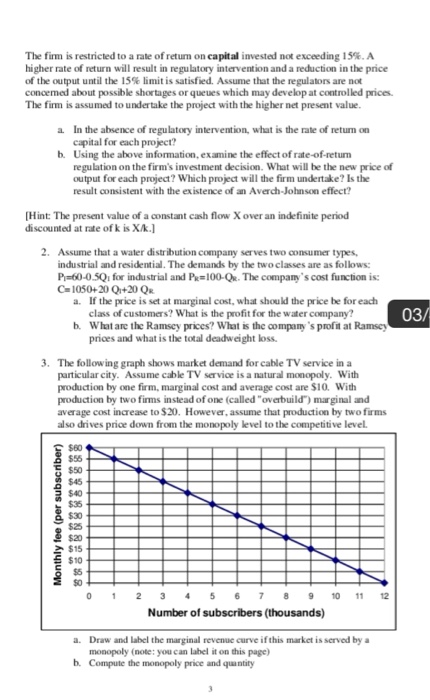

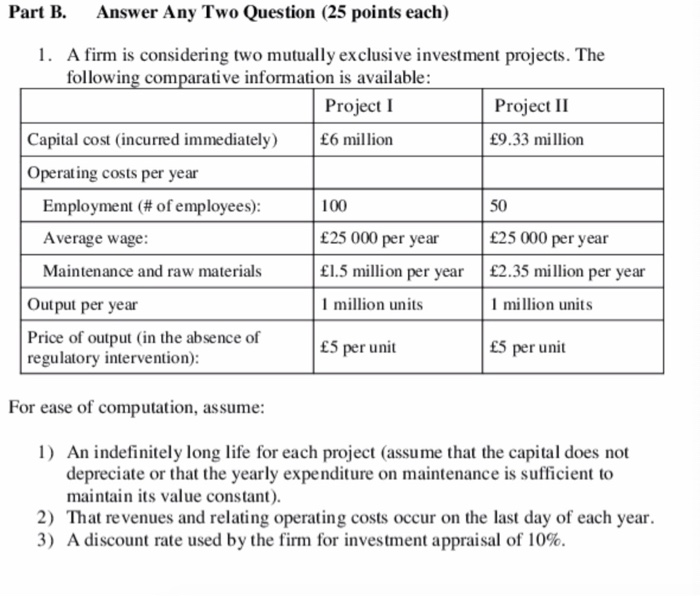

The firm is restricted to a rate of return on capital invested not exceeding 15% A higher rate of return will result in regulatory intervention and a reduction in the price of the output until the 15% limit is satisfied. Assume that the regulators are not consemed about possible shortages or queues which may develop at controlled prices The firm is assumed to undertake the project with the higher net present value a In the absence of regulatory intervention, what is the rate of return capital for each project? b. Using the above information, examine the effect of rate-of-retum regulation on the firm's investment decision. What will be the new price of output for each project? Which project will the firm undertake? Is the result consistent with the existence of an Averch-Johnson effect? [Hint: The present value of a constant cash flow Xover an indefinite period discounted at rate of k is XI.) 2. Assume that a water distribution company serves two consumer types. industrial and residential. The demands by the two classes are as follows: P60-0.5Q. for industrial and Pr=100-Qk. The company's cost function is: C=1050+20 Qr+20 QR a. If the price is set at marginal cost, what should the price be for each class of customers? What is the profit for the water company? b. What are the Ramsey prices? What is the company's profitat Ramsey prices and what is the total deadweight loss 03/ 3. The following graph shows market demand for cable TV service in a particular city. Assume cable TV service is a natural monopoly. With production by one firm, marginal cost and average cost are $10. With production by two firms instead of one (called "overbuild") marginal and average cost increase to $20. However, assume that production by two firms also drives price down from the monopoly level to the competitive level. Monthly fee (per subscriber) 0 1 2 10 11 12 3 4 5 6 7 8 9 Number of subscribers (thousands) a. Dew and label the marginal revenue curve if this market is served by a monopoly (note: you can label it on this page) h. Compute the monopoly price and quantity Part B. Answer Any Two Question (25 points each) 1. A firm is considering two mutually exclusive investment projects. The following comparative information is available: Project 1 Project II Capital cost incurred immediately) 6 million 9.33 million 100 50 Operating costs per year Employment (# of employees): Average wage: Maintenance and raw materials 25 000 per year 1.5 million per year 1 million units 25 000 per year 2.35 million per year 1 million units Output per year Price of output in the absence of regulatory intervention): 5 per unit 5 per unit For ease of computation, assume: 1) An indefinitely long life for each project (assume that the capital does not depreciate or that the yearly expenditure on maintenance is sufficient to maintain its value constant). 2) That revenues and relating operating costs occur on the last day of each year. 3) A discount rate used by the firm for investment appraisal of 10%