Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A owns all the stock of T Corp. The only asset of T Corp. is land worth $150,000 with a basis of $60,000. A's

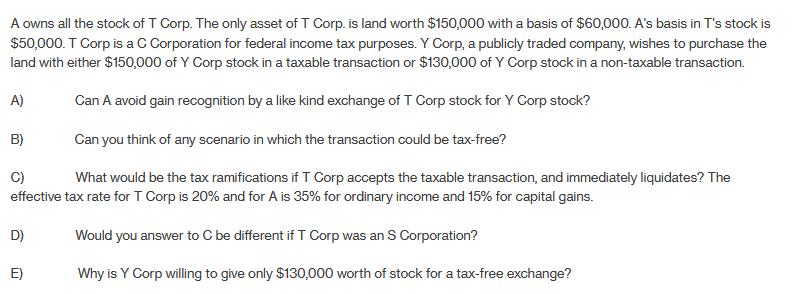

A owns all the stock of T Corp. The only asset of T Corp. is land worth $150,000 with a basis of $60,000. A's basis in T's stock is $50,000. T Corp is a C Corporation for federal income tax purposes. Y Corp, a publicly traded company, wishes to purchase the land with either $150,000 of Y Corp stock in a taxable transaction or $130,000 of Y Corp stock in a non-taxable transaction. A) Can A avoid gain recognition by a like kind exchange of T Corp stock for Y Corp stock? B) Can you think of any scenario in which the transaction could be tax-free? C) What would be the tax ramifications if T Corp accepts the taxable transaction, and immediately liquidates? The effective tax rate for T Corp is 20% and for A is 35% for ordinary income and 15% for capital gains. D) Would you answer to C be different if T Corp was an S Corporation? E) Why is Y Corp willing to give only $130,000 worth of stock for a tax-free exchange?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

here are the considerations for each scenario taxable transaction T Corp tax consequences recognitio...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started