Answered step by step

Verified Expert Solution

Question

1 Approved Answer

the first two pictures are the data sheet Fall 2022 General Information - Assume you are doing all calculations as of November 4, 2022. -

the first two pictures are the data sheet

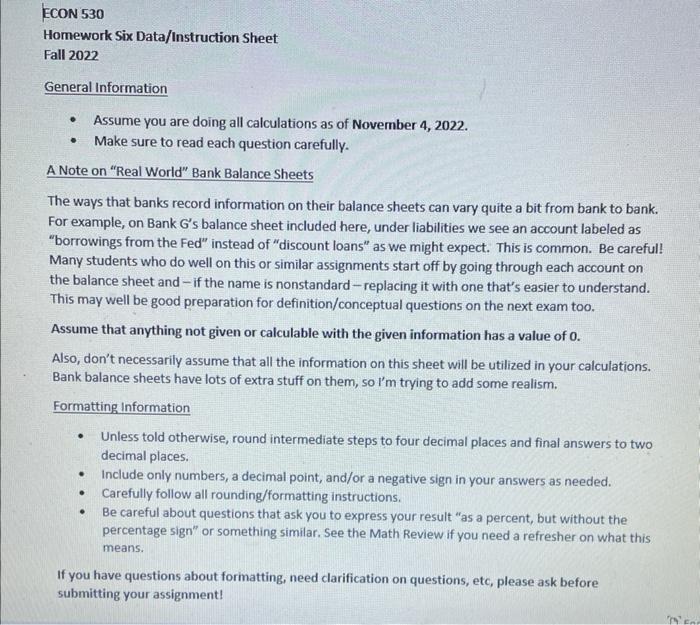

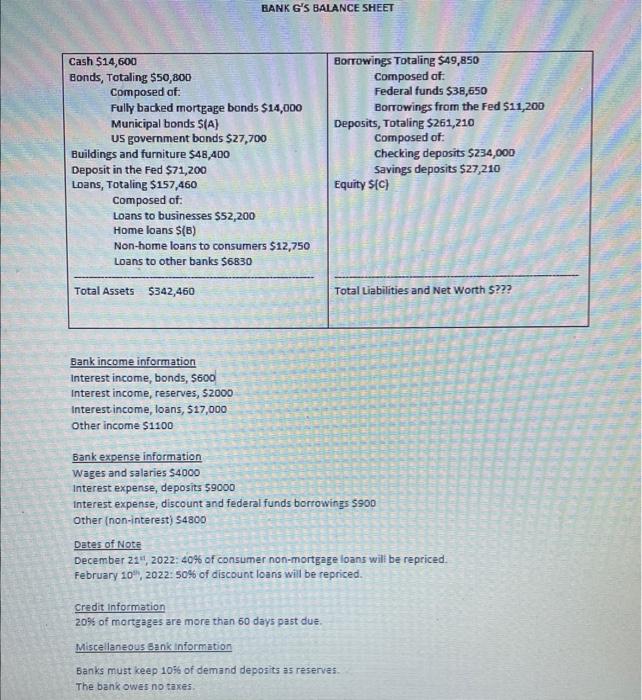

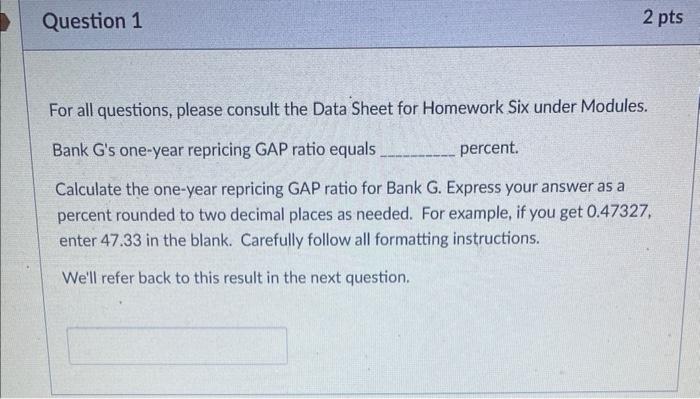

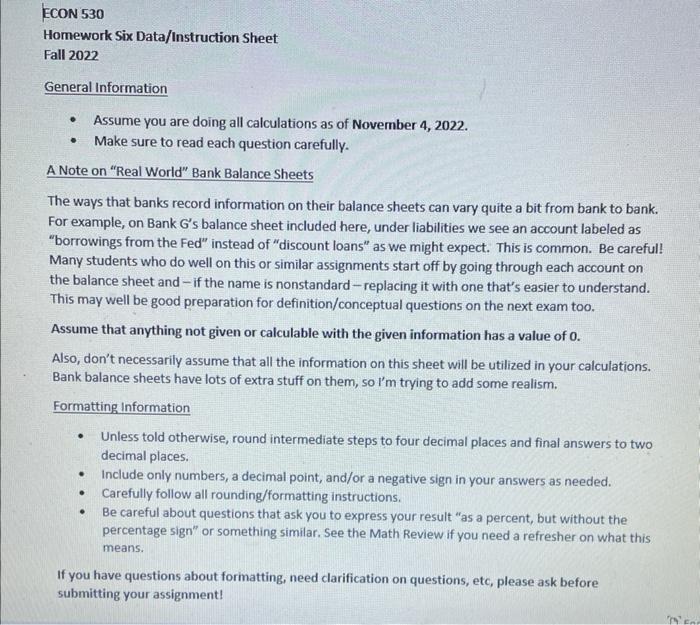

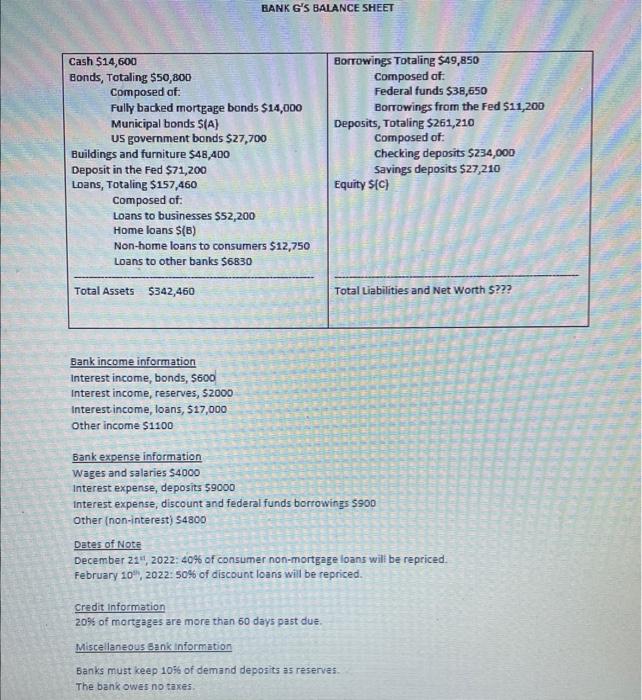

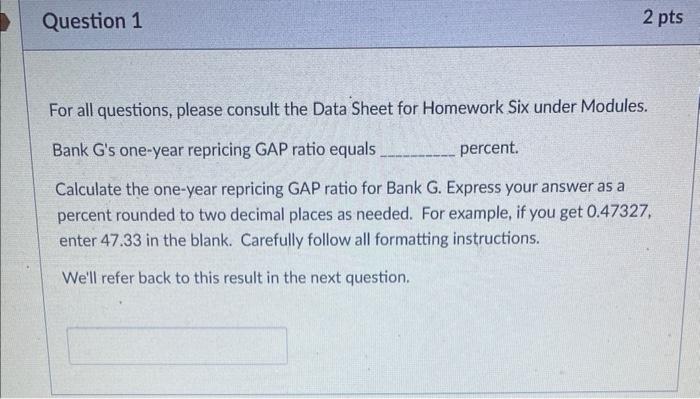

Fall 2022 General Information - Assume you are doing all calculations as of November 4, 2022. - Make sure to read each question carefully. A Note on "Real World" Bank Balance Sheets The ways that banks record information on their balance sheets can vary quite a bit from bank to bank. For example, on Bank G 's balance sheet included here, under liabilities we see an account labeled as "borrowings from the Fed" instead of "discount loans" as we might expect. This is common. Be careful! Many students who do well on this or similar assignments start off by going through each account on the balance sheet and - if the name is nonstandard-replacing it with one that's easier to understand. This may well be good preparation for definition/conceptual questions on the next exam too. Assume that anything not given or calculable with the given information has a value of 0 . Also, don't necessarily assume that all the information on this sheet will be utilized in your calculations. Bank balance sheets have lots of extra stuff on them, so l'm trying to add some realism. Formatting information - Unless told otherwise, round intermediate steps to four decimal places and final answers to two decimal places. - Include only numbers, a decimal point, and/or a negative sign in your answers as needed. - Carefully follow all rounding/formatting instructions. - Be careful about questions that ask you to express your result "as a percent, but without the percentage sign" or something similar. See the Math Review if you need a refresher on what this means. If you have questions about formatting, need clarification on questions, etc, please ask before submitting your assignment! BANK G'S BALANCE SHEET Bank income information Interest income, bonds, 5600 Interest income, reserves, $2000 Interest income, loans, 517,000 other income $1100 Bankexpense information Wages and salaries $4000 Interest expense, deposits 59000 Interest expense, discount and federal funds borrowings $900 other (non-interest) 54800 Detes of Note December 2114,2022 : 40% of consumer non-mortgage loans will be repriced. February 10\%, 2022: 50% of discount loanis will be repriced. Credit information 20% of mortzages are more than 60 days past due. Miscellaneous bank information Banks must keep 10% of demand deposits as reserves. The bank owes no taxes. For all questions, please consult the Data Sheet for Homework Six under Modules. Bank G's one-year repricing GAP ratio equals percent. Calculate the one-year repricing GAP ratio for Bank G. Express your answer as a percent rounded to two decimal places as needed. For example, if you get 0.47327, enter 47.33 in the blank. Carefully follow all formatting instructions. We'll refer back to this result in the next

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started