Answered step by step

Verified Expert Solution

Question

1 Approved Answer

the first picture is what i need help with. the second picture is how to do the problem. ack to Assignment Keep the Highest 1/2

the first picture is what i need help with. the second picture is how to do the problem.

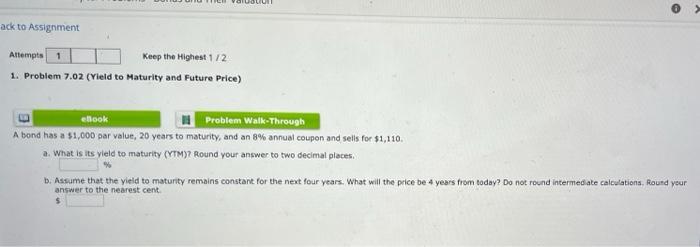

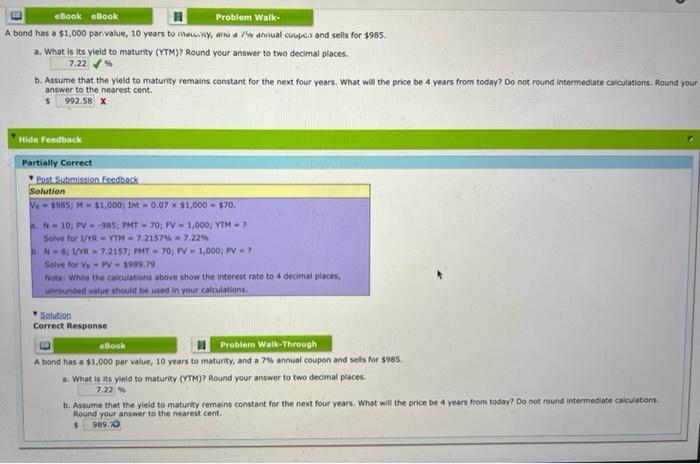

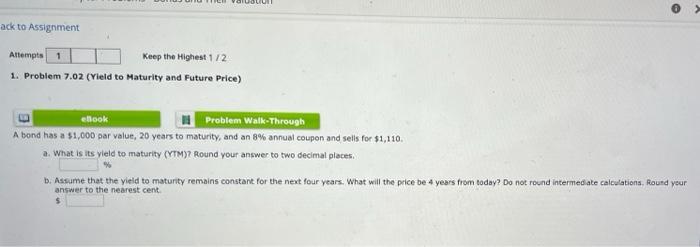

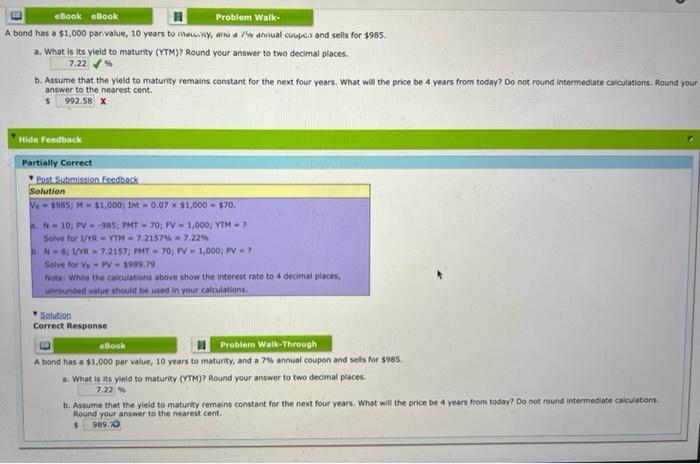

ack to Assignment Keep the Highest 1/2 1. Problem 7.02 (Yield to Maturity and Future Price) Attempts ellook Problem Walk-Through A bond has a $1,000 par value, 20 years to maturity, and an 8% annual coupon and sells for $1,110. a. What is its yield to maturity (YTM)? Round your answer to two decimal places. O b. Assume that the yield to maturity remains constant for the next four years. What will the price be 4 years from today? Do not round intermediate calculations. Round your answer to the nearest cent $ eBook eBook Problem Walk- A bond has a $1,000 par value, 10 years to many, and a 7 annual coups and sells for $985. a. What is its yield to maturity (YTM)? Round your answer to two decimal places. 7.22% b. Assume that the yield to maturity remains constant for the next four years. What will the price be 4 years from today? Do not round intermediate calculations. Round your answer to the nearest cent. $ 992.58 X Hide Feedback Partially Correct Post Submission Feedback Solution Ve-$985; M-$1,000; Int 0.07 * $1,000 $70. 6. N-10; PV-985; PMT-70; FV 1,000; YTM = 7 Solve for 1/YR YTM-7.2157% 7.22% b. N-6; 1/YR - 7.2157; PMT 70; FV 1,000; PV = ? Solve for Ve PV-5989,79 Note: While the calculations above show the interest rate to 4 decimal places, unrounded value should be used in your calculations. Solution Correct Response eBook Problem Walk-Through A bond has a $1,000 par value, 10 years to maturity, and a 7% annual coupon and sells for $985. a. What is its yield to maturity (YTM)? Round your answer to two decimal places. 7.22 % b. Assume that the yield to maturity remains constant for the next four years. What will the price be 4 years from today? Do not round intermediate calculations Round your answer to the nearest cent. $ 989.70

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started