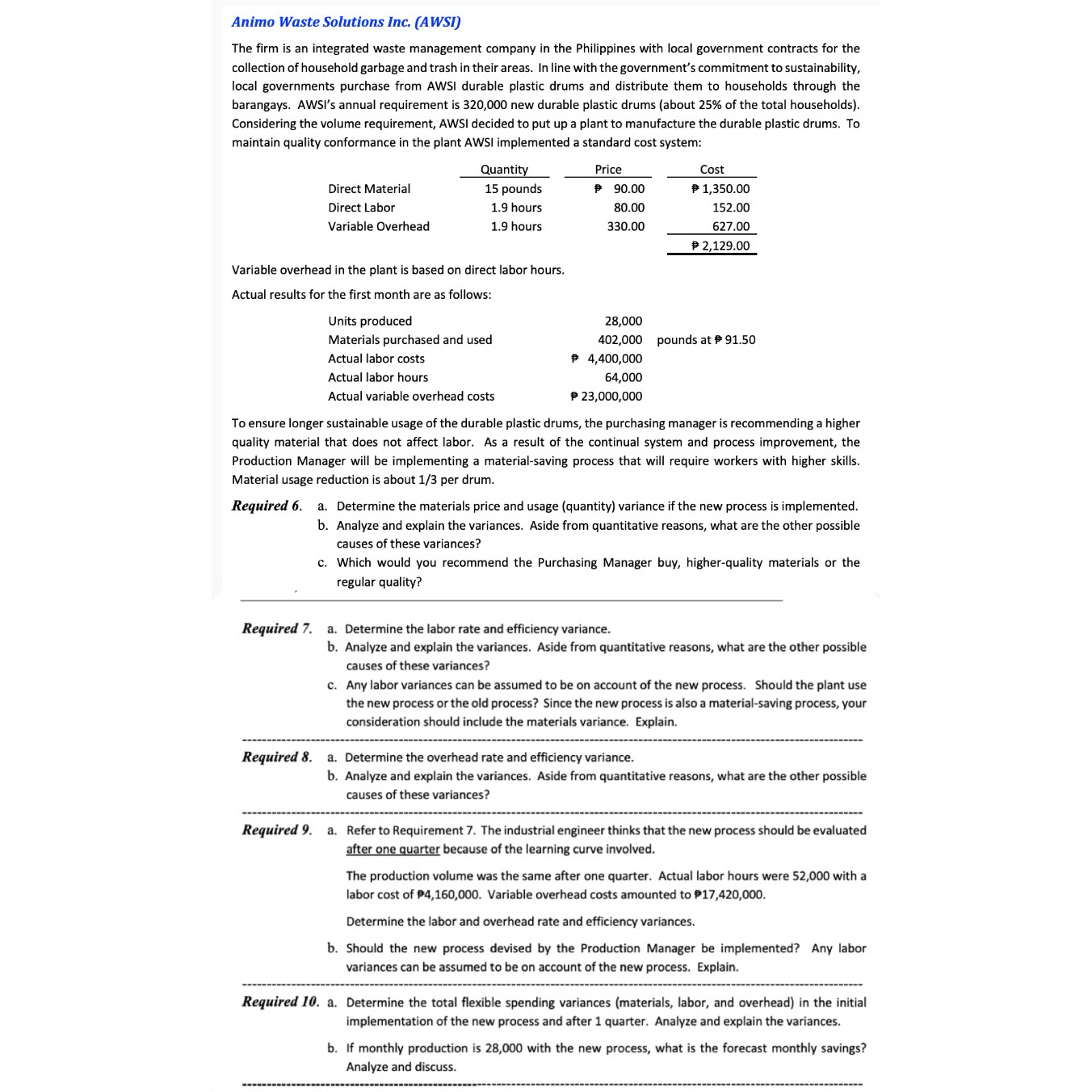

The firm is an integrated waste management company in the Philippines with local government contracts for the collection of household garbage and trash in their

The firm is an integrated waste management company in the Philippines with local government contracts for the collection of household garbage and trash in their areas. In line with the government's commitment to sustainability, local governments purchase from AWSI durable plastic drums and distribute them to households through the barangays. AWS!s annual requirement is new durable plastic drums about of the total householdsConsidering the volume requirement, AWSI decided to put up a plant to manufacture the durable plastic drums. To maintain quality conformance in the plant AWSI implemented a standard cost system:QuantityPriceDirect MaterialDirect LaborVariable Overhead pounds$ hours hoursCost Variable overhead in the plant is based on direct labor hours.Actual results for the first month are as follows:Units producedMaterials purchased and usedActual labor costsActual labor hoursActual variable overhead costspounds at To ensure longer sustainable usage of the durable plastic drums, the purchasing manager is recommending a higher quality material that does not affect labor. As a result of the continual system and process improvement, the Production Manager will be implementing a materialsaving process that will require workers with higher skills.Material usage reduction is about per drum.Required a Determine the materials price and usage quantity variance if the new process is implemented.b Analyze and explain the variances. Aside from quantitative reasons, what are the other possible causes of these variances?c Which would you recommend the Purchasing Manager buy, higherquality materials or the regular quality?Required a Determine the labor rate and efficiency variance.b Analyze and explain the variances. Aside from quantitative reasons, what are the other possible causes of these variances?c Any labor variances can be assumed to be on account of the new process. Should the plant use the new process or the old process? Since the new process is also a materialsaving process, your consideration should include the materials variance. Explain.Required a Determine the overhead rate and efficiency variance.b Analyze and explain the variances. Aside from quantitative reasons, what are the other possible causes of these variances?Required a Refer to Requirement The industrial engineer thinks that the new process should be evaluatedafter one quarter because of the learning curve involved.The production volume was the same after one quarter. Actual labor hours were with a labor cost of Variable overhead costs amounted to Determine the labor and overhead rate and efficiency variances.b Should the new process devised by the Production Manager be implemented? Any labor variances can be assumed to be on account of the new process. Explain.Required a Determine the total flexible spending variances materials labor, and overhead in the initialimplementation of the new process and after quarter. Analyze and explain the variances.b If monthly production is with the new process, what is the forecast monthly savings?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started