Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The first priority settlement amounts to? The total of the second priority settlement amounts to? (Independent assumptions) Assume that after all the liquidating expenses and

The first priority settlement amounts to?

The total of the second priority settlement amounts to?

(Independent assumptions) Assume that after all the liquidating expenses and liabilities were settled, the remaining cash available for distribution is P66,000. How much should Partner Calingasan receive?

(Independent assumptions) Assume that that after all the liquidating expenses and liabilities were settled, the remaining cash available for distribution is P130,000. How much should Partner Limin receive?

The total of the second priority settlement amounts to?

(Independent assumptions) Assume that after all the liquidating expenses and liabilities were settled, the remaining cash available for distribution is P66,000. How much should Partner Calingasan receive?

(Independent assumptions) Assume that that after all the liquidating expenses and liabilities were settled, the remaining cash available for distribution is P130,000. How much should Partner Limin receive?

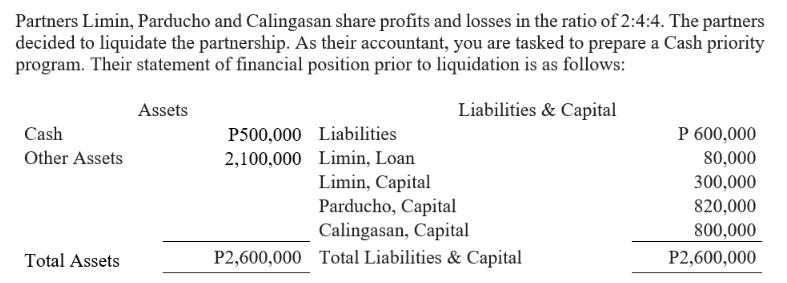

Partners Limin, Parducho and Calingasan share profits and losses in the ratio of 2:4:4. The partners decided to liquidate the partnership. As their accountant, you are tasked to prepare a Cash priority program. Their statement of financial position prior to liquidation is as follows: Liabilities & Capital Cash Other Assets Total Assets Assets P500,000 2,100,000 Liabilities Limin, Loan Limin, Capital Parducho, Capital Calingasan, Capital P2,600,000 Total Liabilities & Capital P 600,000 80,000 300,000 820,000 800,000 P2,600,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To prepare the cash priority program we need to determine the order in which the partners and creditors will be paid during the liquidation process Th...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started