Answered step by step

Verified Expert Solution

Question

1 Approved Answer

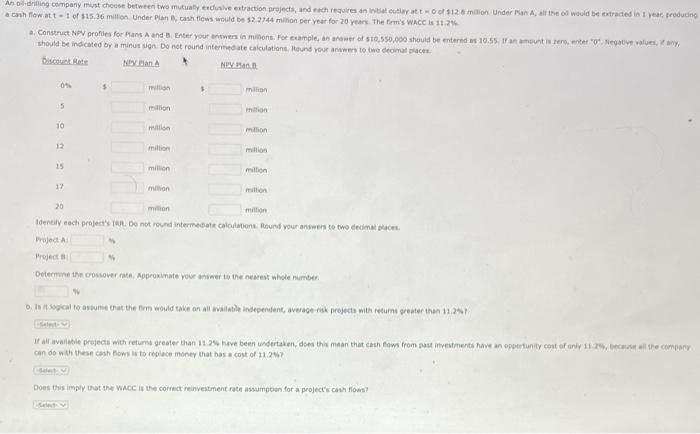

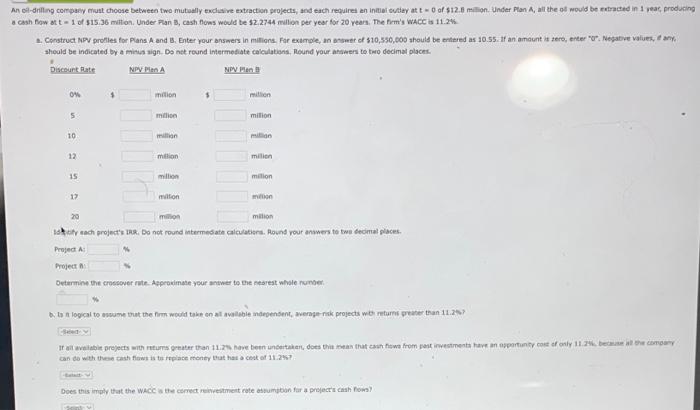

The first pic was blurry I took another one and the other one. I need help with both questions due tomorrow Eah flow at t

The first pic was blurry I took another one and the other one. I need help with both questions due tomorrow

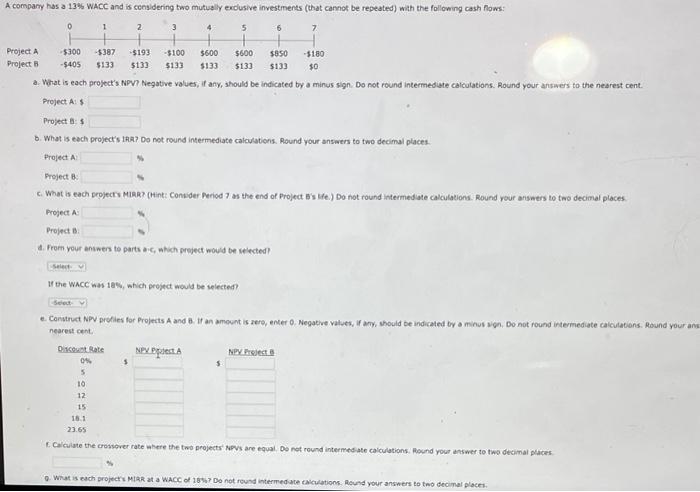

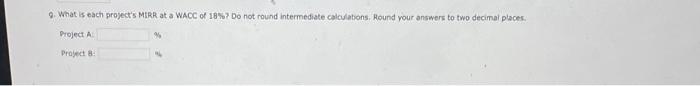

Eah flow at t - 1 of 315.36 mitton. Under Pian B, cash flews would be 12.2744 mithon per vear for 20 yeare. The famis Whce is 11.27h. Bripedth Project bl can do with these cash floms is to replace meney that has a cost of . 11.25? Does this imply that the WNCE is the correct reinvestment rate assumbeien for a projects cash flows? a cash fow of t=1 of $15,36 mitton. Under Fan 3 , cash. flows would te 32.2744 millon per year for 20 yean. The frm's wice is 11.24. shoald be indicated by a mitits aign. Do net round intermetiate calculatishs. Round your atawers to two decimal places. Project A. Oetermine the coscsover note. Acprovimate your antwer to the nedrest while nunowi: can do weth these cash flaws is tu replase money that hat a cest of 11.24 ?. Does this imply that the wacc a the comect rewiestment cote assumption far a prejects cash fowal a. What is each project's NPV? Negative values, if any, should be indicated by a minus sign. Do not round intermediate calculations. Round your answers ta the nearest cent. Project A: $ Project 8: 5 b. What is each project's tala? Do not round intermediate calculations. Round your answers to two decimal places. Project A. Froject B: c. What is each seojects Make? (Hint: Consider Feriod 7 as the end of Project Bis Me.) Do hot round intermediate calculations. Round your answers to tab decimal places. Project A. Project B: d. From your answers to parts aic, which preject would be ielected? If the Wacc was 1as, which project would be selected? 6. Construct NPV profies for Projects A and o. If an amovent is sere, enter 0. Negative vatues, if any, should be indicated ty a minus sign, Do not round intermediate calculations. Povs nearest cent. C. Caiculate the costover rate abere the two projects' Novs are equal, Do not round intermed ate caiculations. Mound your answer to two decinal places. 9. What is each project's MIRR at a WACC of 18.5? Do not round intermediate calculabons. Hound your answers to two decimal places. ProjectAProject&: Eah flow at t - 1 of 315.36 mitton. Under Pian B, cash flews would be 12.2744 mithon per vear for 20 yeare. The famis Whce is 11.27h. Bripedth Project bl can do with these cash floms is to replace meney that has a cost of . 11.25? Does this imply that the WNCE is the correct reinvestment rate assumbeien for a projects cash flows? a cash fow of t=1 of $15,36 mitton. Under Fan 3 , cash. flows would te 32.2744 millon per year for 20 yean. The frm's wice is 11.24. shoald be indicated by a mitits aign. Do net round intermetiate calculatishs. Round your atawers to two decimal places. Project A. Oetermine the coscsover note. Acprovimate your antwer to the nedrest while nunowi: can do weth these cash flaws is tu replase money that hat a cest of 11.24 ?. Does this imply that the wacc a the comect rewiestment cote assumption far a prejects cash fowal a. What is each project's NPV? Negative values, if any, should be indicated by a minus sign. Do not round intermediate calculations. Round your answers ta the nearest cent. Project A: $ Project 8: 5 b. What is each project's tala? Do not round intermediate calculations. Round your answers to two decimal places. Project A. Froject B: c. What is each seojects Make? (Hint: Consider Feriod 7 as the end of Project Bis Me.) Do hot round intermediate calculations. Round your answers to tab decimal places. Project A. Project B: d. From your answers to parts aic, which preject would be ielected? If the Wacc was 1as, which project would be selected? 6. Construct NPV profies for Projects A and o. If an amovent is sere, enter 0. Negative vatues, if any, should be indicated ty a minus sign, Do not round intermediate calculations. Povs nearest cent. C. Caiculate the costover rate abere the two projects' Novs are equal, Do not round intermed ate caiculations. Mound your answer to two decinal places. 9. What is each project's MIRR at a WACC of 18.5? Do not round intermediate calculabons. Hound your answers to two decimal places. ProjectAProject& Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started