Question

The first capital budgeting session will focus on the different criteria that the board could use to evaluate proposed capital expenditures. ABCs top managers have

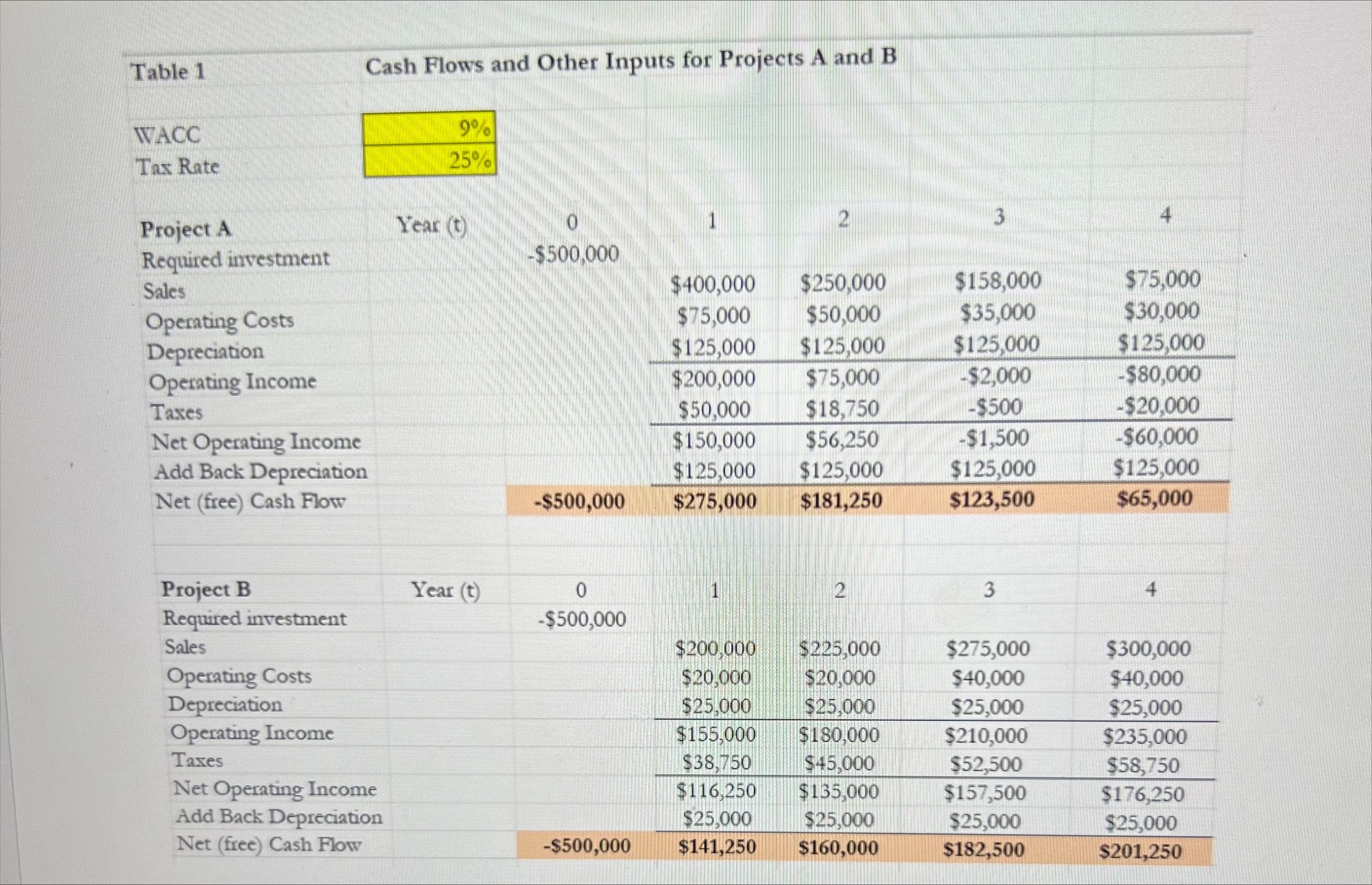

The first capital budgeting session will focus on the different criteria that the board could use to evaluate proposed capital expenditures. ABCs top managers have discussed the appropriateness of different criteria, including the choice between NPV and IRR, and that will be one focus of the session. ABC has a capital budgeting model to analyze all of its proposed projects. The model first forecasts each projects cash flows, after which it calculates the payback, discounted payback, Net Present Value (NPV), Internal Rate of Return (IRR), and Modified Internal rate of Return (MIRR). Only the directors have participated in the prior sessions. Those executives must provide critical inputs for capital budgeting decisions, and the president wants to make sure that all participants know how the data they provide will be used to analyze capital budgeting decisions. In addition, several executives have questioned the weights that have been given to the decision criteria in actual capital budgeting decisions. For example, both the controller and the VP for marketing think that the most weight should be given to the payback, and that any project with a payback of less than 3 years should be accepted. Similarly, the VP for production thinks that the Payback is the best method, but several directors seem more comfortable with the IRR. You personally would like to consider only the NPV had the President not interceded and asked you to calculate all 5 criteria. The first part of the analysis will be to evaluate the net cash flows for project A and B that are mutually exclusive. The projects are both to produce batteries for electric cars. The timing of the cash flows are different as they relate to the strategy on how the product will be rolled out and the aggressiveness of the marketing campaign for the batteries. The companys current cost of capital is given, but your responsibility is to analyze the projects to determine which project would be preferred for the possible range of costs of capital. The second part of the analysis refers to analyzing mutually exclusive projects that have different lives. The projects lives relate to the investment in the required equipment. Longer lasting more expensive equipment is what project BB entails. Conversely, project AA entails cheaper equipment that will not last as long as the equipment proposed for project BB.

The first capital budgeting session will focus on the different criteria that the board could use to evaluate proposed capital expenditures. ABCs top managers have discussed the appropriateness of different criteria, including the choice between NPV and IRR, and that will be one focus of the session. ABC has a capital budgeting model to analyze all of its proposed projects. The model first forecasts each projects cash flows, after which it calculates the payback, discounted payback, Net Present Value (NPV), Internal Rate of Return (IRR), and Modified Internal rate of Return (MIRR). Only the directors have participated in the prior sessions. Those executives must provide critical inputs for capital budgeting decisions, and the president wants to make sure that all participants know how the data they provide will be used to analyze capital budgeting decisions. In addition, several executives have questioned the weights that have been given to the decision criteria in actual capital budgeting decisions. For example, both the controller and the VP for marketing think that the most weight should be given to the payback, and that any project with a payback of less than 3 years should be accepted. Similarly, the VP for production thinks that the Payback is the best method, but several directors seem more comfortable with the IRR. You personally would like to consider only the NPV had the President not interceded and asked you to calculate all 5 criteria. The first part of the analysis will be to evaluate the net cash flows for project A and B that are mutually exclusive. The projects are both to produce batteries for electric cars. The timing of the cash flows are different as they relate to the strategy on how the product will be rolled out and the aggressiveness of the marketing campaign for the batteries. The companys current cost of capital is given, but your responsibility is to analyze the projects to determine which project would be preferred for the possible range of costs of capital. The second part of the analysis refers to analyzing mutually exclusive projects that have different lives. The projects lives relate to the investment in the required equipment. Longer lasting more expensive equipment is what project BB entails. Conversely, project AA entails cheaper equipment that will not last as long as the equipment proposed for project BB.

1. Calculate the Payback, NPV, IRR, modified IRR (MIRR), payback for Projects A and B. Construct an NPV profile that details under what circumstances you would select one project over the other. Based on all your data, which project do you suggest that the company pursue?- Show your table and the graph! Show your work as well.

Table 1 WACC Tax Rate Project A Required investment Sales Operating Costs Depreciation Operating Income Taxes Net Operating Income Add Back Depreciation Net (free) Cash Flow Cash Flows and Other Inputs for Projects A and B \begin{tabular}{|r|} \hline 9% \\ \hline 25% \\ \hline \end{tabular} Year(t) (4) $500,000 \begin{tabular}{cccc} 1 & 2 & 3 & 4 \\ & & & \\ $400,000 & $250,000 & $158,000 & $75,000 \\ $75,000 & $50,000 & $35,000 & $30,000 \\ $125,000 & $125,000 & $125,000 & $125,000 \\ \hline$200,000 & $75,000 & $2,000 & $80,000 \\ $50,000 & $18,750 & $500 & $20,000 \\ \hline$150,000 & $56,250 & $1,500 & $60,000 \\ $125,000 & $125,000 & $125,000 & $125,000 \\ \hline$275,000 & $181,250 & $123,500 & $65,000 \end{tabular} $500,000 Year (t) Project B Required investment 0 Sales Operating Costs Depreciation Operating Income Taxes Net Operating Income Add Back Depreciation Net (free) Cash Flow $500,000 $500,000 1 2 3 $200,000 $225,000 $275,000 $300,000 $20,000 $25,000 $20,000 $38,750 $25,000 \begin{tabular}{ccc} & $25,000 & $25,000 \\ $180,000 & $210,000 & $235,000 \\ $45,000 & $52,500 & $58,750 \\ $135,000 & $157,500 & $176,250 \\ $25,000 & $25,000 & $25,000 \\ $160,000 & $182,500 & $201,250 \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started