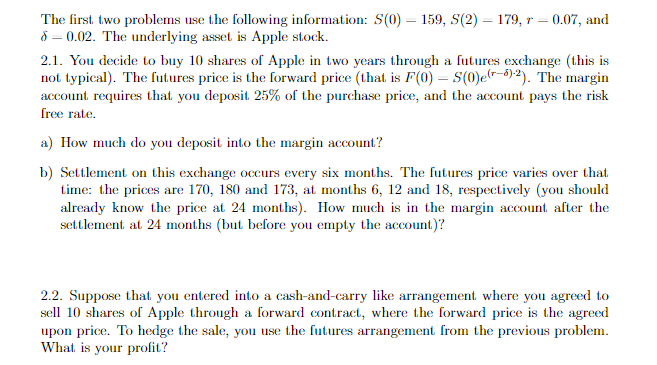

Question: The first two problems use the following information: S(0) 159, S(2)179, r = 0.07, and 8 = 0.02. The underlying asset is Apple stock. 2.1.

The first two problems use the following information: S(0) 159, S(2)179, r = 0.07, and 8 = 0.02. The underlying asset is Apple stock. 2.1. You decide to buy 10 shares of Apple in two years through a futures exchange this is not typical). The futures price is the forward price (that is F(0) - S(0)(-5)2). The margin account requires that you deposit 25% of the purchase price, and the account pays the risk free rate. a) How much do you deposit into the margin account? b) Settlement on this exchange occurs every six months. The futures price varies over that time: the prices are 170, 180 and 173, at months 6, 12 and 18, respectively you should already know the price at 24 months). How much is in the margin account after the settlement at 24 months (but before you empty the account)? 2.2. Suppose that you entered into a cash-and-carry like arrangement where you agreed to sell 10 shares of Apple through a forward contract, where the forward price is the agreed upon price. To hedge the sale, you use the futures arrangement from the previous problem. What is your profit? The first two problems use the following information: S(0) 159, S(2)179, r = 0.07, and 8 = 0.02. The underlying asset is Apple stock. 2.1. You decide to buy 10 shares of Apple in two years through a futures exchange this is not typical). The futures price is the forward price (that is F(0) - S(0)(-5)2). The margin account requires that you deposit 25% of the purchase price, and the account pays the risk free rate. a) How much do you deposit into the margin account? b) Settlement on this exchange occurs every six months. The futures price varies over that time: the prices are 170, 180 and 173, at months 6, 12 and 18, respectively you should already know the price at 24 months). How much is in the margin account after the settlement at 24 months (but before you empty the account)? 2.2. Suppose that you entered into a cash-and-carry like arrangement where you agreed to sell 10 shares of Apple through a forward contract, where the forward price is the agreed upon price. To hedge the sale, you use the futures arrangement from the previous problem. What is your profit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts