Answered step by step

Verified Expert Solution

Question

1 Approved Answer

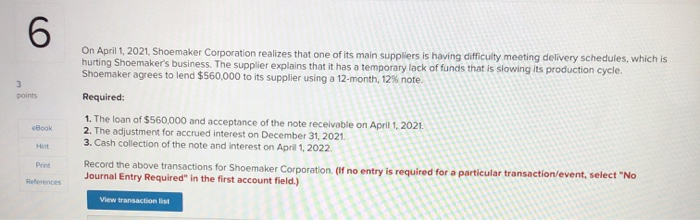

the first picture does not need to be answered 6 3 points On April 1, 2021, Shoemaker Corporation realizes that one of its main suppliers

the first picture does not need to be answered

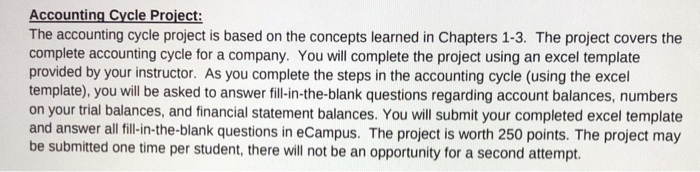

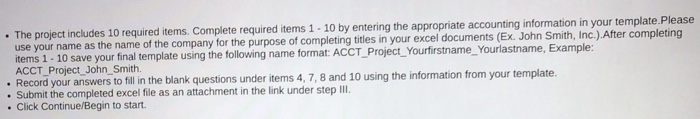

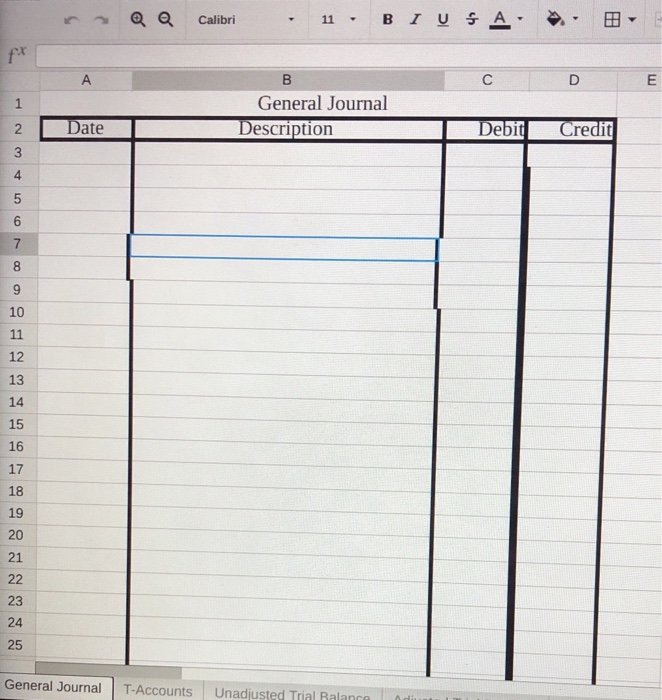

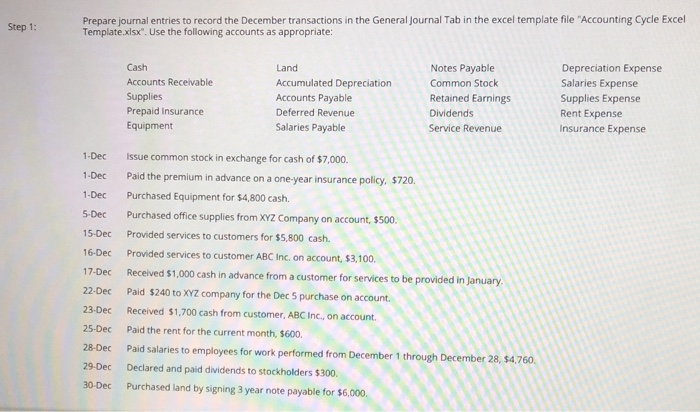

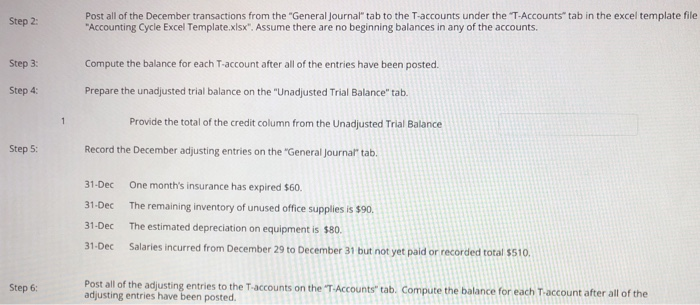

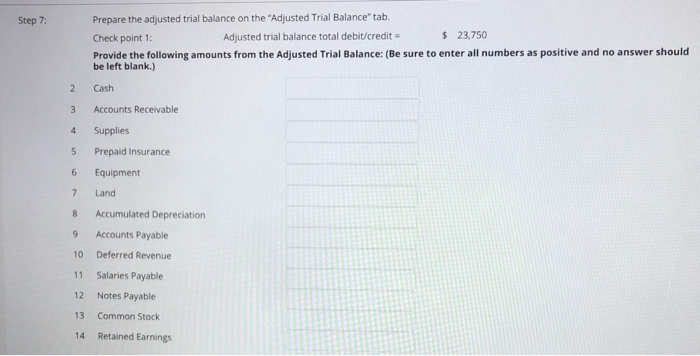

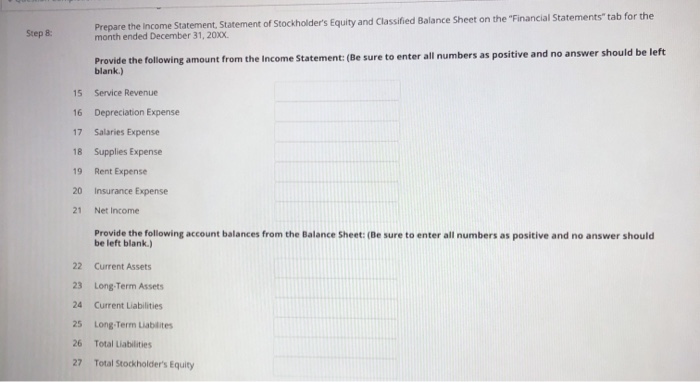

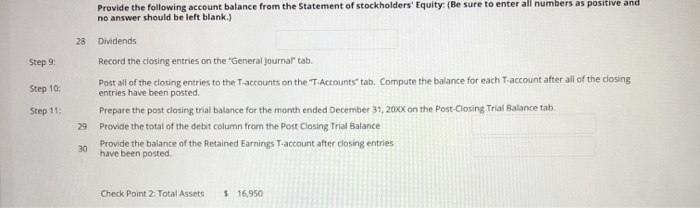

6 3 points On April 1, 2021, Shoemaker Corporation realizes that one of its main suppliers is having difficulty meeting delivery schedules, which is hurting Shoemaker's business. The supplier explains that it has a temporary lack of funds that is slowing its production cycle. Shoemaker agrees to lend $560,000 to its supplier using a 12-month, 12% note. Required: 1. The loan of $560,000 and acceptance of the note receivable on April 1, 2021 2. The adjustment for accrued interest on December 31, 2021. 3. Cash collection of the note and interest on April 1, 2022 Record the above transactions for Shoemaker Corporation. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) Book Hint Print References View transaction is Accounting Cycle Project: The accounting cycle project is based on the concepts learned in Chapters 1-3. The project covers the complete accounting cycle for a company. You will complete the project using an excel template provided by your instructor. As you complete the steps in the accounting cycle (using the excel template), you will be asked to answer fill-in-the-blank questions regarding account balances, numbers on your trial balances, and financial statement balances. You will submit your completed excel template and answer all fill-in-the-blank questions in eCampus. The project is worth 250 points. The project may be submitted one time per student, there will not be an opportunity for a second attempt . The project includes 10 required items. Complete required items 1 - 10 by entering the appropriate accounting information in your template.Please use your name as the name of the company for the purpose of completing titles in your excel documents (Ex John Smith, Inc.). After completing items 1 - 10 save your final template using the following name format: ACCT_Project_Yourfirstname_Yourlastname, Example: ACCT Project_John Smith Record your answers to fill in the blank questions under items 4, 7, 8 and 10 using the information from your template. . Submit the completed excel file as an attachment in the link under step III. Click Continue/Begin to start. Calibri 11 BI U SA f A D E 1 B General Journal Description 2 Date Debit Credit 3 4 5 6 7 00 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 General Journal T-Accounts Unadjusted Trial Ralance Step 1: Prepare journal entries to record the December transactions in the General Journal Tab in the excel template file "Accounting Cycle Excel Template.xlsx". Use the following accounts as appropriate: Cash Accounts Receivable Supplies Prepaid Insurance Equipment Land Accumulated Depreciation Accounts Payable Deferred Revenue Salaries Payable Notes Payable Common Stock Retained Earnings Dividends Service Revenue Depreciation Expense Salaries Expense Supplies Expense Rent Expense Insurance Expense 1-Dec 1-Dec 1-Dec 5-Dec 15-Dec 16-Dec 17-Dec Issue common stock in exchange for cash of $7,000. Paid the premium in advance on a one-year insurance policy, $720. Purchased Equipment for $4,800 cash. Purchased office supplies from XYZ Company on account, $500. Provided services to customers for $5,800 cash. Provided services to customer ABC Inc. on account, $3,100 Received $1,000 cash in advance from a customer for services to be provided in January Paid $240 to XYZ company for the Dec 5 purchase on account Received 51,700 cash from customer, ABC Inc., on account. Paid the rent for the current month, $600. Paid salaries to employees for work performed from December 1 through December 28, $4,760 Declared and paid dividends to stockholders $300 Purchased land by signing 3 year note payable for $6,000 22-Dec 23-Dec 25-Dec 28-Dec 29-Dec 30-Dec Step 2: Post all of the December transactions from the "General Journal" tab to the T-accounts under the "T-Accounts" tab in the excel template file "Accounting Cycle Excel Template.xlsx". Assume there are no beginning balances in any of the accounts. Step 3: Compute the balance for each T-account after all of the entries have been posted. Prepare the unadjusted trial balance on the "Unadjusted Trial Balance" tab. Step 4: 1 Provide the total of the credit column from the Unadjusted Trial Balance Step 5: Record the December adjusting entries on the "General Journal" tab. 31-Dec 31-Dec One month's insurance has expired $60. The remaining inventory of unused office supplies is $90. The estimated depreciation on equipment is $80. Salaries incurred from December 29 to December 31 but not yet paid or recorded total 5510. 31-Dec 31-Dec Step 6: Post all of the adjusting entries to the T-accounts on the 'T.Accounts" tab. Compute the balance for each T-account after all of the adjusting entries have been posted. Step 7: Prepare the adjusted trial balance on the "Adjusted Trial Balance" tab. Check point 1: Adjusted trial balance total debit/credit - $ 23,750 Provide the following amounts from the Adjusted Trial Balance: (Be sure to enter all numbers as positive and no answer should be left blank.) 2 Cash 3 Accounts Receivable 4 5 Supplies Prepaid Insurance Equipment 6 7 Land 8 Accumulated Depreciation 9 Accounts Payable 10 Deferred Revenue 11 Salaries Payable 12 Notes Payable 13 Common Stock 14 Retained Earnings Step 8 Prepare the income Statement, Statement of Stockholder's Equity and Classified Balance Sheet on the "Financial Statements" tab for the month ended December 31, 20XX. Provide the following amount from the Income Statement: (Be sure to enter all numbers as positive and no answer should be left blank.) 15 17 Service Revenue 16 Depreciation Expense Salaries Expense 18 Supplies Expense 19 Rent Expense Insurance Expense 21 Net Income Provide the following account balances from the Balance Sheet(Be sure to enter all numbers as positive and no answer should 20 be left blank.) 22 Current Assets 23 Long Term Assets 24 Current Liabilities 25 Long Term Liablites 26 Total Liabilities 27 Total Stockholder's Equity Provide the following account balance from the Statement of stockholders' Equity (Be sure to enter all numbers as positive and no answer should be left blank.) 28 Step 9 Step 10: Dividends Record the closing entries on the "General journaltab. Post all of the closing entries to the accounts on the "T-Accounts" tab. Compute the balance for each T-account after all of the closing entries have been posted Prepare the post closing trial balance for the month ended December 31, 20XX on the Post-Closing Trial Balance tab Provide the total of the debit column from the Post Closing Trial Balance Provide the balance of the Retained Earnings T-account after closing entries have been posted Step 11 29 30 Check Point 2: Total Assets $ 16,950 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started