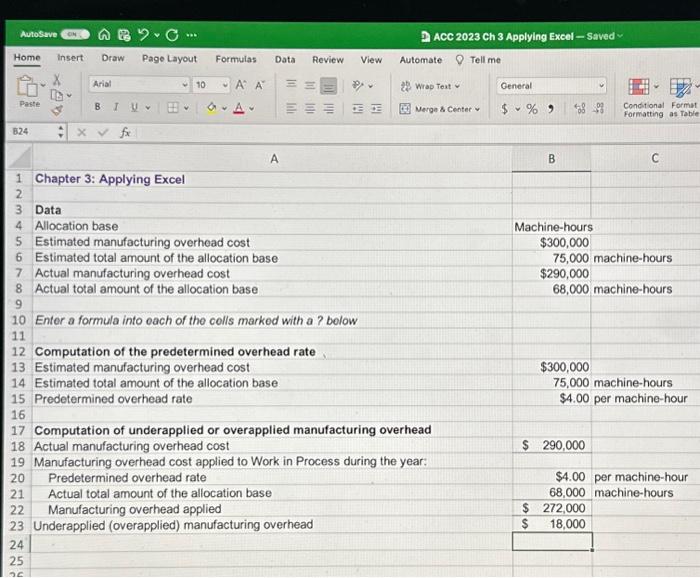

The first step of putting the formulas into the Excel is complete, but none of the rest is

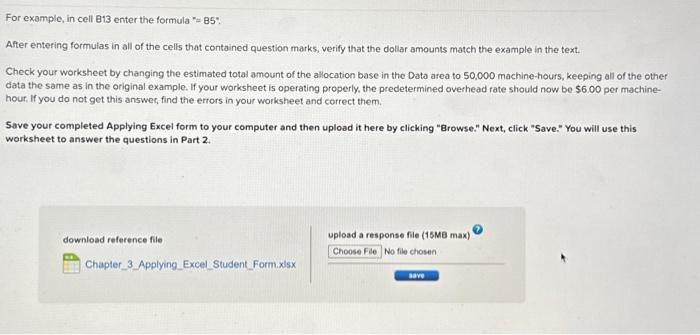

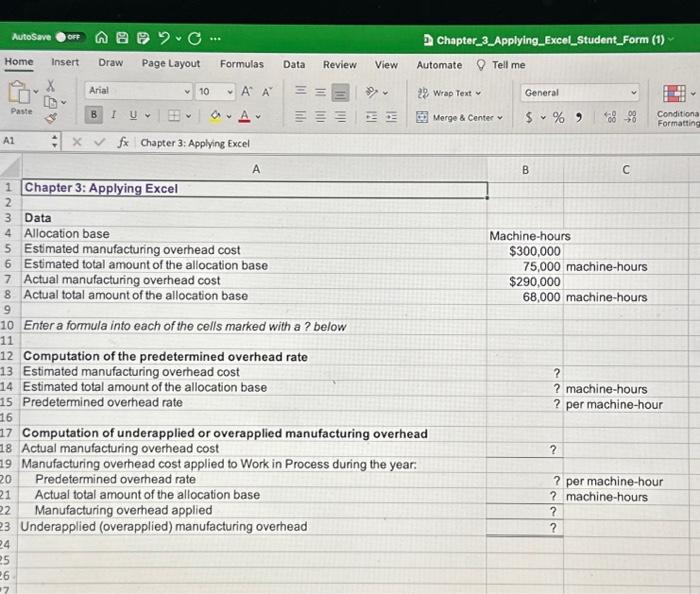

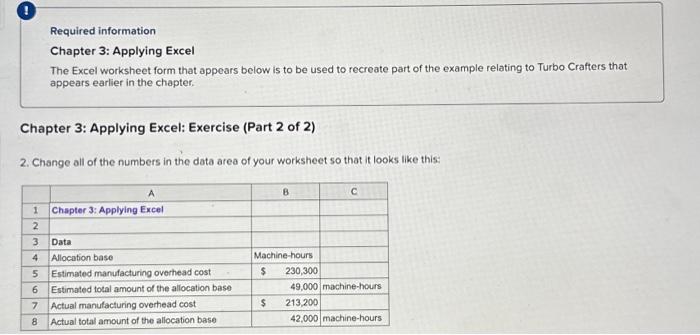

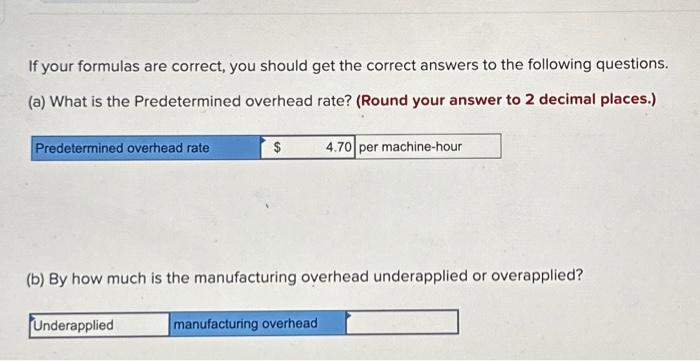

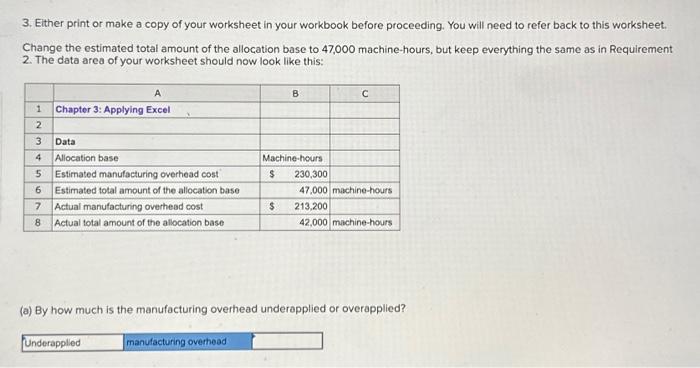

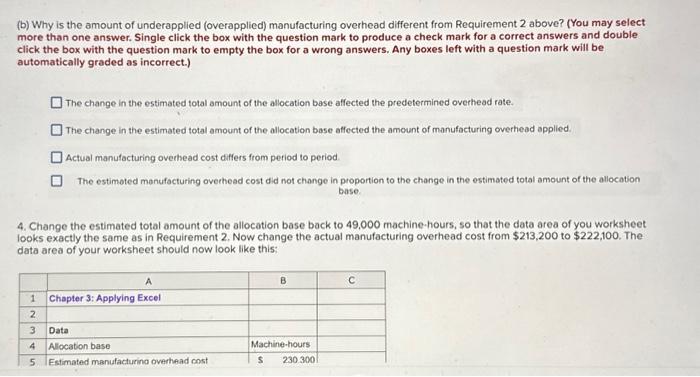

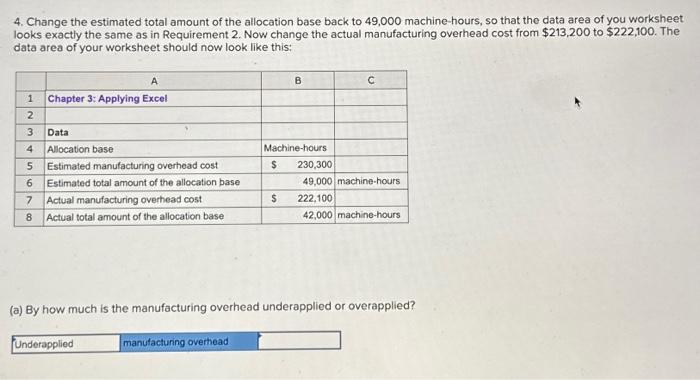

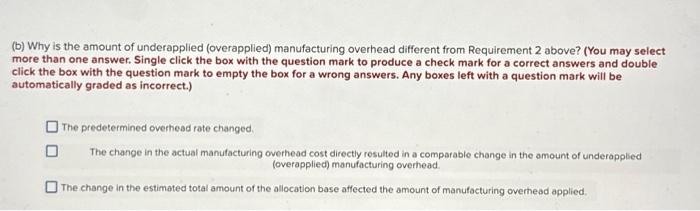

Required information Chapter 3: Applying Excel The Excel worksheet form that appears below is to be used to recreate part of the example relating to Turbo Crafters that oppears earlier in the chapter. Chapter 3: Applying Excel: Excel Worksheet (Part 1 of 2) Download the Applying Excel form and enter formulas in all cells that contain question marks. For example, in cell B13 enter the formula =85 : After entering formulas in all of the cells that contained question marks, verify that the dollar amounts match the example in the text. Check your worksheet by changing the estimated total amount of the allocation base in the Data area to 50,000 machine-hours, keeping all of the other data the same as in the original example. If your worksheet is operating properly, the predetermined overhead rate should now be $6.00 per machinehour, If you do not get this answer, find the errors in your worksheet and correct them. Save your completed Applying Excel form to your computer and then upload it here by clicking "Browse." Next, click "Save." You will use this worksheet to answer the questions in Part 2. For example, in cell B13 enter the formula "=85: After entering formulas in all of the cells that contained question marks, verify that the dollar amounts match the example in the text. Check your worksheet by changing the estimated total amount of the allocation base in the Data area to 50,000 machine-hours, keeping all of the other data the same as in the original example. If your worksheet is operating properly, the predetermined overhead rate should now be $6.00 per machinehour, If you do not get this answer, find the errors in your worksheet and correct them. Save your completed Applying Excel form to your computer and then upload it here by cliching "Browse." Next, click "Save." You will use this worksheet to answer the questions in Part 2 . upload a response file (15MB max) No file chosen Enter a formula into each of the cells marked with a ? below Computation of the predetermined overhead rate Estimated manufacturing overhead cost Estimated total amount of the allocation base ? machine-hours Predetermined overhead rate ? per machine-hour Computation of underapplied or overapplied manufacturing overhead Actual manufacturing overhead cost Manufacturing overhead cost applied to Work in Process during the year: Predetermined overhead rate ? per machine-hour Actual total amount of the allocation base ? machine-hours Manufacturing overhead applied Underapplied (overapplied) manufacturing overhead Required information Chapter 3: Applying Excel The Excel worksheet form that appears below is to be used to recreate part of the example relating to Turbo Crafters that appears earlier in the chapter. Chapter 3: Applying Excel: Exercise (Part 2 of 2) 2. Change all of the numbers in the data area of your worksheet so that it looks like this: If your formulas are correct, you should get the correct answers to the following questions. (a) What is the Predetermined overhead rate? (Round your answer to 2 decimal places.) (b) By how much is the manufacturing overhead underapplied or overapplied? 3. Elther print or make a copy of your worksheet in your workbook before proceeding. You will need to refer back to this worksheet. Change the estimated total amount of the allocation base to 47,000 machine-hours, but keep everything the same as in Requirement 2. The data area of your worksheet should now look like this: (a) By how much is the manufacturing overhead underapplied or overapplied? (b) Why is the amount of underapplied (overapplied) manufacturing overhead different from Requirement 2 above? (You may select more than one answer. Single click the box with the question mark to produce a check mark for a correct answers and double click the box with the question mark to empty the box for a wrong answers. Any boxes left with a question mark will be automatically graded as incorrect.) The change in the estimated total amount of the allocation base affected the predetermined overhead rate. The change in the estimated total amount of the allocation base affected the amount of manufacturing overhead applied. Actual manufacturing overhead cost differs from period to period. The estimoted manufacturing overhead cost did not change in proportion to the change in the estimated total amount of the allocation base. 4. Change the estimated total amount of the allocation base back to 49.000 machine-hours, so that the data area of you worksheet looks exactly the same as in Requirement 2. Now change the actual manufacturing overhead cost from $213,200 to $222,100. The data area of your worksheet should now look like this: 4. Change the estimated total amount of the allocation base back to 49,000 machine-hours, so that the data area of you worksheet looks exactly the same as in Requirement 2 . Now change the actual manufacturing overhead cost from $213,200 to $222,100. The data area of your worksheet should now look like this: (a) By how much is the manufacturing overhead underapplied or overapplied? (b) Why is the amount of underapplied (overapplied) manufacturing overhead different from Requirement 2 above? (You may select more than one answer. Single click the box with the question mark to produce a check mark for a correct answers and double click the box with the question mark to empty the box for a wrong answers. Any boxes left with a question mark will be automatically graded as incorrect.) The predetermined overhesd rate changed