Answered step by step

Verified Expert Solution

Question

1 Approved Answer

the first question from (a- d) if done please do as much as you can and i will post again if it is no done.

the first question from (a- d) if done please do as much as you can and i will post again if it is no done.

i can't do anything about the image it is the apps fault.

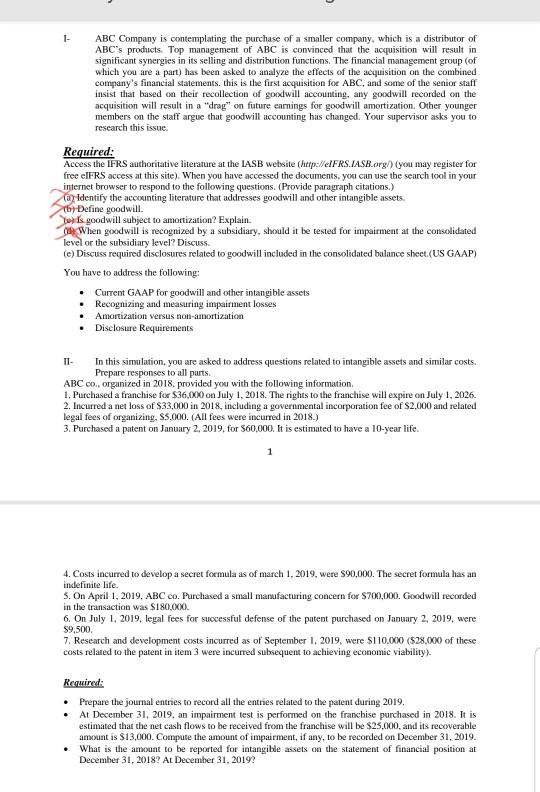

I- ABC Company is contemplating the purchase of a smaller company, which is a distributor of ABC's products Top management of ABC is convinced that the acquisition will result in significant synergies in its selling and distribution functions. The financial management group (of which you are a part) has been asked to analyze the effects of the acquisition on the combined company's financial statements. this is the first acquisition for ABC, and some of the senior staff insist that based on their recollection of goodwill accounting, any goodwill recorded on the acquisition will result in a "drag" on future earnings for goodwill amortization. Other younger members on the staff argue that goodwill accounting has changed. Your supervisor asks you to research this issue Required: Access the IFRS authoritative literature at the IASB website (http://eIFRS. IASB.org/) (you may register for free elFRS access at this site). When you have accessed the documents, you can use the search tool in your internet browser to respond to the following questions. (Provide paragraph citations.) (a) Identify the accounting literature that addresses goodwill and other intangible assets. to Define goodwill. You is goodwill subject to amortization? Explain. 1 When goodwill is recognized by a subsidiary, should it be tested for imp the consolidated level or the subsidiary level? Discuss. (e) Discuss required disclosures related to goodwill included in the consolidated balance sheet (US GAAP) You have to address the following: . Current GAAP for goodwill and other intangible assets Recognizing and measuring impairment losses Amortization versus non-amortization Disclosure Requirements 11- In this simulation, you are asked to address questions related to intangible assets and similar costs. Prepare responses to all parts ABC Co., organized in 2018. provided you with the following information 1. Purchased a franchise for $36.000 on July 1, 2018. The rights to the franchise will expire on July 1, 2026. 2. Incurred a net loss of S33,000 in 2018, including a governmental incorporation fee of $2,000 and related legal fees of organizing, $5.000. (All fees were incurred in 2018.) 3. Purchased a patent on January 2, 2019, for $60,000. It is estimated to have a 10-year life. 1 4. Costs incurred to develop a secret formula as of march 1, 2019, were $90,000. The secret formula has an indefinite life. 5. On April 1, 2019, ABC Co. Purchased a small manufacturing concern for $700,000. Goodwill recorded in the transaction was $180.000 6. On July 1, 2019, legal fees for successful defense of the patent purchased on January 2, 2019, were $9,500 7. Research and development costs incurred as of September 1, 2019, were $110.000 ($28.000 of these costs related to the patent in item 3 were incurred subsequent to achieving economic viability) Required: Prepare the journal entries to record all the entries related to the patent during 2019. At December 31, 2019. an impairment test is performed on the franchise purchased in 2018. It is estimated that the net cash flows to be received from the franchise will be $25.000, and its recoverable amount is $13,000. Compute the amount of impairment, if any, to be recorded on December 31, 2019. What is the amount to be reported for intangible assets on the statement of financial position at December 31, 2018? At December 31, 2019Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started