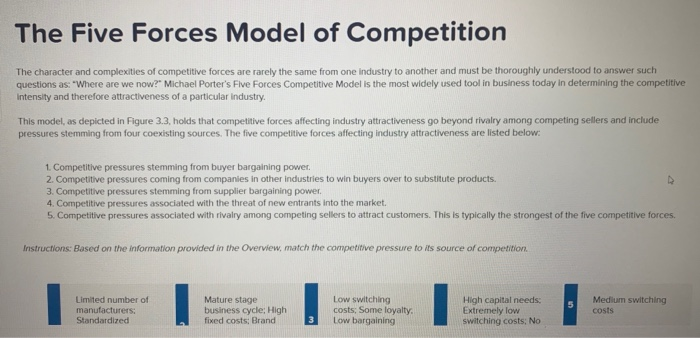

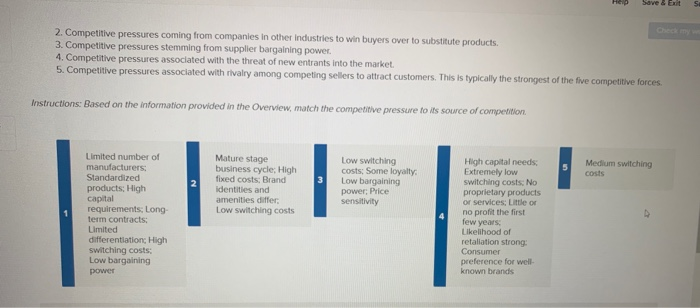

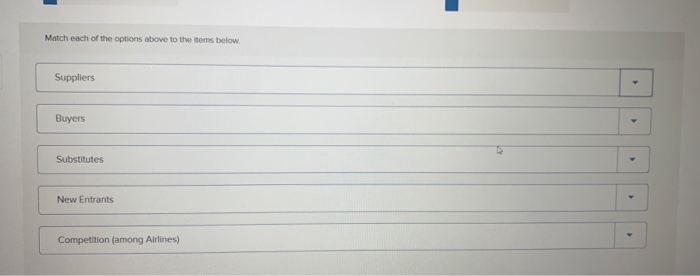

The Five Forces Model of Competition The character and complexities of competitive forces are rarely the same from one industry to another and must be thoroughly understood to answer such questions as "Where are we now?" Michael Porter's Five Forces Competitive Model is the most widely used tool in business today in determining the competitive Intensity and therefore attractiveness of a particular industry. This model, as depicted in Figure 3.3. holds that competitive forces affecting industry attractiveness go beyond rivalry among competing sellers and include pressures stemming from four coexisting sources. The five competitive forces affecting industry attractiveness are listed below: 1. Competitive pressures stemming from buyer bargaining power. 2. Competitive pressures coming from companies in other industries to win buyers over to substitute products. 3. Competitive pressures stemming from supplier bargaining power. 4. Competitive pressures associated with the threat of new entrants into the market. 5. Competitive pressures associated with rivalry among competing sellers to attract customers. This is typically the strongest of the five competitive forces. Instructions: Based on the information provided in the Overview, match the competitive pressure to its source of competition 5 Limited number of manufacturers: Standardized Mature stage business cycle: High fixed costs: Brand Low switching costs: Some loyalty Low bargaining High capital needs: Extremely low switching costs: No Medium switching costs 3 Hei 2. Competitive pressures coming from companies in other industries to win buyers over to substitute products. 3. Competitive pressures stemming from supplier bargaining power 4. Competitive pressures associated with the threat of new entrants into the market. 5. Competitive pressures associated with rivalry among competing sellers to attract customers. This is typically the strongest of the five competitive forces Instructions: Based on the information provided in the Overview, match the competitive pressure to its source of competition Medium switching costs 3 Mature stage business cycle: High fixed costs: Brand identities and amenities differ, Low switching costs Low switching costs: Some loyalty Low bargaining power, Price sensitivity N Limited number of manufacturers: Standardized products: High capital requirements: Long- term contracts: Limited differentiation, High switching costs: Low bargaining power High capital needs: Extremely low switching costs: No proprietary products or services: Little or no profit the first few years Likelihood of retallation strong Consumer preference for well- known brands Match each of the options above to the items below Suppliers Buyers Substitutes New Entrants Competition (among Airlines)