The first picture is the information.

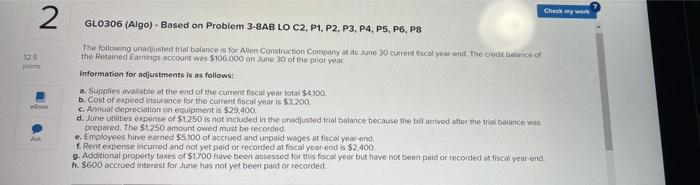

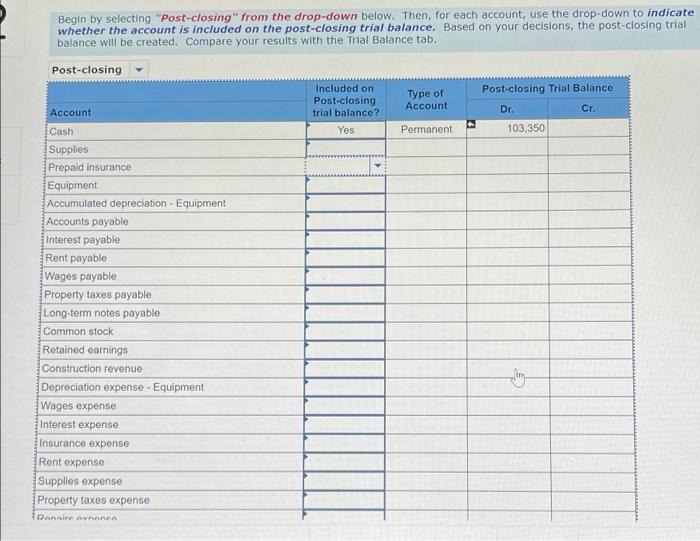

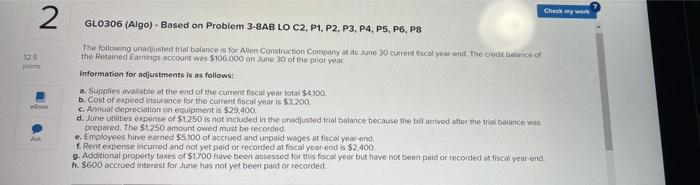

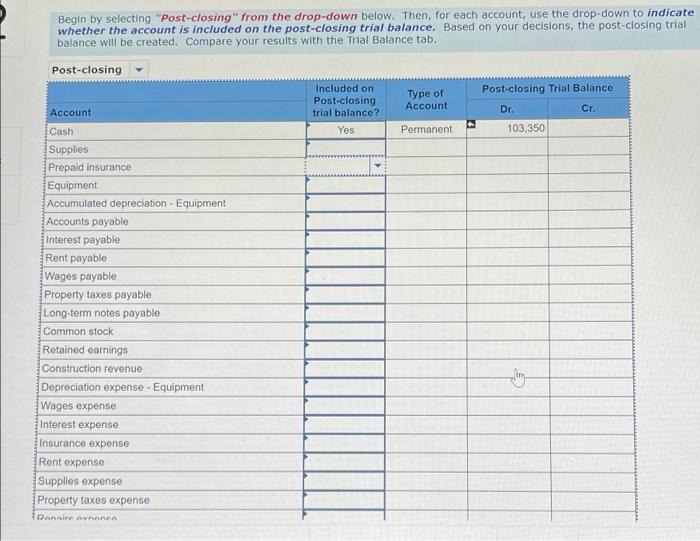

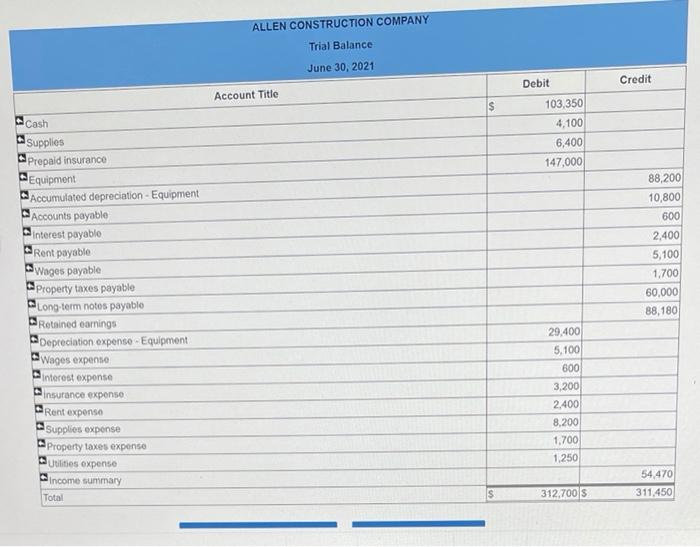

Chede my work 2 GLO306 (Algo). Based on Problem 3-8AB LO C2, P1, P2, P3, P4, P5, P6, P8 125 The following unadjusted trial balance is for Alien Construction Company at its June 30 current fiscal year and The credit balance of the Retained Eamings account was $106.000 on June 30 of the prior year Information for adjustments is as follows: a. Supplies available at the end of the current fiscal year total $4500 b. Cost of expired Insurance for the current fiscal year is $3.200. c. Annual depreciation on equipments $29.400. di June utilities expense of $1.250 is not included in the unadjusted trial balance because the bil arrived after the trial balance was prepared. The $1.250 amount owed must be recorded e. Employees have earned $5.100 of accrued and unpaid wages at fiscal year-end. Rent expense incurred and not yet paid or recorded at fiscal year-end is $2.400 g. Additional property taxes of $1700 have been assessed for this fiscal year but have not been paid or recorded on fiscal year end h. $600 accrued interest for Jure has not yet been paid or recorded AL Begin by selecting "Post-closing" from the drop-down below. Then, for each account, use the drop-down to indicate whether the account is included on the post-closing trial balance. Based on your decisions, the post-closing trial balance will be created. Compare your results with the Trial Balance tab. Post-closing Post-closing Trial Balance Included on Post-closing trial balance? Yes Type of Account Dr. Cr. Permanent 103,350 Account Cash Supplies Prepaid insurance Equipment Accumulated depreciation - Equipment Accounts payable Interest payable Rent payable Wages payable Property taxes payable Long-term notes payable Common stock Retained earnings Construction revenue Depreciation expense - Equipment Wages expense Interest expense Insurance expense Rent expense Supplies expense Property taxes expense Dansananen ALLEN CONSTRUCTION COMPANY Trial Balance June 30, 2021 Debit Credit Account Title s 103,350 4,100 6,400 147,000 12 Cash Supplies Prepaid insurance Equipment Accumulated depreciation - Equipment Accounts payable interest payablo Rent payable Wages payable Property taxes payable Long-term notos payablo Retained earnings Depreciation expense - Equipment Wages expense Interest expense Insurance expense Rent expenso Supplies expense Property taxes expense Utilities expense Income summary Total 88,200 10,800 600 2,400 5,100 1,700 60,000 88,180 12 29.400 5,100 600 3,200 2.400 8,200 1,700 1.250 54.470 311.450 IS 312,7005 Chede my work 2 GLO306 (Algo). Based on Problem 3-8AB LO C2, P1, P2, P3, P4, P5, P6, P8 125 The following unadjusted trial balance is for Alien Construction Company at its June 30 current fiscal year and The credit balance of the Retained Eamings account was $106.000 on June 30 of the prior year Information for adjustments is as follows: a. Supplies available at the end of the current fiscal year total $4500 b. Cost of expired Insurance for the current fiscal year is $3.200. c. Annual depreciation on equipments $29.400. di June utilities expense of $1.250 is not included in the unadjusted trial balance because the bil arrived after the trial balance was prepared. The $1.250 amount owed must be recorded e. Employees have earned $5.100 of accrued and unpaid wages at fiscal year-end. Rent expense incurred and not yet paid or recorded at fiscal year-end is $2.400 g. Additional property taxes of $1700 have been assessed for this fiscal year but have not been paid or recorded on fiscal year end h. $600 accrued interest for Jure has not yet been paid or recorded AL Begin by selecting "Post-closing" from the drop-down below. Then, for each account, use the drop-down to indicate whether the account is included on the post-closing trial balance. Based on your decisions, the post-closing trial balance will be created. Compare your results with the Trial Balance tab. Post-closing Post-closing Trial Balance Included on Post-closing trial balance? Yes Type of Account Dr. Cr. Permanent 103,350 Account Cash Supplies Prepaid insurance Equipment Accumulated depreciation - Equipment Accounts payable Interest payable Rent payable Wages payable Property taxes payable Long-term notes payable Common stock Retained earnings Construction revenue Depreciation expense - Equipment Wages expense Interest expense Insurance expense Rent expense Supplies expense Property taxes expense Dansananen ALLEN CONSTRUCTION COMPANY Trial Balance June 30, 2021 Debit Credit Account Title s 103,350 4,100 6,400 147,000 12 Cash Supplies Prepaid insurance Equipment Accumulated depreciation - Equipment Accounts payable interest payablo Rent payable Wages payable Property taxes payable Long-term notos payablo Retained earnings Depreciation expense - Equipment Wages expense Interest expense Insurance expense Rent expenso Supplies expense Property taxes expense Utilities expense Income summary Total 88,200 10,800 600 2,400 5,100 1,700 60,000 88,180 12 29.400 5,100 600 3,200 2.400 8,200 1,700 1.250 54.470 311.450 IS 312,7005