Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The Firm is completing the accounting process for the year just ended, December 31, Year 1. The following data with respect to adjusting entries

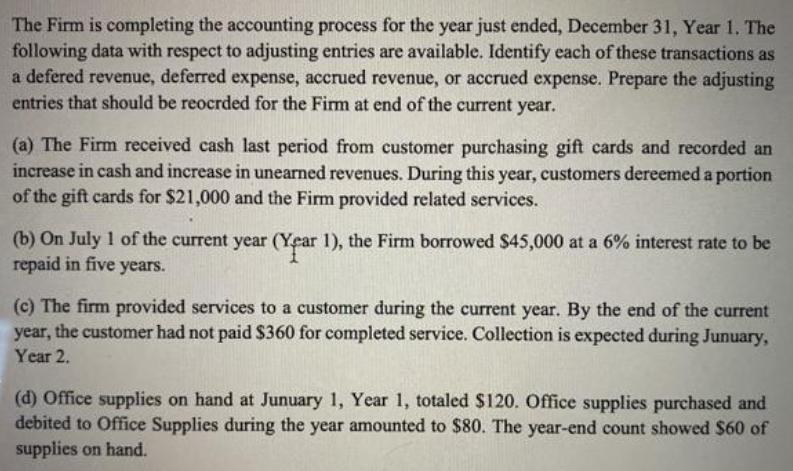

The Firm is completing the accounting process for the year just ended, December 31, Year 1. The following data with respect to adjusting entries are available. Identify each of these transactions as a defered revenue, deferred expense, accrued revenue, or accrued expense. Prepare the adjusting entries that should be reocrded for the Firm at end of the current year. (a) The Firm received cash last period from customer purchasing gift cards and recorded an increase in cash and increase in unearned revenues. During this year, customers dereemed a portion of the gift cards for $21,000 and the Firm provided related services. (b) On July 1 of the current year (Year 1), the Firm borrowed $45,000 at a 6% interest rate to be repaid in five years. (c) The firm provided services to a customer during the current year. By the end of the current year, the customer had not paid $360 for completed service. Collection is expected during Junuary, Year 2. (d) Office supplies on hand at Junuary 1, Year 1, totaled $120. Office supplies purchased and debited to Office Supplies during the year amounted to $80. The year-end count showed $60 of supplies on hand.

Step by Step Solution

★★★★★

3.28 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

Adjusting entries No General Journal Debit Credit a Unearned reve...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started