Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The first answer is correct but the next two are wrong. I'm looking for some help on the second two problems (#2 & #3). thank

The first answer is correct but the next two are wrong. I'm looking for some help on the second two problems (#2 & #3). thank you.

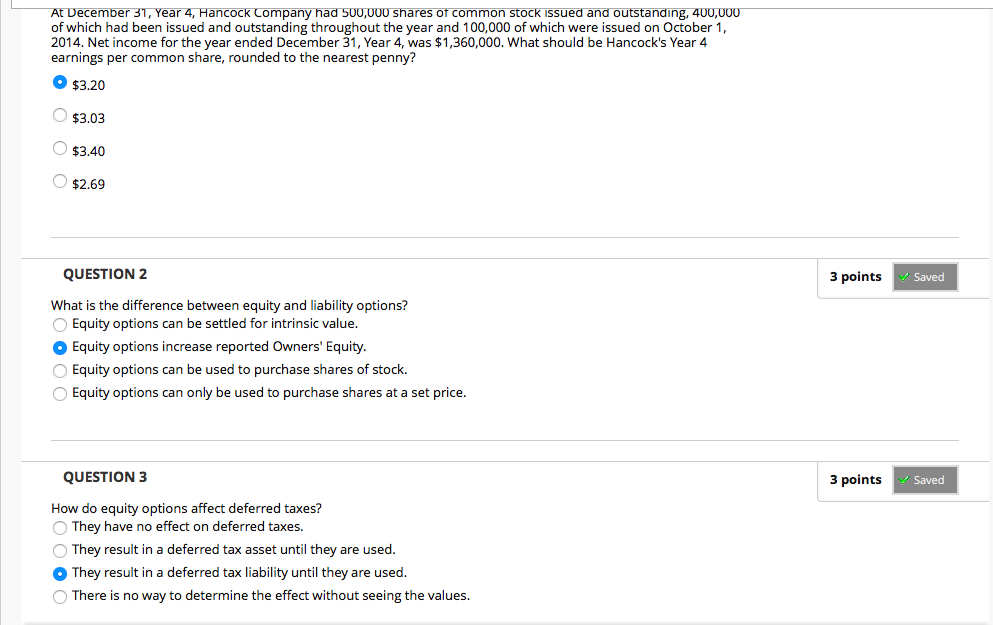

At December 31, Year 4, Hancock Company had 500,000 shares of common stock issued and outstanding, 400,000 of which had been issued and outstanding throughout the year and 100,000 of which were issued on October 1, 2014. Net income for the year ended December 31, Year 4, was $1,360,000. What should be Hancock's Year 4 earnings per common share, rounded to the nearest penny? $3.20 $3.03 $3.40 $2.69 QUESTION 2 3 points Saved What is the difference between equity and liability options? Equity options can be settled for intrinsic value. Equity options increase reported Owners' Equity. Equity options can be used to purchase shares of stock. Equity options can only be used to purchase shares at a set price. QUESTION 3 3 points Saved How do equity options affect deferred taxes? They have no effect on deferred taxes. They result in a deferred tax asset until they are used. They result in a deferred tax liability until they are used. There is no way to determine the effect without seeing the valuesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started