Answered step by step

Verified Expert Solution

Question

1 Approved Answer

the first time i posted this questions i got incorrect feedback. Intro DeLuxe Furniture is thinking of buying a wood cutting machine for $140,000 that

the first time i posted this questions i got incorrect feedback.

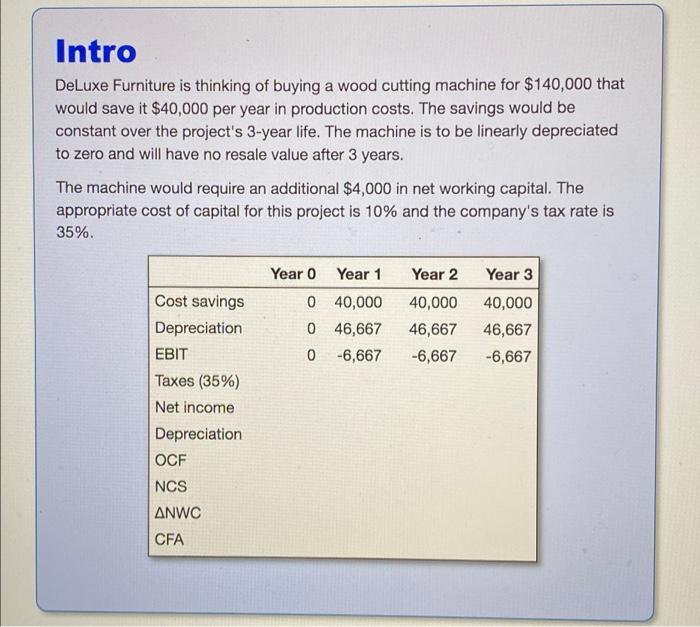

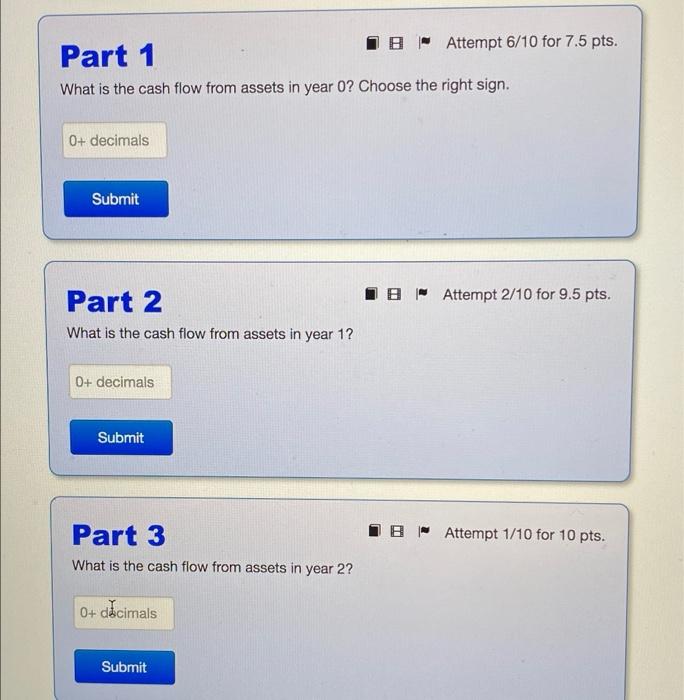

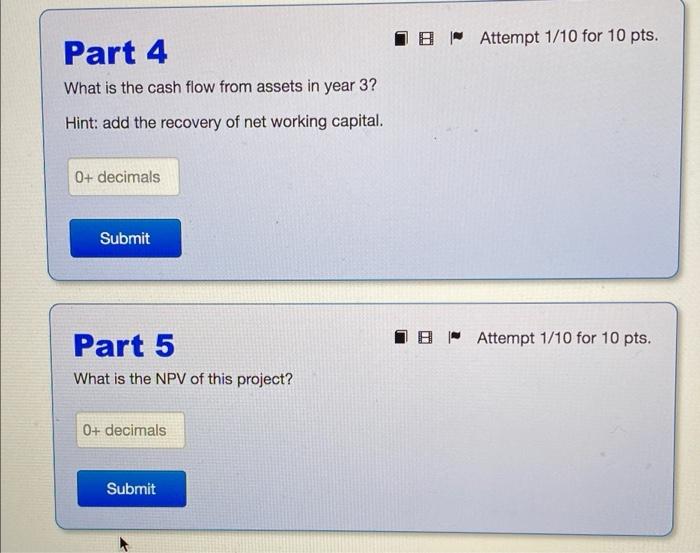

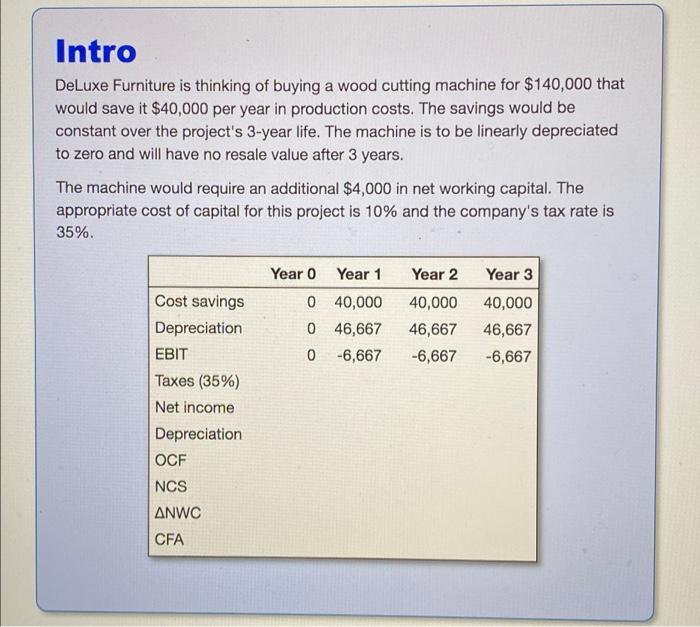

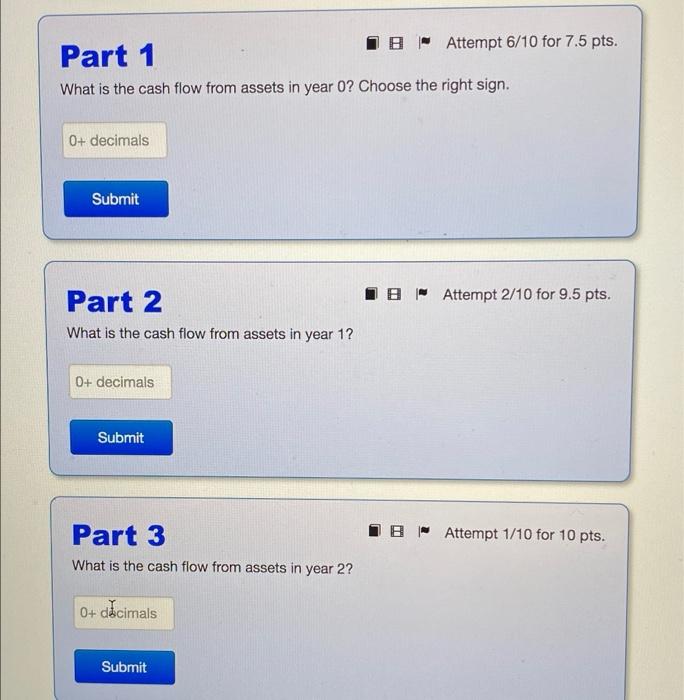

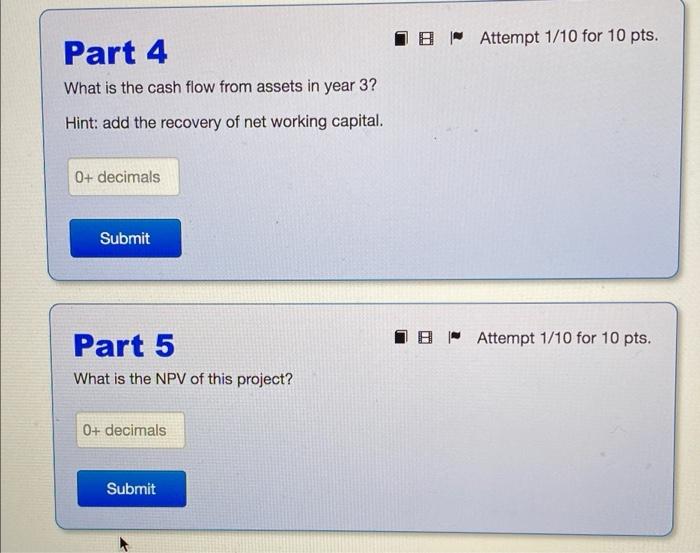

Intro DeLuxe Furniture is thinking of buying a wood cutting machine for $140,000 that would save it $40,000 per year in production costs. The savings would be constant over the project's 3-year life. The machine is to be linearly depreciated to zero and will have no resale value after 3 years. The machine would require an additional $4,000 in net working capital. The appropriate cost of capital for this project is 10% and the company's tax rate is 35%. Year 0 Year 1 0 40,000 0 46,667 0 -6,667 Year 2 40,000 46,667 -6,667 Year 3 40,000 46,667 -6,667 Cost savings Depreciation EBIT Taxes (35%) Net income Depreciation OCF NCS ANWC CFA Part 1 IB"Attempt 6/10 for 7.5 pts. What is the cash flow from assets in year o? Choose the right sign. 0+ decimals Submit IB Attempt 2/10 for 9.5 pts. Part 2 What is the cash flow from assets in year 1? 0+ decimals Submit - Attempt 1/10 for 10 pts. Part 3 What is the cash flow from assets in year 2? 0+ dcimals Submit 18 Attempt 1/10 for 10 pts. Part 4 What is the cash flow from assets in year 3? Hint: add the recovery of net working capital. 0+ decimals Submit 18 Attempt 1/10 for 10 pts. Part 5 What is the NPV of this project? 0+ decimals Submit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started