Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The Flying Dutchman Inc. (henceforth, Flying) is a manufacturer of luxury yachts and ships for cruise lines and high net worth individuals. Flying has

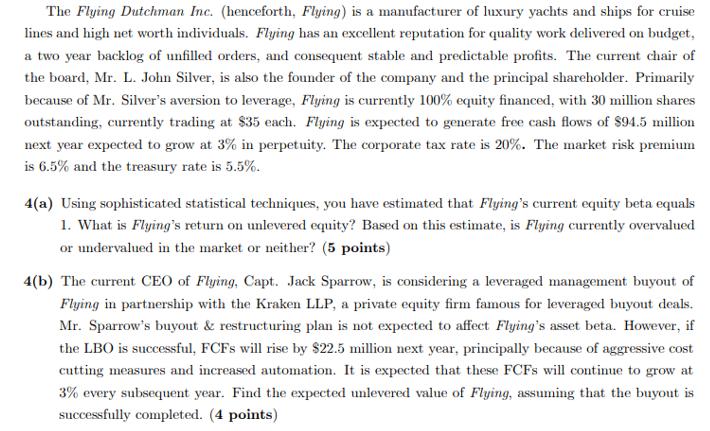

The Flying Dutchman Inc. (henceforth, Flying) is a manufacturer of luxury yachts and ships for cruise lines and high net worth individuals. Flying has an excellent reputation for quality work delivered on budget, a two year backlog of unfilled orders, and consequent stable and predictable profits. The current chair of the board, Mr. L. John Silver, is also the founder of the company and the principal shareholder. Primarily because of Mr. Silver's aversion to leverage, Flying is currently 100% equity financed, with 30 million shares outstanding, currently trading at $35 each. Flying is expected to generate free cash flows of $94.5 million next year expected to grow at 3% in perpetuity. The corporate tax rate is 20%. The market risk premium is 6.5% and the treasury rate is 5.5%. 4(a) Using sophisticated statistical techniques, you have estimated that Flying's current equity beta equals 1. What is Flying's return on unlevered equity? Based on this estimate, is Flying currently overvalued or undervalued in the market or neither? (5 points) 4(b) The current CEO of Flying, Capt. Jack Sparrow, is considering a leveraged management buyout of Flying in partnership with the Kraken LLP, a private equity firm famous for leveraged buyout deals. Mr. Sparrow's buyout & restructuring plan is not expected to affect Flying's asset beta. However, if the LBO is successful, FCFS will rise by $22.5 million next year, principally because of aggressive cost cutting measures and increased automation. It is expected that these FCFS will continue to grow at 3% every subsequent year. Find the expected unlevered value of Flying, assuming that the buyout is successfully completed. (4 points)

Step by Step Solution

★★★★★

3.43 Rating (175 Votes )

There are 3 Steps involved in it

Step: 1

Calculation Worki...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started