Question

Your firm is deciding to invest in two different projects. Both have an initial cost of $ 15 million. Estimated future cash flows are as

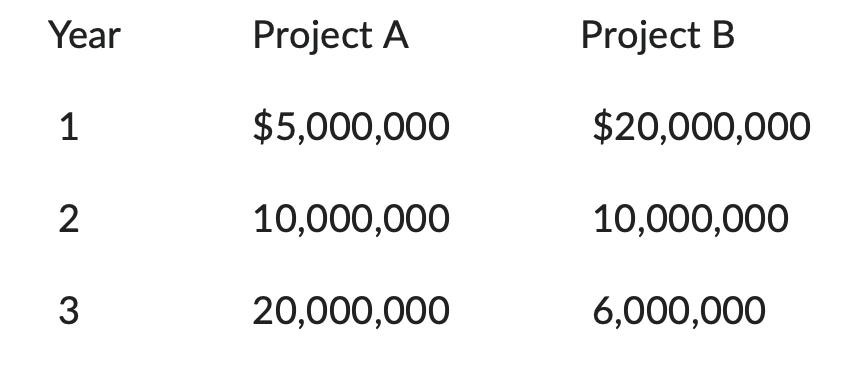

Your firm is deciding to invest in two different projects. Both have an initial cost of $ 15 million. Estimated future cash flows are as follows:

A. Calculate both projects' NPV, assuming the cost of capital is 5%, then 10%, then 15%.

B. What is the project's IRRs at the three costs of capital?

Year 1 2 3 Project A $5,000,000 10,000,000 20,000,000 Project B $20,000,000 10,000,000 6,000,000

Step by Step Solution

3.46 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the Net Present Value NPV of the two projects at different costs of capital you can use ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Vector Mechanics for Engineers Statics and Dynamics

Authors: Ferdinand Beer, E. Russell Johnston, Jr., Elliot Eisenberg, William Clausen, David Mazurek, Phillip Cornwell

8th Edition

73212229, 978-0073212227

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App