Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The firm's receivables conversion period (measured in days) is equal to its accounts receivable divided by its a. annual credit sales/360 b. annual credit

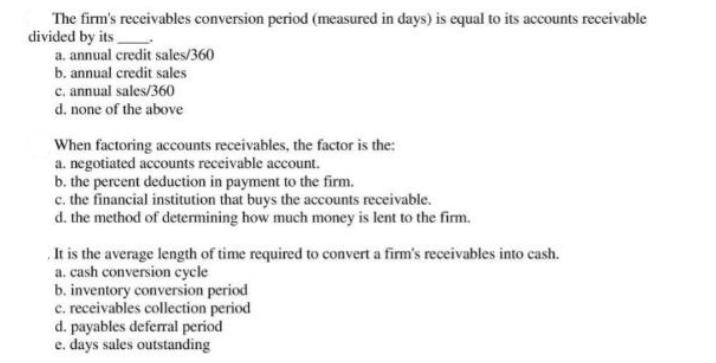

The firm's receivables conversion period (measured in days) is equal to its accounts receivable divided by its a. annual credit sales/360 b. annual credit sales c. annual sales/360 d. none of the above When factoring accounts receivables, the factor is the: a. negotiated accounts receivable account. b. the percent deduction in payment to the firm. c. the financial institution that buys the accounts receivable. d. the method of determining how much money is lent to the firm. It is the average length of time required to convert a firm's receivables into cash. a. cash conversion cycle b. inventory conversion period c. receivables collection period d. payables deferral period e. days sales outstanding The firm's receivables conversion period (measured in days) is equal to its accounts receivable divided by its a. annual credit sales/360 b. annual credit sales c. annual sales/360 d. none of the above When factoring accounts receivables, the factor is the: a. negotiated accounts receivable account. b. the percent deduction in payment to the firm. c. the financial institution that buys the accounts receivable. d. the method of determining how much money is lent to the firm. It is the average length of time required to convert a firm's receivables into cash. a. cash conversion cycle b. inventory conversion period c. receivables collection period d. payables deferral period e. days sales outstanding

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The provided image contains three multiplechoice questions Let me provide you with the answers for e...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started