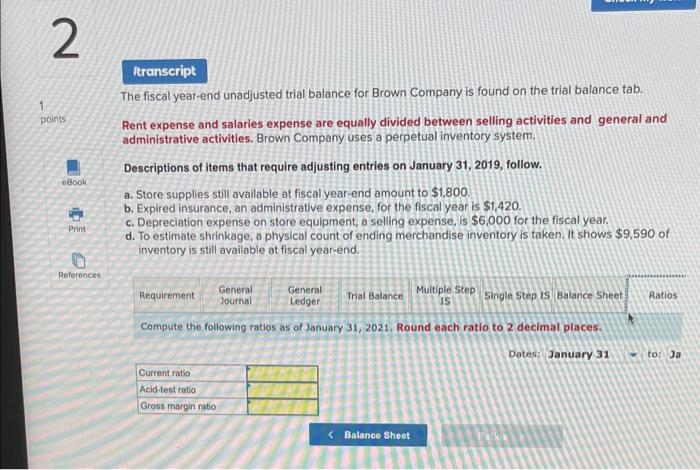

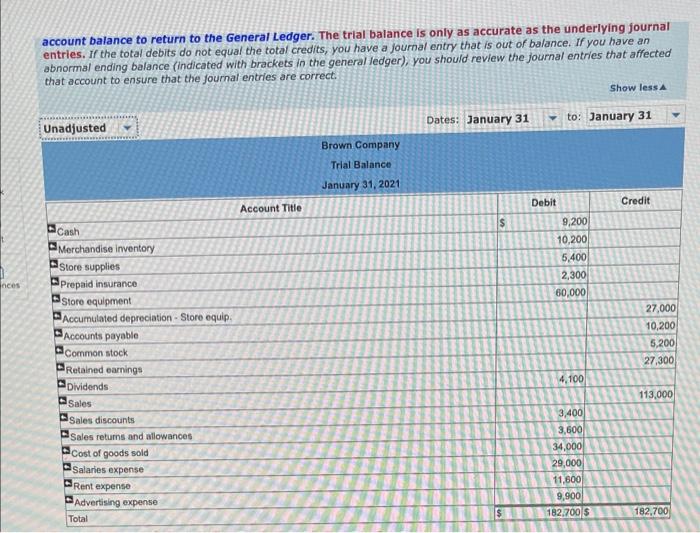

The fiscal year-end unadjusted trial balance for Brown Company is found on the trial balance tab. Rent expense and salaries expense are equally divided between selling activities and general and administrative activities. Brown Company uses a perpetual inventory system. Descriptions of items that require adjusting entries on January 31,2019 , follow. a. Store supplies still available at fiscal year-end amount to $1,800. b. Expired insurance, an administrative expense, for the fiscal year is $1,420. c. Depreciation expense on store equipment, a selling expense, is $6,000 for the fiscal year. d. To estimate shrinkage, a physical count of ending merchandise inventory is taken. It shows $9.590 of inventory is still available at fiscal year-end. Compute the following ratios as of January 31, 2021. Round each ratio to 2 decimal places. account balance to return to the General Ledger. The trial balance is only as accurate as the underlying journal entries. If the total debits do not equal the total credits, you have a journal entry that is out of balance. If you have an abnormal ending balance (indicated with brackets in the general fedger), you should review the journal entries that affected that account to ensure that the journal entries are correct. The fiscal year-end unadjusted trial balance for Brown Company is found on the trial balance tab. Rent expense and salaries expense are equally divided between selling activities and general and administrative activities. Brown Company uses a perpetual inventory system. Descriptions of items that require adjusting entries on January 31,2019 , follow. a. Store supplies still available at fiscal year-end amount to $1,800. b. Expired insurance, an administrative expense, for the fiscal year is $1,420. c. Depreciation expense on store equipment, a selling expense, is $6,000 for the fiscal year. d. To estimate shrinkage, a physical count of ending merchandise inventory is taken. It shows $9.590 of inventory is still available at fiscal year-end. Compute the following ratios as of January 31, 2021. Round each ratio to 2 decimal places. account balance to return to the General Ledger. The trial balance is only as accurate as the underlying journal entries. If the total debits do not equal the total credits, you have a journal entry that is out of balance. If you have an abnormal ending balance (indicated with brackets in the general fedger), you should review the journal entries that affected that account to ensure that the journal entries are correct