Answered step by step

Verified Expert Solution

Question

1 Approved Answer

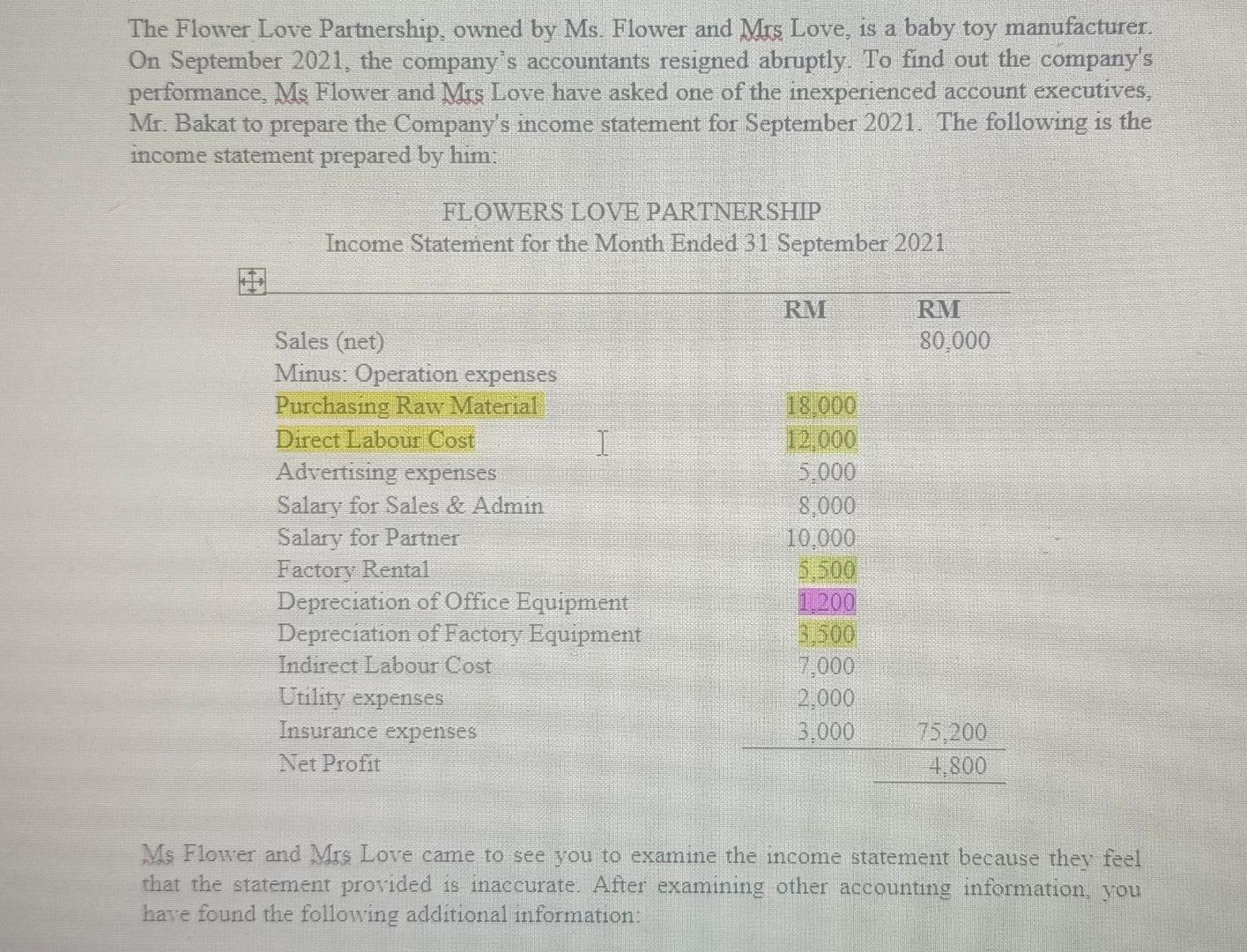

The Flower Love Partnership, owned by Ms. Flower and Mrs Love, is a baby toy manufacturer. On September 2021, the company's accountants resigned abruptly. To

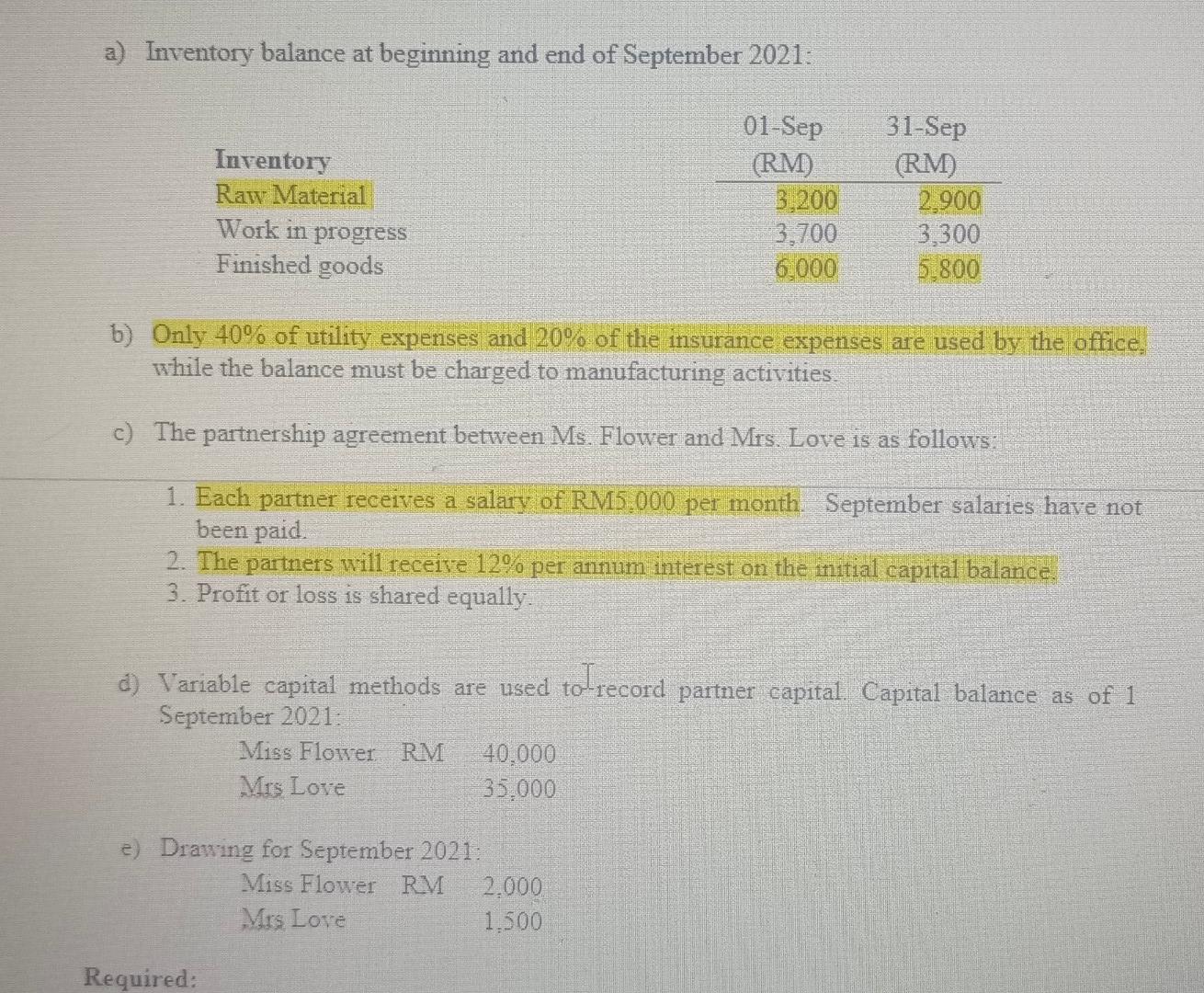

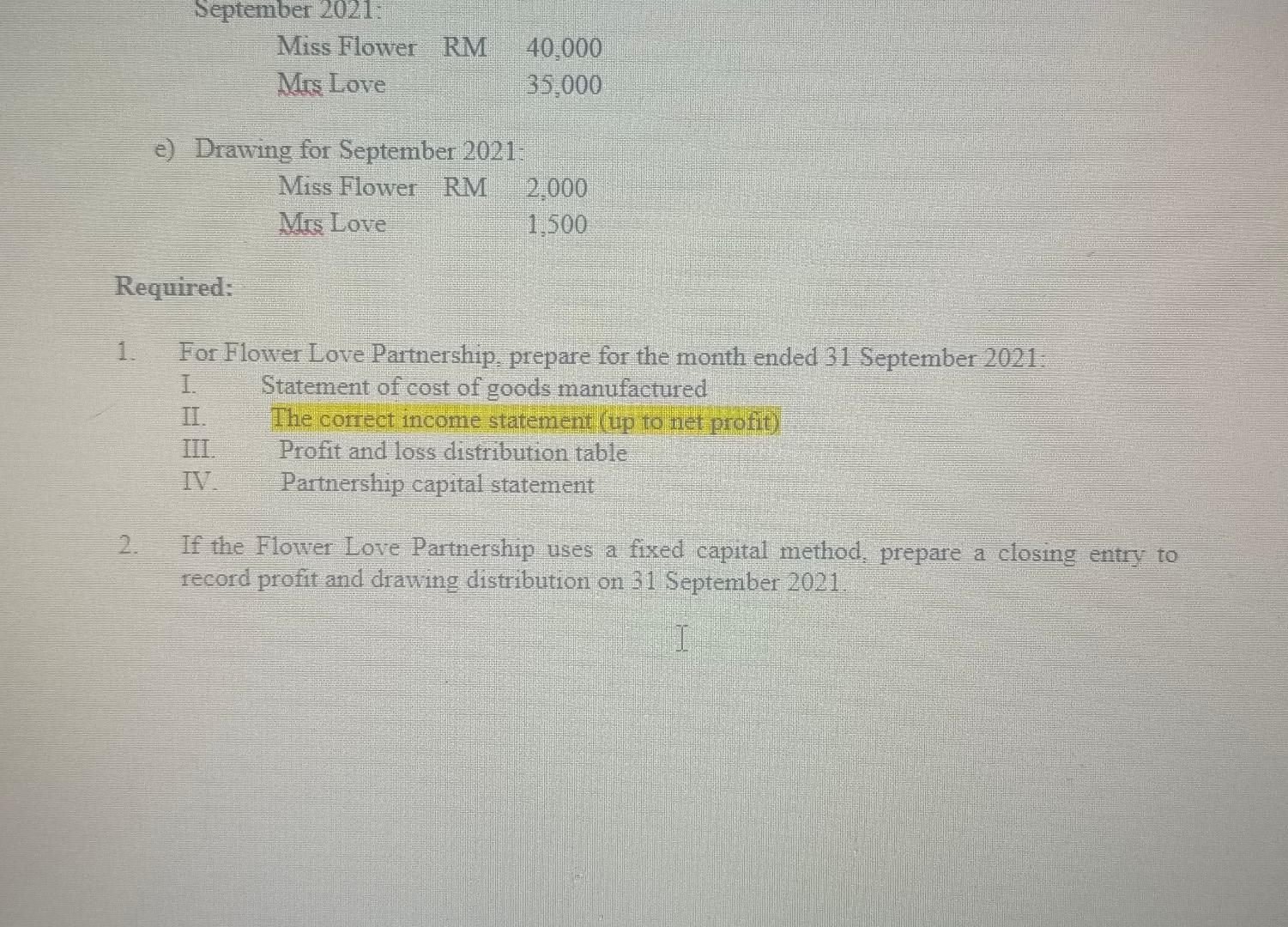

The Flower Love Partnership, owned by Ms. Flower and Mrs Love, is a baby toy manufacturer. On September 2021, the company's accountants resigned abruptly. To find out the company's performance, Ms Flower and Mrs Love have asked one of the inexperienced account executives, Mr. Bakat to prepare the Company's income statement for September 2021. The following is the income statement prepared by him: FLOWERS LOVE PARTNERSHIP Income Statement for the Month Ended 31 September 2021 RM RM Sales (net) 80,000 Minus: Operation expenses Purchasing Raw Material 18,000 Direct Labour Cost I 12,000 Advertising expenses 5.000 Salary for Sales & Admin 8,000 Salary for Partner 10.000 Factory Rental $ 500 1.200 Depreciation of Office Equipment Depreciation of Factory Equipment 3.500 Indirect Labour Cost 7,000 Utility expenses 2,000 Insurance expenses 3,000 75,200 4,800 Net Profit Ms Flower and Mrs Love came to see you to examine the income statement because they feel that the statement provided is inaccurate. After examining other accounting information, you have found the following additional information: a) Inventory balance at beginning and end of September 2021: 01-Sep (RM) Inventory Raw Material 3,200 2,900 3,700 3,300 Work in progress Finished goods 6,000 5.800 b) Only 40% of utility expenses and 20% of the insurance expenses are used by the office. while the balance must be charged to manufacturing activities. c) The partnership agreement between Ms. Flower and Mrs. Love is as follows: 1. Each partner receives a salary of RM5,000 per month. September salaries have not been paid. 2. The partners will receive 12% per annum interest on the initial capital balance. 3. Profit or loss is shared equally. to record d) Variable capital methods are used to record partner capital. Capital balance as of 1 September 2021: Miss Flower RM 40,000 Mrs Love 35,000 e) Drawing for September 2021: Miss Flower RM 2,000 Mrs Love 1,500 Required: 31-Sep (RM) September 2021: Miss Flower RM 40,000 Mrs Love 35,000 e) Drawing for September 2021- Miss Flower RM 2,000 Mrs Love 1,500 Required: 1. For Flower Love Partnership, prepare for the month ended 31 September 2021. I. Statement of cost of goods manufactured II. The correct income statement (up to net profit) III. Profit and loss distribution table IV. Partnership capital statement 2. If the Flower Love Partnership uses a fixed capital method, prepare a closing entry to record profit and drawing distribution on 31 September 2021

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started