Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The firms tax rate is 40% The above information will be used in the calculation of the A. Annual operating flows B. Annual change in

The firms tax rate is 40% The above information will be used in the calculation of the

A. Annual operating flows

B. Annual change in ONWC

C. EBIT

D. Purchase price of the new machinery

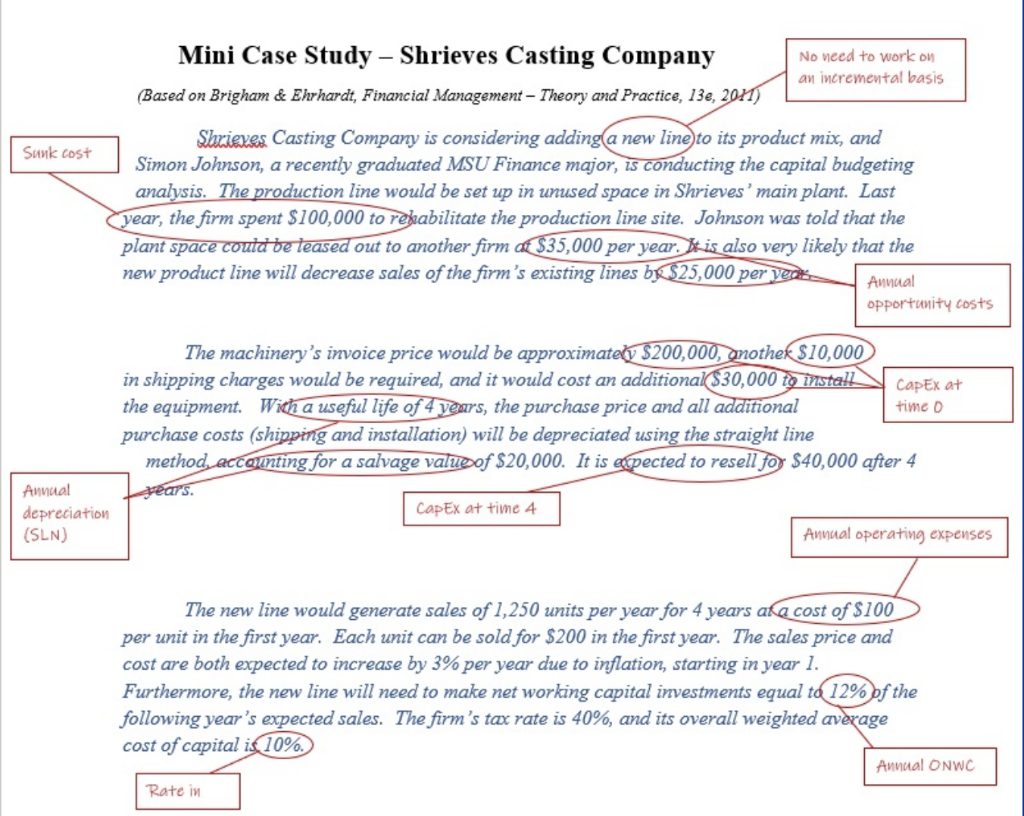

E. Annual depreciation

Sunk cost Annual depreciation (SLN) Mini Case Study - Shrieves Casting Company No need to work on an incremental basis (Based on Brigham & Ehrhardt, Financial Management - Theory and Practice, 13e, 2011) Shriexes Casting Company is considering adding a new line to its product mix, and Simon Johnson, a recently graduated MSU Finance major, is conducting the capital budgeting analysis. The production line would be set up in unused space in Shrieves' main plant. Last year, the firm spent $100,000 to rehabilitate the production line site. Johnson was told that the plant space could be leased out to another firm at $35,000 per year. It is also very likely that the new product line will decrease sales of the firm's existing lines by $25,000 per year. Annual opportunity costs The machinery's invoice price would be approximately $200,000, another $10,000 in shipping charges would be required, and it would cost an additional $30,000 to install the equipment. With a useful life of 4 years, the purchase price and all additional purchase costs (shipping and installation) will be depreciated using the straight line CapEx at time D method, accounting for a salvage value of $20,000. It is expected to resell for $40,000 after 4 years. CapEx at time 4 Annual operating expenses The new line would generate sales of 1,250 units per year for 4 years at a cost of $100 per unit in the first year. Each unit can be sold for $200 in the first year. The sales price and cost are both expected to increase by 3% per year due to inflation, starting in year 1. Furthermore, the new line will need to make net working capital investments equal to 12% of the following year's expected sales. The firm's tax rate is 40%, and its overall weighted average cost of capital is 10% Annual ONWC Rate inStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started