Answered step by step

Verified Expert Solution

Question

1 Approved Answer

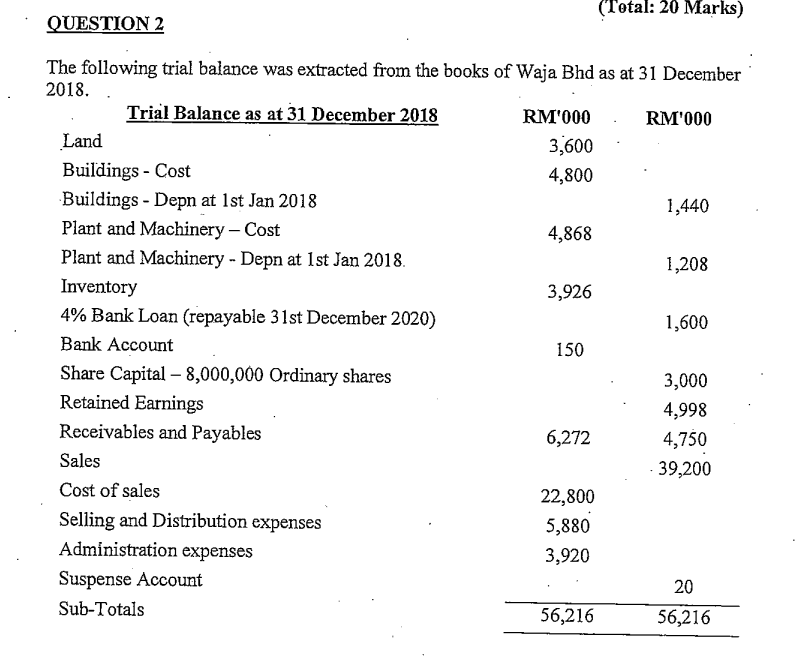

The fnllnwing trial halance wac eytranted from the honlo nf Xin Dhe The following matters have not been taken into account in the preparation of

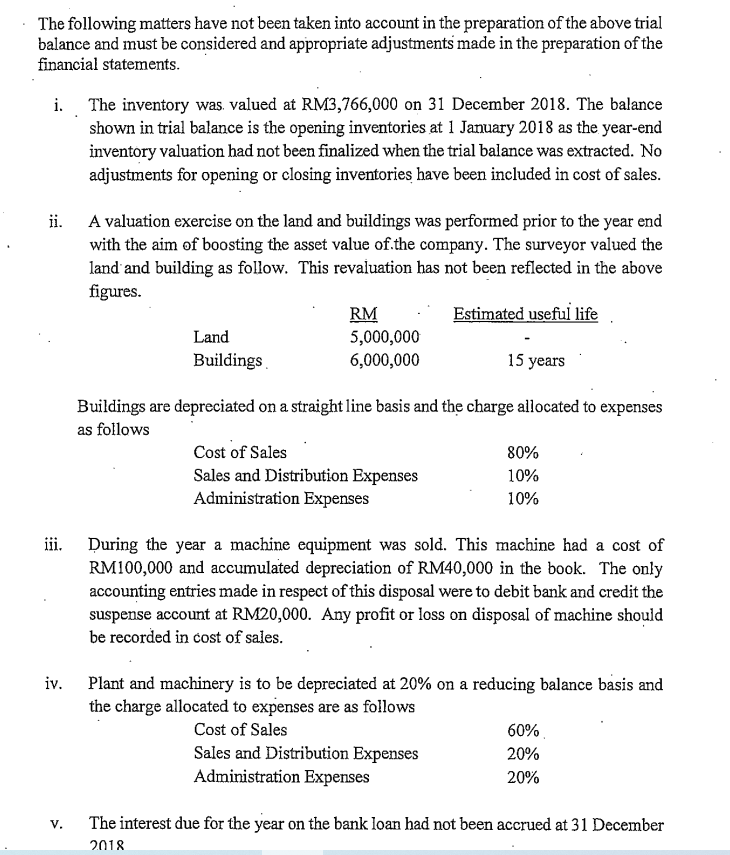

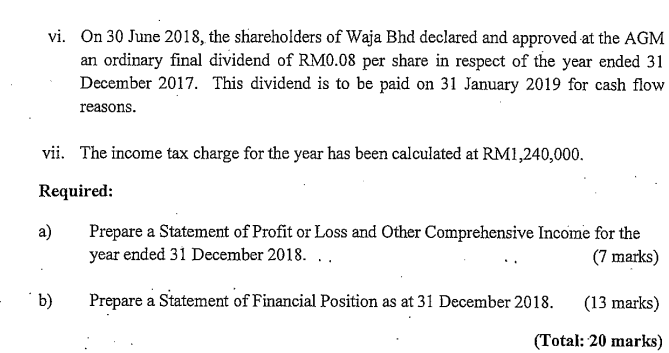

The fnllnwing trial halance wac eytranted from the honlo nf Xin Dhe The following matters have not been taken into account in the preparation of the above trial balance and must be considered and appropriate adjustments made in the preparation of the financial statements. i. The inventory was. valued at RM3,766,000 on 31 December 2018. The balance shown in trial balance is the opening inventories at 1 January 2018 as the year-end inventory valuation had not been finalized when the trial balance was extracted. No adjustments for opening or closing inventories have been included in cost of sales. ii. A valuation exercise on the land and buildings was performed prior to the year end with the aim of boosting the asset value of.the company. The surveyor valued the land and building as follow. This revaluation has not been reflected in the above figures. Buildings are depreciated on a straight line basis and the charge allocated to expenses as follows iii. During the year a machine equipment was sold. This machine had a cost of RM100,000 and accumulated depreciation of RM40,000 in the book. The only accounting entries made in respect of this disposal were to debit bank and credit the suspense account at RM20,000. Any profit or loss on disposal of machine should be recorded in cost of sales. iv. Plant and machinery is to be depreciated at 20% on a reducing balance basis and the charge allocated to expenses are as follows v. The interest due for the year on the bank loan had not been accrued at 31 December 2018 vi. On 30 June 2018, the shareholders of Waja Bhd declared and approved at the AGM an ordinary final dividend of RM0.08 per share in respect of the year ended 31 December 2017. This dividend is to be paid on 31 January 2019 for cash flow reasons. vii. The income tax charge for the year has been calculated at RM1,240,000. Required: a) Prepare a Statement of Profit or Loss and Other Comprehensive Income for the year ended 31 December 2018. . . (7 marks) b) Prepare a Statement of Financial Position as at 31 December 2018. (13 marks) (Total: 20 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started