Question

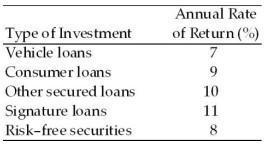

The firm will have $2,500,000 available for investment during the coming year. The following restrictions apply:- Risk-free securities may not exceed 30% of the total

The firm will have $2,500,000 available for investment during the coming year. The following restrictions apply:- Risk-free securities may not exceed 30% of the total funds, but must comprise at least 5% of the total.

- Signature loans may not exceed 12% of the funds invested in all loans (vehicle, consumer, other secured loans, and signature loans).

- Consumer loans plus other secured loans may not exceed the vehicle loans.

- Other secured loans plus signature loans may not exceed the funds invested in risk-free securities. How should the $2,500,000 be allocated to each alternative to maximize annual return?

How should the $2,500,000 be allocated to each alternative to maximize annual return?

Formulate this problem as a Linear Programming model.

Define decision variables.

Define objective function.

Define the constraints.

Annual Rate Type of Investment Vehicle loans of Return (%) Consumer loans 9 Other secured loans 10 Signature loans 11 Risk-free securities 8

Step by Step Solution

3.33 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

a Define decision variables Let x1 be fund allocated for vehicle ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started